Automotive Fascia Market Share

Automotive Fascia Market Research Report Information By Position Type (Front Fascia, Rear Fascia), By Material (Steel & Aluminium, Rubber, Plastic Covered Styrofoam, Plastic Covered Aluminium, Others), By Vehicle Type (Passenger Cars, Commercial Vehicles), By Sales Channel (OEM, Aftermarket), and By Region (North America, Europe, Asia-Pacific, And Rest Of The World) –Market Forecast Till 2035

Market Summary

The Global Automotive Fascia Market is projected to grow from 21.24 USD Billion in 2024 to 37.10 USD Billion by 2035.

Key Market Trends & Highlights

Automotive Fascia Key Trends and Highlights

- The market is expected to experience a compound annual growth rate (CAGR) of 5.0 percent from 2025 to 2035. By 2035, the market valuation is anticipated to reach 35.3 USD Billion, reflecting a robust growth trajectory. in 2024, the market is valued at 21.24 USD Billion, indicating a solid foundation for future expansion. Growing adoption of advanced materials due to increasing demand for lightweight vehicles is a major market driver.

Market Size & Forecast

| 2024 Market Size | 21.24 (USD Billion) |

| 2035 Market Size | 37.10 (USD Billion) |

| CAGR (2025-2035) | 5.20% |

| Largest Regional Market Share in 2024 | south_america) |

Major Players

<p>Chiyoda Manufacturing, FLEX-N-GATE CORPORATION, Plastic Omnium, Inhance Technologies, Magna International Inc., MRC Manufacturing, Dongfeng Electronic Technology Co. Ltd., SANKO GOSEI, Eakas Corporation, Gestamp Automoción S.A.</p>

Market Trends

Increasing demand for vehicle customization is driving the market growth

The market for automobile fascias is significantly being driven by rising demand for vehicle customisation. As customers desire to customise and distinguish their automobiles, customization has emerged as a major trend in the automotive sector. This trend now includes factory customisation choices provided by automakers in addition to aftermarket alterations. Owners of vehicles may now express their uniqueness and sense of style by picking their front fascia from a variety of alternatives. The desire for distinctiveness is one of the primary drivers driving the rising demand for vehicle personalization.

Customization enables owners to stand out from the crowd in a market where many vehicles have similar styles and features. Customization options for the front fascia can assist in achieving the desired aesthetic and helping to establish a distinctive character, whether it's a sporty appearance, a tough off-road look, or a sleek and opulent aesthetic.

Customization also fosters a sense of pride in and intimacy with the vehicle. Many automobile lovers take pleasure in their rides and see them as extensions of their personalities. They can express themselves and showcase their unique tastes and preferences by personalising the front fascia. Owners of vehicles report increased levels of happiness and loyalty as a result of this emotional connection. Technology development has been essential in enabling vehicle personalization. Significant advancements in manufacturing processes including injection moulding, 3D printing, and computer-aided design (CAD) have been seen in the car sector.

These innovations have made it simpler and more affordable to create complicated and unique fascia patterns. The alternatives available to consumers now range from various shapes and styles to distinctive textures and finishes, thanks to the work of automakers and aftermarket providers.

The popularity of customising vehicles has also increased, thanks in part to social media and online platforms. Automotive forums, YouTube, and websites like Instagram give fans a place to get ideas and a way to share their customised cars. As a result, there is now a culture of presenting original and striking designs, inspiring others to do the same. The desire for customising vehicles, notably the front fascia, has increased as a result of the availability of information and inspiration online. Automakers are becoming more aware of the value of personalization in luring customers.

Today, a lot of automakers provide optional trims or packages that let customers customise the front fascia of their cars. These factory customisation solutions offer seamless design integration and guarantee that the adjustments adhere to performance and safety regulations. Consumers can experiment with various fascia designs with the knowledge that their warranty and overall vehicle quality won't be jeopardised due to the availability of factory modification choices.

The aftermarket sector is also essential in meeting the demand for car customisation. Numerous fascia parts are available from specialised aftermarket vendors, enabling owners to totally redesign the front end of their cars. With the help of these aftermarket choices, owners can explore and express their creativity to produce really one-of-a-kind and customised designs. Thus, driving the Automotive Fascia market revenue.

<p>The ongoing evolution of automotive design and consumer preferences appears to drive a notable shift towards lightweight and aesthetically appealing fascia components, reflecting a broader trend in the automotive industry towards sustainability and innovation.</p>

U.S. Department of Transportation

Automotive Fascia Market Market Drivers

Market Growth Projections

The Global Automotive Fascia Market Industry is projected to experience substantial growth over the next decade. With a market size anticipated to reach 20.6 USD Billion in 2024 and further expand to 35.3 USD Billion by 2035, the industry is poised for a compound annual growth rate of 5.0 percent from 2025 to 2035. This growth trajectory is indicative of the increasing demand for automotive fascias driven by various factors, including technological advancements, rising vehicle production, and evolving consumer preferences. The market's expansion reflects the broader trends within the automotive sector, where innovation and sustainability are becoming paramount.

Consumer Preferences for Customization

The Global Automotive Fascia Market Industry is increasingly influenced by consumer preferences for vehicle customization. Modern consumers are seeking personalized vehicles that reflect their individual styles and preferences. This trend has prompted manufacturers to offer a wider range of fascia designs, colors, and finishes. Customization options not only enhance the aesthetic appeal of vehicles but also allow consumers to express their identities through their automobiles. As a result, the demand for diverse fascia options is expected to rise, contributing to the overall growth of the market. The industry's expansion is further supported by the projected increase in market size, reaching 35.3 USD Billion by 2035.

Increasing Vehicle Production and Sales

The Global Automotive Fascia Market Industry is significantly influenced by the rising production and sales of vehicles worldwide. As emerging economies continue to expand their automotive manufacturing capabilities, the demand for fascias is expected to surge. For instance, countries like India and China are witnessing a rapid increase in vehicle production, which directly correlates with the demand for automotive fascias. This trend is further supported by the growing consumer preference for personal vehicles, particularly in urban areas. The industry is projected to grow from 20.6 USD Billion in 2024 to 35.3 USD Billion by 2035, indicating a robust market trajectory driven by increased vehicle output.

Rising Demand for Lightweight Materials

The Global Automotive Fascia Market Industry experiences a notable shift towards lightweight materials, driven by the automotive sector's focus on enhancing fuel efficiency and reducing emissions. Manufacturers are increasingly adopting materials such as thermoplastics and composites, which not only lower vehicle weight but also improve performance. For instance, the integration of lightweight fascias can lead to a reduction in overall vehicle weight by up to 10 percent, contributing to better fuel economy. This trend aligns with the projected market growth, with the industry expected to reach 20.6 USD Billion in 2024 and 35.3 USD Billion by 2035, reflecting a compound annual growth rate of 5.0 percent from 2025 to 2035.

Regulatory Compliance and Safety Standards

The Global Automotive Fascia Market Industry is also shaped by stringent regulatory compliance and safety standards imposed by governments worldwide. These regulations often mandate the use of specific materials and designs that enhance vehicle safety and environmental sustainability. For example, regulations regarding pedestrian safety have led to the development of softer and more impact-resistant fascias. Manufacturers are compelled to innovate and adapt their designs to meet these standards, which in turn drives market growth. As the industry evolves, compliance with these regulations is likely to become a key factor influencing the design and production of automotive fascias, contributing to the anticipated market expansion.

Technological Advancements in Automotive Design

Technological innovations play a pivotal role in shaping the Global Automotive Fascia Market Industry. The introduction of advanced manufacturing techniques, such as 3D printing and automated assembly processes, enhances design flexibility and production efficiency. These advancements enable manufacturers to create more intricate and aesthetically pleasing fascias that meet consumer preferences. Furthermore, the integration of smart technologies, such as sensors and lighting systems, into fascias is becoming increasingly prevalent. This evolution not only elevates vehicle aesthetics but also enhances functionality, thereby driving demand in the market. As a result, the industry is poised for substantial growth, with projections indicating a market size of 20.6 USD Billion in 2024.

Market Segment Insights

Automotive Fascia Position Type Insights

<p>The Automotive Fascia Market segmentation, based on position type includes front fascia and rear fascia. With 55.55% of market revenue coming from the front fascia segment, this sector led the market. The front fascia, which is the most noticeable component of a car, is very important to the design of the whole thing. It frequently acts as the design's focal point and a major determinant of how consumers perceive the car.</p>

<p>Figure 1: Automotive Fascia Market, by Position Type, 2023 & 2032 (USD Billion)</p>

<p>Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review</p>

Automotive Fascia Material Insights

<p>The Automotive Fascia Market segmentation, based on material, includes rubber, plastic covered polystyrene, plastic covered aluminium, steel & aluminium, and others. The most money was made in the steel & aluminium sector. In premium cars and high-performance cars, when the benefits of weight reduction, strength, and design freedom are greatly sought, aluminium fascias are frequently used.</p>

Automotive Fascia Vehicle Type Insights

<p>The Automotive Fascia Market segmentation, based on vehicle type, includes passenger cars and commercial vehicles. The category of passenger cars produced the highest revenue. The demand for luxury high-end automobiles is predicted to increase along with consumer spending increases, which is expected to propel the expansion of the automotive fascia market throughout the forecast period.</p>

Automotive Fascia Sales Channel Insights

<p>The Automotive Fascia Market segmentation, based on sales channel, includes aftermarket and OEM. The OEM category produced the highest revenue. The main reason for this is that OEMs are in charge of the initial production and assembly of automobiles. OEMs are the main suppliers of front fascia systems since automotive fascia components are frequently added during the manufacturing process.</p>

Get more detailed insights about Automotive Fascia Market Research Report—Global Forecast till 2032

Regional Insights

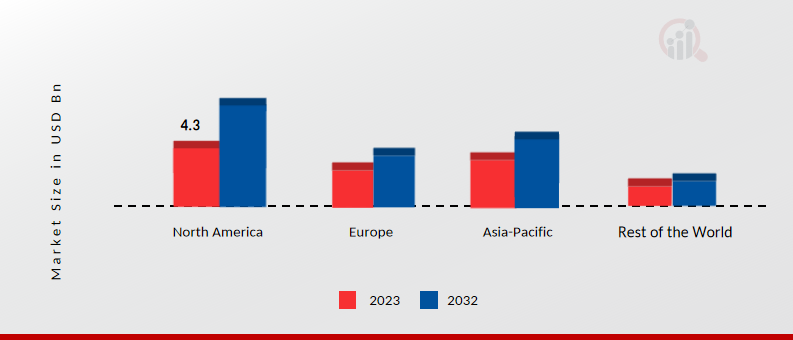

By region, the study provides the market insights into North America, Europe, Asia-Pacific and Rest of the World. The North America Automotive Fascia Market dominated this market in 2022 (45.80%). Strong safety laws, such as those governing pedestrian protection, are present in North America. Modern fascia designs that include elements like impact-absorbing materials and pedestrian-friendly structures are therefore in high demand. Further, the U.S. Automotive Fascia market held the largest market share, and the Canada Automotive Fascia market was the fastest growing market in the North America region.

Further, the major countries studied in the market report are The U.S., Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: Automotive Fascia Market Share By Region 2023 (Usd Billion)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Europe Automotive Fascia market accounts for the second-largest market share. In order to cut greenhouse gas emissions and boost fuel efficiency, European nations have strict restrictions. Further, the German Automotive Fascia market held the largest market share, and the UK Automotive Fascia market was the fastest growing market in the European region

The Asia-Pacific Automotive Fascia Market is expected to grow at the fastest CAGR from 2023 to 2032. The Asia-Pacific region has the largest automotive market in the world, with China and India dominating both car production and sales. The demand for automotive fascia components in the area is directly influenced by this increase in vehicle production and sales. Moreover, China’s Automotive Fascia market held the largest market share, and the Indian Automotive Fascia market was the fastest growing market in the Asia-Pacific region.

Key Players and Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Automotive Fascia market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Automotive Fascia industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global Automotive Fascia industry to benefit clients and increase the market sector. In recent years, the Automotive Fascia industry has offered some of the most significant advantages to medicine. Major players in the Automotive Fascia market, including Chiyoda Manufacturing, FLEX-N-GATE CORPORATION, Plastic Omnium, Inhance Technologies, Magna International Inc., MRC Manufacturing, Dongfeng Electronic Technology Co. Ltd., SANKO GOSEI, Eakas Corporation, Gestamp Automoción S.A., and others, are attempting to increase market demand by investing in research and development operations.

Compagnie Plastic Omnium SA (Plastic Omnium), a division of Burelle SA, produces and markets high-tech goods and automobile parts. It creates and sells bodywork modules, bumpers and front-end assemblies, body panels and spoilers, rear closure systems, semi-structural and structural elements, and other front-end modules. It also produces and sells painted external plastic and composite components. It provides goods to companies that make cars and trucks. The company conducts business across the Americas, Europe, and Asia. The headquarters of Plastic Omnium are located in Levallois, Ile-de-France, France.

Engineering company Chiyoda Corp (Chiyoda) is integrated. It offers services in engineering, planning, procurement, construction, operation, and maintenance. Asset management and business support services are also provided by the corporation. Chiyoda creates its own technology to offer cutting-edge solutions in the areas of chemical and environmental engineering. It runs through a network of sales bases, project execution bases, engineering centres, procurement bases, and operation support offices. Oil and gas, chemicals and petrochemicals, medicines, environmental technology, new and renewable energy, social infrastructure, and industrial sectors are just a few of the industries the company serves.

The headquarters of Chiyoda are in Yokohama, Kanagawa, Japan.

Key Companies in the Automotive Fascia Market market include

Industry Developments

March 2023 Magna International announced intentions to increase the size of its Puebla, Mexico, plant that makes automobile fascias. The addition is anticipated to add 100,000 square feet of manufacturing space and 500 new jobs.

April 2023 Cartrim, a producer of car fascias and other parts, was bought by Plastic Omnium. Plastic Omnium's position in the market for automobile fascias globally is anticipated to improve as a result of the acquisition.

Future Outlook

Automotive Fascia Market Future Outlook

<p>The Automotive Fascia Market is projected to grow at a 5.20% CAGR from 2025 to 2035, driven by advancements in materials and increasing demand for lightweight components.</p>

New opportunities lie in:

- <p>Invest in sustainable materials to meet regulatory demands and consumer preferences. Leverage smart technology integration for enhanced vehicle aesthetics and functionality. Expand into emerging markets with tailored fascia solutions for local automotive manufacturers.</p>

<p>By 2035, the Automotive Fascia Market is expected to achieve substantial growth, reflecting evolving consumer and technological trends.</p>

Market Segmentation

Vehicle Fascia Material Outlook

- Steel & Aluminium

- Rubber

- Plastic Covered Styrofoam

- Plastic Covered Aluminium

- Others

Vehicle Fascia Regional Outlook

- US.

- Canada

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia-Pacific

- Middle East

- Africa

- Latin America

Vehicle Fascia Vehicle Type Outlook

- Passenger Cars

- Commercial Vehicles

Vehicle Fascia Position Type Outlook

- Front Fascia

- Rear Fascia

Vehicle Fascia Sales Channel Outlook

- OEM

- Aftermarket

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2035 | 37.10 (Value (USD Billion)) |

| Compound Annual Growth Rate (CAGR) | 5.20% (2025 - 2035) |

| Base Year | 2024 |

| Market Forecast Period | 2025 - 2035 |

| Historical Data | 2018- 2022 |

| Market Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Type, Material, Vehicle Type, Sales Channel, and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered | The U.S., Canada, German, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled | Chiyoda Manufacturing, FLEX-N-GATE CORPORATION, Plastic Omnium, Inhance Technologies, Magna International Inc., MRC Manufacturing, Dongfeng Electronic Technology Co. Ltd., SANKO GOSEI, Eakas Corporation, Gestamp Automoción S.A. |

| Key Market Opportunities | Desire for distinctiveness and rising demand for vehicle personalization |

| Key Market Dynamics | Advancements in manufacturing processes including injection moulding, 3D printing, and computer-aided design (CAD) have been seen in the car sector |

| Market Size 2024 | 21.24 (Value (USD Billion)) |

| Market Size 2025 | 22.35 (Value (USD Billion)) |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How much is the Automotive Fascia market?

The Automotive Fascia Market size was valued at USD 19.2 Billion in 2022.

What is the growth rate of the Automotive Fascia market?

The global market is projected to grow at a CAGR of 5.20% during the forecast period, 2023-2032.

Which region held the largest market share in the Automotive Fascia market?

North America had the largest share in the global market

Who are the key players in the Automotive Fascia market?

The key players in the market are Chiyoda Manufacturing, FLEX-N-GATE CORPORATION, Plastic Omnium, Inhance Technologies, Magna International Inc., MRC Manufacturing, Dongfeng Electronic Technology Co. Ltd., SANKO GOSEI, Eakas Corporation, Gestamp Automoción S.A..

Which Position Type led the Automotive Fascia market?

The Front Fascia category dominated the market in 2022.

Which Material had the largest market share in the Automotive Fascia market?

The Steel & Aluminium had the largest share in the global market.

-

Table of Contents

-

Executive Summary

-

Market Introduction

- Definition

-

Scope of the Study

- Research Objective

- Assumptions

- Limitations

-

Research Methodology

- Overview

- Data Mining

- Secondary Research

-

Primary Research

- Primary Interviews and Information Gathering Process

- Breakdown of Primary Respondents

- Forecasting Modality

-

Market Size Estimation

- Bottom-up Approach

- Top-Down Approach

- Data Triangulation

- Validation

-

MARKET DYNAMICS

- Overview

- Drivers

- Restraints

- Opportunities

-

MARKET FACTOR ANALYSIS

- Value Chain Analysis

-

Porter’s Five Forces Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrants

- Threat of Substitutes

- Intensity of Rivalry

-

COVID-19 Impact Analysis

- Market Impact Analysis

- Regional Impact

- Opportunity and Threat Analysis

-

GLOBAL AUTOMOTIVE FASCIA MARKET, BY POSITION TYPE

- Overview

- Front Fascia

- Rear Fascia

-

GLOBAL AUTOMOTIVE FASCIA MARKET, BY MATERIAL

- Overview

- Steel & Aluminium

- Rubber

- Plastic Covered Styrofoam

- Plastic Covered Aluminium

- Others

-

GLOBAL AUTOMOTIVE FASCIA MARKET, BY VEHICLE TYPE

- Overview

- Passenger Cars

- Commercial Vehicles

-

GLOBAL AUTOMOTIVE FASCIA MARKET, BY SALES CHANNEL

- Overview

- OEM

- Aftermarket

-

GLOBAL AUTOMOTIVE FASCIA MARKET, BY REGION

- Overview

-

North America

- U.S.

- Canada

-

Europe

- Germany

- France

- U.K

- Italy

- Spain

- Rest of Europe

-

Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia-Pacific

-

Rest of the World

- Middle East

- Africa

- Latin America

-

Competitive Landscape

- Overview

- Competitive Analysis

- Market Share Analysis

- Major Growth Strategy in the Global Automotive fascia Market,

- Competitive Benchmarking

- Leading Players in Terms of Number of Developments in the Global Automotive fascia Market,

-

Key developments and Growth Strategies

- New Position Type Launch/Material Vehicle Type

- Merger & Acquisitions

- Joint Ventures

-

Major Players Financial Matrix

- Sales & Operating Income, 2022

- Major Players R&D Expenditure. 2022

-

COMPANY PROFILES

-

CHIYODA MANUFACTURING

- Company Overview

- Financial Overview

- Position Types Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

FLEX-N-GATE CORPORATION

- Company Overview

- Financial Overview

- Position Types Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

PLASTIC OMNIUM

- Company Overview

- Financial Overview

- Position Types Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Inhance Technologies

- Company Overview

- Financial Overview

- Position Types Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Magna International Inc.

- Company Overview

- Financial Overview

- Position Types Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

MRC MANUFACTURING

- Company Overview

- Financial Overview

- Position Types Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Dongfeng Electronic Technology Co. Ltd.

- Company Overview

- Financial Overview

- Position Types Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

SANKO GOSEI

- Company Overview

- Financial Overview

- Position Types Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Eakas Corporation

- Company Overview

- Financial Overview

- Position Types Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Gestamp Automoción S.A.

- Company Overview

- Financial Overview

- Position Types Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

CHIYODA MANUFACTURING

-

APPENDIX

- References

- Related Reports

-

-

List of Tables and Figures

- LIST OF TABLES

- TABLE 1 GLOBAL AUTOMOTIVE FASCIA MARKET, SYNOPSIS, 2018-2032

- TABLE 2 GLOBAL AUTOMOTIVE FASCIA MARKET, ESTIMATES & FORECAST, 2018-2032 (USD BILLION)

- TABLE 3 GLOBAL AUTOMOTIVE FASCIA MARKET, BY POSITION TYPE, 2018-2032 (USD BILLION)

- TABLE 4 GLOBAL AUTOMOTIVE FASCIA MARKET, BY MATERIAL, 2018-2032 (USD BILLION)

- TABLE 5 GLOBAL AUTOMOTIVE FASCIA MARKET, BY VEHICLE TYPE, 2018-2032 (USD BILLION)

- TABLE 6 GLOBAL AUTOMOTIVE FASCIA MARKET, BY SALES CHANNEL, 2018-2032 (USD BILLION)

- TABLE 7 NORTH AMERICA AUTOMOTIVE FASCIA MARKET, BY POSITION TYPE, 2018-2032 (USD BILLION)

- TABLE 8 NORTH AMERICA AUTOMOTIVE FASCIA MARKET, BY MATERIAL, 2018-2032 (USD BILLION)

- TABLE 9 NORTH AMERICA AUTOMOTIVE FASCIA MARKET, BY VEHICLE TYPE, 2018-2032 (USD BILLION)

- TABLE 10 NORTH AMERICA AUTOMOTIVE FASCIA MARKET, BY SALES CHANNEL, 2018-2032 (USD BILLION)

- TABLE 11 NORTH AMERICA AUTOMOTIVE FASCIA MARKET, BY COUNTRY, 2018-2032 (USD BILLION)

- TABLE 12 U.S. AUTOMOTIVE FASCIA MARKET, BY POSITION TYPE, 2018-2032 (USD BILLION)

- TABLE 13 U.S. AUTOMOTIVE FASCIA MARKET, BY MATERIAL, 2018-2032 (USD BILLION)

- TABLE 14 U.S. AUTOMOTIVE FASCIA MARKET, BY VEHICLE TYPE, 2018-2032 (USD BILLION)

- TABLE 15 U.S. AUTOMOTIVE FASCIA MARKET, BY SALES CHANNEL, 2018-2032 (USD BILLION)

- TABLE 16 CANADA AUTOMOTIVE FASCIA MARKET, BY POSITION TYPE, 2018-2032 (USD BILLION)

- TABLE 17 CANADA AUTOMOTIVE FASCIA MARKET, BY MATERIAL, 2018-2032 (USD BILLION)

- TABLE 18 CANADA AUTOMOTIVE FASCIA MARKET, BY VEHICLE TYPE, 2018-2032 (USD BILLION)

- TABLE 19 CANADA AUTOMOTIVE FASCIA MARKET, BY SALES CHANNEL, 2018-2032 (USD BILLION)

- TABLE 20 EUROPE AUTOMOTIVE FASCIA MARKET, BY POSITION TYPE, 2018-2032 (USD BILLION)

- TABLE 21 EUROPE AUTOMOTIVE FASCIA MARKET, BY MATERIAL, 2018-2032 (USD BILLION)

- TABLE 22 EUROPE AUTOMOTIVE FASCIA MARKET, BY VEHICLE TYPE, 2018-2032 (USD BILLION)

- TABLE 23 EUROPE AUTOMOTIVE FASCIA MARKET, BY SALES CHANNEL, 2018-2032 (USD BILLION)

- TABLE 24 EUROPE AUTOMOTIVE FASCIA MARKET, BY COUNTRY, 2018-2032 (USD BILLION)

- TABLE 25 GERMANY AUTOMOTIVE FASCIA MARKET, BY POSITION TYPE, 2018-2032 (USD BILLION)

- TABLE 26 GERMANY AUTOMOTIVE FASCIA MARKET, BY MATERIAL, 2018-2032 (USD BILLION)

- TABLE 27 GERMANY AUTOMOTIVE FASCIA MARKET, BY VEHICLE TYPE, 2018-2032 (USD BILLION)

- TABLE 28 GERMANY AUTOMOTIVE FASCIA MARKET, BY SALES CHANNEL, 2018-2032 (USD BILLION)

- TABLE 29 FRANCE AUTOMOTIVE FASCIA MARKET, BY POSITION TYPE, 2018-2032 (USD BILLION)

- TABLE 30 FRANCE AUTOMOTIVE FASCIA MARKET, BY MATERIAL, 2018-2032 (USD BILLION)

- TABLE 31 FRANCE AUTOMOTIVE FASCIA MARKET, BY VEHICLE TYPE, 2018-2032 (USD BILLION)

- TABLE 32 FRANCE AUTOMOTIVE FASCIA MARKET, BY SALES CHANNEL, 2018-2032 (USD BILLION)

- TABLE 33 ITALY AUTOMOTIVE FASCIA MARKET, BY POSITION TYPE, 2018-2032 (USD BILLION)

- TABLE 34 ITALY AUTOMOTIVE FASCIA MARKET, BY MATERIAL, 2018-2032 (USD BILLION)

- TABLE 35 ITALY AUTOMOTIVE FASCIA MARKET, BY VEHICLE TYPE, 2018-2032 (USD BILLION)

- TABLE 36 ITALY AUTOMOTIVE FASCIA MARKET, BY SALES CHANNEL, 2018-2032 (USD BILLION)

- TABLE 37 SPAIN AUTOMOTIVE FASCIA MARKET, BY POSITION TYPE, 2018-2032 (USD BILLION)

- TABLE 38 SPAIN AUTOMOTIVE FASCIA MARKET, BY MATERIAL, 2018-2032 (USD BILLION)

- TABLE 39 SPAIN AUTOMOTIVE FASCIA MARKET, BY VEHICLE TYPE, 2018-2032 (USD BILLION)

- TABLE 40 SPAIN AUTOMOTIVE FASCIA MARKET, BY SALES CHANNEL, 2018-2032 (USD BILLION)

- TABLE 41 U.K AUTOMOTIVE FASCIA MARKET, BY POSITION TYPE, 2018-2032 (USD BILLION)

- TABLE 42 U.K AUTOMOTIVE FASCIA MARKET, BY MATERIAL, 2018-2032 (USD BILLION)

- TABLE 43 U.K AUTOMOTIVE FASCIA MARKET, BY VEHICLE TYPE, 2018-2032 (USD BILLION)

- TABLE 44 U.K AUTOMOTIVE FASCIA MARKET, BY SALES CHANNEL, 2018-2032 (USD BILLION)

- TABLE 45 REST OF EUROPE AUTOMOTIVE FASCIA MARKET, BY POSITION TYPE, 2018-2032 (USD BILLION)

- TABLE 46 REST OF EUROPE AUTOMOTIVE FASCIA MARKET, BY MATERIAL, 2018-2032 (USD BILLION)

- TABLE 47 REST OF EUROPE AUTOMOTIVE FASCIA MARKET, BY VEHICLE TYPE, 2018-2032 (USD BILLION)

- TABLE 48 REST OF EUROPE AUTOMOTIVE FASCIA MARKET, BY SALES CHANNEL, 2018-2032 (USD BILLION)

- TABLE 49 ASIA PACIFIC AUTOMOTIVE FASCIA MARKET, BY POSITION TYPE, 2018-2032 (USD BILLION)

- TABLE 50 ASIA PACIFIC AUTOMOTIVE FASCIA MARKET, BY MATERIAL, 2018-2032 (USD BILLION)

- TABLE 51 ASIA PACIFIC AUTOMOTIVE FASCIA MARKET, BY VEHICLE TYPE, 2018-2032 (USD BILLION)

- TABLE 52 ASIA PACIFIC AUTOMOTIVE FASCIA MARKET, BY SALES CHANNEL, 2018-2032 (USD BILLION)

- TABLE 53 ASIA PACIFIC AUTOMOTIVE FASCIA MARKET, BY COUNTRY, 2018-2032 (USD BILLION)

- TABLE 54 JAPAN AUTOMOTIVE FASCIA MARKET, BY POSITION TYPE, 2018-2032 (USD BILLION)

- TABLE 55 JAPAN AUTOMOTIVE FASCIA MARKET, BY MATERIAL, 2018-2032 (USD BILLION)

- TABLE 56 JAPAN AUTOMOTIVE FASCIA MARKET, BY VEHICLE TYPE, 2018-2032 (USD BILLION)

- TABLE 57 JAPAN AUTOMOTIVE FASCIA MARKET, BY SALES CHANNEL, 2018-2032 (USD BILLION)

- TABLE 58 CHINA AUTOMOTIVE FASCIA MARKET, BY POSITION TYPE, 2018-2032 (USD BILLION)

- TABLE 59 CHINA AUTOMOTIVE FASCIA MARKET, BY MATERIAL, 2018-2032 (USD BILLION)

- TABLE 60 CHINA AUTOMOTIVE FASCIA MARKET, BY VEHICLE TYPE, 2018-2032 (USD BILLION)

- TABLE 61 CHINA AUTOMOTIVE FASCIA MARKET, BY SALES CHANNEL, 2018-2032 (USD BILLION)

- TABLE 62 INDIA AUTOMOTIVE FASCIA MARKET, BY POSITION TYPE, 2018-2032 (USD BILLION)

- TABLE 63 INDIA AUTOMOTIVE FASCIA MARKET, BY MATERIAL, 2018-2032 (USD BILLION)

- TABLE 64 INDIA AUTOMOTIVE FASCIA MARKET, BY VEHICLE TYPE, 2018-2032 (USD BILLION)

- TABLE 65 INDIA AUTOMOTIVE FASCIA MARKET, BY SALES CHANNEL, 2018-2032 (USD BILLION)

- TABLE 66 AUSTRALIA AUTOMOTIVE FASCIA MARKET, BY POSITION TYPE, 2018-2032 (USD BILLION)

- TABLE 67 AUSTRALIA AUTOMOTIVE FASCIA MARKET, BY MATERIAL, 2018-2032 (USD BILLION)

- TABLE 68 AUSTRALIA AUTOMOTIVE FASCIA MARKET, BY VEHICLE TYPE, 2018-2032 (USD BILLION)

- TABLE 69 AUSTRALIA AUTOMOTIVE FASCIA MARKET, BY SALES CHANNEL, 2018-2032 (USD BILLION)

- TABLE 70 SOUTH KOREA AUTOMOTIVE FASCIA MARKET, BY POSITION TYPE, 2018-2032 (USD BILLION)

- TABLE 71 SOUTH KOREA AUTOMOTIVE FASCIA MARKET, BY MATERIAL, 2018-2032 (USD BILLION)

- TABLE 72 SOUTH KOREA AUTOMOTIVE FASCIA MARKET, BY VEHICLE TYPE, 2018-2032 (USD BILLION)

- TABLE 73 SOUTH KOREA AUTOMOTIVE FASCIA MARKET, BY SALES CHANNEL, 2018-2032 (USD BILLION)

- TABLE 74 REST OF ASIA-PACIFIC AUTOMOTIVE FASCIA MARKET, BY POSITION TYPE, 2018-2032 (USD BILLION)

- TABLE 75 REST OF ASIA-PACIFIC AUTOMOTIVE FASCIA MARKET, BY MATERIAL, 2018-2032 (USD BILLION)

- TABLE 76 REST OF ASIA-PACIFIC AUTOMOTIVE FASCIA MARKET, BY VEHICLE TYPE, 2018-2032 (USD BILLION)

- TABLE 77 REST OF ASIA-PACIFIC AUTOMOTIVE FASCIA MARKET, BY SALES CHANNEL, 2018-2032 (USD BILLION)

- TABLE 78 REST OF WORLD AUTOMOTIVE FASCIA MARKET, BY POSITION TYPE, 2018-2032 (USD BILLION)

- TABLE 79 REST OF WORLD AUTOMOTIVE FASCIA MARKET, BY MATERIAL, 2018-2032 (USD BILLION)

- TABLE 80 REST OF WORLD AUTOMOTIVE FASCIA MARKET, BY VEHICLE TYPE, 2018-2032 (USD BILLION)

- TABLE 81 REST OF WORLD AUTOMOTIVE FASCIA MARKET, BY SALES CHANNEL, 2018-2032 (USD BILLION)

- TABLE 82 REST OF WORLD AUTOMOTIVE FASCIA MARKET, BY COUNTRY, 2018-2032 (USD BILLION)

- TABLE 83 MIDDLE EAST AUTOMOTIVE FASCIA MARKET, BY POSITION TYPE, 2018-2032 (USD BILLION)

- TABLE 84 MIDDLE EAST AUTOMOTIVE FASCIA MARKET, BY MATERIAL, 2018-2032 (USD BILLION)

- TABLE 85 MIDDLE EAST AUTOMOTIVE FASCIA MARKET, BY VEHICLE TYPE, 2018-2032 (USD BILLION)

- TABLE 86 MIDDLE EAST AUTOMOTIVE FASCIA MARKET, BY SALES CHANNEL, 2018-2032 (USD BILLION)

- TABLE 87 AFRICA AUTOMOTIVE FASCIA MARKET, BY POSITION TYPE, 2018-2032 (USD BILLION)

- TABLE 88 AFRICA AUTOMOTIVE FASCIA MARKET, BY MATERIAL, 2018-2032 (USD BILLION)

- TABLE 89 AFRICA AUTOMOTIVE FASCIA MARKET, BY VEHICLE TYPE, 2018-2032 (USD BILLION)

- TABLE 90 AFRICA AUTOMOTIVE FASCIA MARKET, BY SALES CHANNEL, 2018-2032 (USD BILLION)

- TABLE 91 LATIN AMERICA AUTOMOTIVE FASCIA MARKET, BY POSITION TYPE, 2018-2032 (USD BILLION)

- TABLE 92 LATIN AMERICA AUTOMOTIVE FASCIA MARKET, BY MATERIAL, 2018-2032 (USD BILLION)

- TABLE 93 LATIN AMERICA AUTOMOTIVE FASCIA MARKET, BY VEHICLE TYPE, 2018-2032 (USD BILLION)

- TABLE 94 LATIN AMERICA AUTOMOTIVE FASCIA MARKET, BY SALES CHANNEL, 2018-2032 (USD BILLION) LIST OF FIGURES

- FIGURE 1 RESEARCH PROCESS

- FIGURE 2 MARKET STRUCTURE FOR THE GLOBAL AUTOMOTIVE FASCIA MARKET

- FIGURE 3 MARKET DYNAMICS FOR THE GLOBAL AUTOMOTIVE FASCIA MARKET

- FIGURE 4 GLOBAL AUTOMOTIVE FASCIA MARKET, SHARE (%), BY POSITION TYPE, 2022

- FIGURE 5 GLOBAL AUTOMOTIVE FASCIA MARKET, SHARE (%), BY MATERIAL, 2022

- FIGURE 6 GLOBAL AUTOMOTIVE FASCIA MARKET, SHARE (%), BY VEHICLE TYPE, 2022

- FIGURE 7 GLOBAL AUTOMOTIVE FASCIA MARKET, SHARE (%), BY SALES CHANNEL, 2022

- FIGURE 8 GLOBAL AUTOMOTIVE FASCIA MARKET, SHARE (%), BY REGION, 2022

- FIGURE 9 NORTH AMERICA: AUTOMOTIVE FASCIA MARKET, SHARE (%), BY REGION, 2022

- FIGURE 10 EUROPE: AUTOMOTIVE FASCIA MARKET, SHARE (%), BY REGION, 2022

- FIGURE 11 ASIA-PACIFIC: AUTOMOTIVE FASCIA MARKET, SHARE (%), BY REGION, 2022

- FIGURE 12 REST OF THE WORLD: AUTOMOTIVE FASCIA MARKET, SHARE (%), BY REGION, 2022

- FIGURE 13 GLOBAL AUTOMOTIVE FASCIA MARKET: COMPANY SHARE ANALYSIS, 2022 (%)

- FIGURE 14 CHIYODA MANUFACTURING: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 15 CHIYODA MANUFACTURING: SWOT ANALYSIS

- FIGURE 16 FLEX-N-GATE CORPORATION: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 17 FLEX-N-GATE CORPORATION: SWOT ANALYSIS

- FIGURE 18 PLASTIC OMNIUM.: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 19 PLASTIC OMNIUM.: SWOT ANALYSIS

- FIGURE 20 INHANCE TECHNOLOGIES: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 21 INHANCE TECHNOLOGIES: SWOT ANALYSIS

- FIGURE 22 MAGNA INTERNATIONAL INC..: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 23 MAGNA INTERNATIONAL INC..: SWOT ANALYSIS

- FIGURE 24 MRC MANUFACTURING: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 25 MRC MANUFACTURING: SWOT ANALYSIS

- FIGURE 26 DONGFENG ELECTRONIC TECHNOLOGY CO. LTD.: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 27 DONGFENG ELECTRONIC TECHNOLOGY CO. LTD.: SWOT ANALYSIS

- FIGURE 28 SANKO GOSEI: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 29 SANKO GOSEI: SWOT ANALYSIS

- FIGURE 30 EAKAS CORPORATION: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 31 EAKAS CORPORATION: SWOT ANALYSIS

- FIGURE 32 GESTAMP AUTOMOCIÓN S.A.: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 33 GESTAMP AUTOMOCIÓN S.A.: SWOT ANALYSIS

Automotive fascia Market Segmentation

Automotive fascia Market Position Type Outlook (USD Billion, 2018-2032)

Front Fascia

Rear Fascia

Automotive fascia Market Material Outlook (USD Billion, 2018-2032)

Steel & Aluminium

Rubber

Plastic Covered Styrofoam

Plastic Covered Aluminium

Others

Automotive fascia Market Vehicle Type Outlook (USD Billion, 2018-2032)

Passenger Cars

Commercial Vehicles

Automotive fascia Market Sales Channel Outlook (USD Billion, 2018-2032)

OEM

Aftermarket

Automotive fascia Market Regional Outlook (USD Billion, 2018-2032)

North America Outlook (USD Billion, 2018-2032)

Front Fascia

Rear Fascia

Automotive fascia Market by MaterialSteel & Aluminium

Rubber

Plastic Covered Styrofoam

Plastic Covered Aluminium

Others

Automotive fascia Market by Vehicle TypePassenger Cars

Commercial Vehicles

Automotive fascia Market by Sales ChannelOEM

Aftermarket

US Outlook (USD Billion, 2018-2032)

Front Fascia

Rear Fascia

Automotive fascia Market by MaterialSteel & Aluminium

Rubber

Plastic Covered Styrofoam

Plastic Covered Aluminium

Others

Automotive fascia Market by Vehicle TypePassenger Cars

Commercial Vehicles

Automotive fascia Market by Sales ChannelOEM

Aftermarket

Canada Outlook (USD Billion, 2018-2032)

Front Fascia

Rear Fascia

Automotive fascia Market by MaterialSteel & Aluminium

Rubber

Plastic Covered Styrofoam

Plastic Covered Aluminium

Others

Automotive fascia Market by Vehicle TypePassenger Cars

Commercial Vehicles

Automotive fascia Market by Sales ChannelOEM

Aftermarket

Europe Outlook (USD Billion, 2018-2032)

Front Fascia

Rear Fascia

Automotive fascia Market by MaterialSteel & Aluminium

Rubber

Plastic Covered Styrofoam

Plastic Covered Aluminium

Others

Automotive fascia Market by Vehicle TypePassenger Cars

Commercial Vehicles

Automotive fascia Market by Sales ChannelOEM

Aftermarket

Germany Outlook (USD Billion, 2018-2032)

Automotive fascia Market by Position TypeFront Fascia

Rear Fascia

Automotive fascia Market by MaterialSteel & Aluminium

Rubber

Plastic Covered Styrofoam

Plastic Covered Aluminium

Others

Automotive fascia Market by Vehicle TypePassenger Cars

Commercial Vehicles

Automotive fascia Market by Sales ChannelOEM

Aftermarket

France Outlook (USD Billion, 2018-2032)

Front Fascia

Rear Fascia

Automotive fascia Market by MaterialSteel & Aluminium

Rubber

Plastic Covered Styrofoam

Plastic Covered Aluminium

Others

Automotive fascia Market by Vehicle TypePassenger Cars

Commercial Vehicles

Automotive fascia Market by Sales ChannelOEM

Aftermarket

UK Outlook (USD Billion, 2018-2032)

Front Fascia

Rear Fascia

Automotive fascia Market by MaterialSteel & Aluminium

Rubber

Plastic Covered Styrofoam

Plastic Covered Aluminium

Others

Automotive fascia Market by Vehicle TypePassenger Cars

Commercial Vehicles

Automotive fascia Market by Sales ChannelOEM

Aftermarket

Italy Outlook (USD Billion, 2018-2032)

Front Fascia

Rear Fascia

Automotive fascia Market by MaterialSteel & Aluminium

Rubber

Plastic Covered Styrofoam

Plastic Covered Aluminium

Others

Automotive fascia Market by Vehicle TypePassenger Cars

Commercial Vehicles

Automotive fascia Market by Sales ChannelOEM

Aftermarket

Spain Outlook (USD Billion, 2018-2032)

Front Fascia

Rear Fascia

Automotive fascia Market by MaterialSteel & Aluminium

Rubber

Plastic Covered Styrofoam

Plastic Covered Aluminium

Others

Automotive fascia Market by Vehicle TypePassenger Cars

Commercial Vehicles

Automotive fascia Market by Sales ChannelOEM

Aftermarket

Rest Of Europe Outlook (USD Billion, 2018-2032)

Front Fascia

Rear Fascia

Automotive fascia Market by MaterialSteel & Aluminium

Rubber

Plastic Covered Styrofoam

Plastic Covered Aluminium

Others

Automotive fascia Market by Vehicle TypePassenger Cars

Commercial Vehicles

Automotive fascia Market by Sales ChannelOEM

Aftermarket

Asia-Pacific Outlook (USD Billion, 2018-2032)

Front Fascia

Rear Fascia

Automotive fascia Market by MaterialSteel & Aluminium

Rubber

Plastic Covered Styrofoam

Plastic Covered Aluminium

Others

Automotive fascia Market by Vehicle TypePassenger Cars

Commercial Vehicles

Automotive fascia Market by Sales ChannelOEM

Aftermarket

China Outlook (USD Billion, 2018-2032)

Front Fascia

Rear Fascia

Automotive fascia Market by MaterialSteel & Aluminium

Rubber

Plastic Covered Styrofoam

Plastic Covered Aluminium

Others

Automotive fascia Market by Vehicle TypePassenger Cars

Commercial Vehicles

Automotive fascia Market by Sales ChannelOEM

Aftermarket

Japan Outlook (USD Billion, 2018-2032)

Front Fascia

Rear Fascia

Automotive fascia Market by MaterialSteel & Aluminium

Rubber

Plastic Covered Styrofoam

Plastic Covered Aluminium

Others

Automotive fascia Market by Vehicle TypePassenger Cars

Commercial Vehicles

Automotive fascia Market by Sales ChannelOEM

Aftermarket

India Outlook (USD Billion, 2018-2032)

Front Fascia

Rear Fascia

Automotive fascia Market by MaterialSteel & Aluminium

Rubber

Plastic Covered Styrofoam

Plastic Covered Aluminium

Others

Automotive fascia Market by Vehicle TypePassenger Cars

Commercial Vehicles

Automotive fascia Market by Sales ChannelOEM

Aftermarket

Australia Outlook (USD Billion, 2018-2032)

Front Fascia

Rear Fascia

Automotive fascia Market by MaterialSteel & Aluminium

Rubber

Plastic Covered Styrofoam

Plastic Covered Aluminium

Others

Automotive fascia Market by Vehicle TypePassenger Cars

Commercial Vehicles

Automotive fascia Market by Sales ChannelOEM

Aftermarket

Rest of Asia-Pacific Outlook (USD Billion, 2018-2032)

Front Fascia

Rear Fascia

Automotive fascia Market by MaterialSteel & Aluminium

Rubber

Plastic Covered Styrofoam

Plastic Covered Aluminium

Others

Automotive fascia Market by Vehicle TypePassenger Cars

Commercial Vehicles

Automotive fascia Market by Sales ChannelOEM

Aftermarket

Rest of the World Outlook (USD Billion, 2018-2032)

Front Fascia

Rear Fascia

Automotive fascia Market by MaterialSteel & Aluminium

Rubber

Plastic Covered Styrofoam

Plastic Covered Aluminium

Others

Automotive fascia Market by Vehicle TypePassenger Cars

Commercial Vehicles

Automotive fascia Market by Sales ChannelOEM

Aftermarket

Middle East Outlook (USD Billion, 2018-2032)

Front Fascia

Rear Fascia

Automotive fascia Market by MaterialSteel & Aluminium

Rubber

Plastic Covered Styrofoam

Plastic Covered Aluminium

Others

Automotive fascia Market by Vehicle TypePassenger Cars

Commercial Vehicles

Automotive fascia Market by Sales ChannelOEM

Aftermarket

Africa Outlook (USD Billion, 2018-2032)

Front Fascia

Rear Fascia

Automotive fascia Market by MaterialSteel & Aluminium

Rubber

Plastic Covered Styrofoam

Plastic Covered Aluminium

Others

Automotive fascia Market by Vehicle TypePassenger Cars

Commercial Vehicles

Automotive fascia Market by Sales ChannelOEM

Aftermarket

Latin America Outlook (USD Billion, 2018-2032)

Front Fascia

Rear Fascia

Automotive fascia Market by MaterialSteel & Aluminium

Rubber

Plastic Covered Styrofoam

Plastic Covered Aluminium

Others

Automotive fascia Market by Vehicle TypePassenger Cars

Commercial Vehicles

Automotive fascia Market by Sales ChannelOEM

Aftermarket

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment