Automated Cell Culture Equipment Market Analysis

Automated Cell Culture Equipment Market Research Report Information by Lab Automation Type (Modular Automation and Whole Lab Automation), by Product Type (Consumables, Equipment and Software), Application (Biopharmaceutical Production, Tissue Engineering, Vaccine Production, Gene Therapy & Regenerative Medicine, Stem Cell Therapy, Toxicity Testing and Diagnostics), End User (Pharmaceutical ...

Market Summary

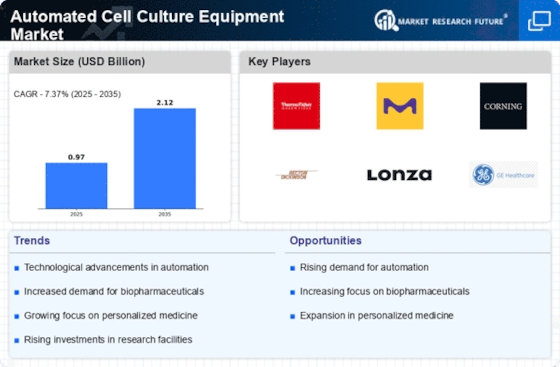

The Global Automated Cell Culture Equipment Market is projected to grow from 0.97 USD Billion in 2024 to 2.12 USD Billion by 2035, reflecting a robust growth trajectory.

Key Market Trends & Highlights

Automated Cell Culture Equipment Key Trends and Highlights

- The market is expected to achieve a compound annual growth rate (CAGR) of 7.37% from 2025 to 2035.

- By 2035, the market valuation is anticipated to reach 2.12 USD Billion, indicating substantial growth potential.

- In 2024, the market is valued at 0.97 USD Billion, laying a solid foundation for future expansion.

- Growing adoption of automated cell culture technologies due to increased demand for high-throughput screening is a major market driver.

Market Size & Forecast

| 2024 Market Size | 0.97 (USD Billion) |

| 2035 Market Size | 2.12 (USD Billion) |

| CAGR (2025-2035) | 7.37% |

| Largest Regional Market Share in 2024 | latin_america) |

Major Players

Tecan Trading AG, Siemens, Pfizer Inc., Hitachi, Ltd, Thermo Fisher Scientific Inc., Sartorius AG, Hamilton Company, Beckman Coulter, Inc., F. Hoffmann-La Roche Ltd., Perkinelmer, Inc., Anton Paar GmBH, Becton, Dickinson, and Company (U.S.), HiMedia Laboratories (India), GE Healthcare (U.S.), Lonza (Switzerland), CellGenix GmbH (Germany)

Market Trends

The increasing demand for advanced biopharmaceuticals and regenerative medicine is driving innovation in automated cell culture technologies, which are poised to enhance research efficiency and reproducibility.

U.S. National Institutes of Health (NIH)

Automated Cell Culture Equipment Market Market Drivers

Market Growth Projections

The Global Automated Cell Culture Equipment Market Industry is projected to experience substantial growth over the coming years. The market is expected to reach approximately 0.97 USD Billion in 2024 and is forecasted to grow to around 2.12 USD Billion by 2035. This growth trajectory suggests a robust demand for automated solutions in cell culture processes. The anticipated CAGR of 7.37% from 2025 to 2035 indicates a strong market potential, driven by various factors including technological advancements, increased investment in R&D, and a rising focus on personalized medicine. This upward trend highlights the importance of automated cell culture equipment in modern biopharmaceutical development.

Rising Demand for Biopharmaceuticals

The Global Automated Cell Culture Equipment Market Industry experiences a notable surge in demand driven by the increasing need for biopharmaceuticals. As the global population ages and chronic diseases rise, the biopharmaceutical sector is expected to expand significantly. In 2024, the market is valued at approximately 0.97 USD Billion, reflecting the industry's growth potential. This trend is likely to continue, with projections indicating a market size of 2.12 USD Billion by 2035. The CAGR of 7.37% from 2025 to 2035 suggests that automated cell culture equipment will play a crucial role in meeting the production demands of biopharmaceuticals.

Increased Focus on Personalized Medicine

The Global Automated Cell Culture Equipment Market Industry is significantly influenced by the growing emphasis on personalized medicine. As healthcare shifts towards tailored therapies, the demand for advanced cell culture techniques rises. Automated cell culture systems facilitate the development of patient-specific treatments by enabling high-throughput screening and efficient cell manipulation. This trend is expected to contribute to the market's expansion, with a projected growth from 0.97 USD Billion in 2024 to 2.12 USD Billion by 2035. The CAGR of 7.37% from 2025 to 2035 indicates that automated cell culture equipment will be integral to the future of personalized medicine.

Technological Advancements in Automation

Technological advancements in automation are pivotal for the Global Automated Cell Culture Equipment Market Industry. Innovations such as robotics, artificial intelligence, and machine learning enhance the efficiency and precision of cell culture processes. These technologies streamline workflows, reduce human error, and improve reproducibility, which are essential for research and production. As laboratories increasingly adopt automated solutions, the market is poised for growth. The anticipated increase in market size from 0.97 USD Billion in 2024 to 2.12 USD Billion by 2035 underscores the importance of these advancements in driving the adoption of automated cell culture equipment.

Growing Investment in Research and Development

Investment in research and development is a critical driver for the Global Automated Cell Culture Equipment Market Industry. As organizations strive to innovate and develop new therapies, the demand for sophisticated cell culture systems increases. Enhanced funding from both public and private sectors supports the development of automated solutions that improve research outcomes. The market's growth from 0.97 USD Billion in 2024 to 2.12 USD Billion by 2035 reflects this trend. The projected CAGR of 7.37% from 2025 to 2035 indicates that sustained investment in R&D will likely propel the adoption of automated cell culture equipment.

Regulatory Support for Advanced Cell Culture Techniques

Regulatory bodies are increasingly supporting the adoption of advanced cell culture techniques, which positively impacts the Global Automated Cell Culture Equipment Market Industry. Guidelines that promote the use of automated systems in research and production enhance compliance and safety in biopharmaceutical manufacturing. This regulatory support encourages investment in automated technologies, leading to market growth. With the market projected to grow from 0.97 USD Billion in 2024 to 2.12 USD Billion by 2035, the role of regulatory frameworks in facilitating the adoption of automated cell culture equipment cannot be understated. The anticipated CAGR of 7.37% from 2025 to 2035 further emphasizes this trend.

Market Segment Insights

Regional Insights

Key Companies in the Automated Cell Culture Equipment Market market include

Industry Developments

Various developments are seen in the automated cell culture equipment market which is as follows:

- In the year 2020, a japan based biotechnical organization named ThinkCyte Inc., came in a joint venture with Hitachi to develop an artificial intelligence system for strengthening cell analysis.

- In the year 2019, Thermo Fisher introduced a new automated incubator for delivering and maintaining cells and microorganisms in a controlled environment.

- In June of 2020, ThermoGnesis Corp., a pharmaceutical company, launched an X-series cell culturing products at a commercial level.

- In May of 2019, Sartorius AG brought into being an automated micro-bioreactor, called Ambr 15 Cell Culture.

- In the year 2020, HORIBA Medical and CellaVision collaborated and produced an automated digital cell morphology solution.

Future Outlook

Automated Cell Culture Equipment Market Future Outlook

The Automated Cell Culture Equipment Market is projected to grow at a 7.37% CAGR from 2024 to 2035, driven by technological advancements, increasing demand for biopharmaceuticals, and enhanced research capabilities.

New opportunities lie in:

- Develop automated systems for personalized medicine applications.

- Invest in AI-driven analytics for optimized cell culture processes.

- Expand product lines to include sustainable and eco-friendly materials.

By 2035, the market is expected to achieve substantial growth, reflecting advancements and increased adoption across various sectors.

Market Segmentation

Report Overview

- Recent Developments

- Competitive Landscape

- Regional Analysis

- Automated Cell Culture Equipment Market Segmentation

- Value Chain Analysis

- Market Dynamics

- COVID19 Analysis

- Automated Cell Culture Equipment Market Overview

Regional Analysis

- CellGenix GmbH (Germany).

- Lonza (Switzerland)

- GE Healthcare (U.S.)

- HiMedia Laboratories (India)

- Anton Paar GmBH . Becton, Dickinson, and Company (U.S.)

- Perkinelmer, Inc.

- F. Hoffmann-La Roche Ltd.

- Beckman Coulter, Inc.

- Hamilton Company

- Sartorius AG

- Thermo Fisher Scientific Inc.

- Hitachi, Ltd

- Pfizer Inc.

- Siemens

- Tecan Trading AG

- In the year 2020, HORIBA Medical and CellaVision collaborated and produced an automated digital cell morphology solution.

- In May of 2019, Sartorius AG brought into being an automated micro-bioreactor, called Ambr 15 Cell Culture.

- In June of 2020, ThermoGnesis Corp., a pharmaceutical company, launched an X-series cell culturing products at a commercial level.

- In the year 2019, Thermo Fisher introduced a new automated incubator for delivering and maintaining cells and microorganisms in a controlled environment.

- In the year 2020, a japan based biotechnical organization named ThinkCyte Inc., came in a joint venture with Hitachi to develop an artificial intelligence system for strengthening cell analysis.

- Recent Developments

- Competitive Landscape

- Regional Analysis

- Automated Cell Culture Equipment Market Segmentation

- Value Chain Analysis

- Market Dynamics

- COVID19 Analysis

- Automated Cell Culture Equipment Market Overview

Recent Development

- In the year 2020, HORIBA Medical and CellaVision collaborated and produced an automated digital cell morphology solution.

- In May of 2019, Sartorius AG brought into being an automated micro-bioreactor, called Ambr 15 Cell Culture.

- In June of 2020, ThermoGnesis Corp., a pharmaceutical company, launched an X-series cell culturing products at a commercial level.

- In the year 2019, Thermo Fisher introduced a new automated incubator for delivering and maintaining cells and microorganisms in a controlled environment.

- In the year 2020, a japan based biotechnical organization named ThinkCyte Inc., came in a joint venture with Hitachi to develop an artificial intelligence system for strengthening cell analysis.

- Recent Developments

- Competitive Landscape

- Regional Analysis

- Automated Cell Culture Equipment Market Segmentation

- Value Chain Analysis

- Market Dynamics

- COVID19 Analysis

- Automated Cell Culture Equipment Market Overview

Competitive Landscape

- CellGenix GmbH (Germany).

- Lonza (Switzerland)

- GE Healthcare (U.S.)

- HiMedia Laboratories (India)

- Anton Paar GmBH . Becton, Dickinson, and Company (U.S.)

- Perkinelmer, Inc.

- F. Hoffmann-La Roche Ltd.

- Beckman Coulter, Inc.

- Hamilton Company

- Sartorius AG

- Thermo Fisher Scientific Inc.

- Hitachi, Ltd

- Pfizer Inc.

- Siemens

- Tecan Trading AG

- In the year 2020, HORIBA Medical and CellaVision collaborated and produced an automated digital cell morphology solution.

- In May of 2019, Sartorius AG brought into being an automated micro-bioreactor, called Ambr 15 Cell Culture.

- In June of 2020, ThermoGnesis Corp., a pharmaceutical company, launched an X-series cell culturing products at a commercial level.

- In the year 2019, Thermo Fisher introduced a new automated incubator for delivering and maintaining cells and microorganisms in a controlled environment.

- In the year 2020, a japan based biotechnical organization named ThinkCyte Inc., came in a joint venture with Hitachi to develop an artificial intelligence system for strengthening cell analysis.

- Recent Developments

- Competitive Landscape

- Regional Analysis

- Automated Cell Culture Equipment Market Segmentation

- Value Chain Analysis

- Market Dynamics

- COVID19 Analysis

- Automated Cell Culture Equipment Market Overview

Automated Cell Culture Equipment Market on end-user

- CellGenix GmbH (Germany).

- Lonza (Switzerland)

- GE Healthcare (U.S.)

- HiMedia Laboratories (India)

- Anton Paar GmBH . Becton, Dickinson, and Company (U.S.)

- Perkinelmer, Inc.

- F. Hoffmann-La Roche Ltd.

- Beckman Coulter, Inc.

- Hamilton Company

- Sartorius AG

- Thermo Fisher Scientific Inc.

- Hitachi, Ltd

- Pfizer Inc.

- Siemens

- Tecan Trading AG

- In the year 2020, HORIBA Medical and CellaVision collaborated and produced an automated digital cell morphology solution.

- In May of 2019, Sartorius AG brought into being an automated micro-bioreactor, called Ambr 15 Cell Culture.

- In June of 2020, ThermoGnesis Corp., a pharmaceutical company, launched an X-series cell culturing products at a commercial level.

- In the year 2019, Thermo Fisher introduced a new automated incubator for delivering and maintaining cells and microorganisms in a controlled environment.

- In the year 2020, a japan based biotechnical organization named ThinkCyte Inc., came in a joint venture with Hitachi to develop an artificial intelligence system for strengthening cell analysis.

- Recent Developments

- Competitive Landscape

- Regional Analysis

- Automated Cell Culture Equipment Market Segmentation

- Value Chain Analysis

- Market Dynamics

- COVID19 Analysis

- Automated Cell Culture Equipment Market Overview

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2023 | 0.90 (USD Billion) |

| Market Size 2024 | 0.97 (USD Billion) |

| Market Size 2032 | 1.71 (USD Billion) |

| Compound Annual Growth Rate (CAGR) | 7.43 % (2024 - 2032) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Base Year | 2023 |

| Market Forecast Period | 2024 - 2032 |

| Historical Data | 2019 - 2023 |

| Geographies Covered | North America, Europe, Asia-Pacific, and Rest of the World (RoW) |

| Key Vendors | Tecan Trading AG, Hamilton Company, Beckman Coulter, Inc., Pfizer Inc., Hitachi, Ltd, F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific Inc., Anton Paar GmBH, Sartorius AG, Perkinelmer, Inc., and Siemens |

| Key Market Opportunities | Growing research & development (R&D) initiatives in the pharmaceutical industry |

| Key Market Drivers | · The rising prevalence of cancer and other chronic disorders demands the discovery of newer and more effective drugs for their treatment. · The growing incidence of cancer and other chronic diseases is anticipated to fuel the market growth |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

What is the projected market value of the automated cell culture equipment market?

Automated cell culture equipment market is touted to record a substantial market valuation of USD 1.71 Billion by 2032.

What is the estimated growth rate of the automated cell culture equipment market?

Automated cell culture equipment market is projected to register a moderate 7.43% CAGR in the forecast period.

Which factors are poised to drive the automated cell culture equipment market growth?

The massive growth of the automated cell culture equipment market is driven by the growing R&D projects in the pharmaceutical industry.

Which type is touted to witness the highest growth?

The modular automation segment is expected to observe substantial demand over the review period.

Which region is expected to observe the highest growth?

The APAC is poised to secure the highest CAGR.

What is the application of the automated cell culture equipment market expected to witness the highest growth?

The stem cell therapy segment is slated to mature as the fastest-growing segment.

Who are the significant players operative in the automated cell culture equipment market?

A few eminent market players functioning in the global automated cell culture equipment market are Siemens, Pfizer Inc., Thermo Fisher Scientific Inc., Hitachi, Ltd, among others.

-

Executive Summary

- MARKET SYNOPSIS 18

-

Market Introduction

- DEFINITION 19

- Scope of the Study 19

- RESEARCH OBJECTIVE 19

- MARKET STRUCTURE 20

-

Research Methodology

- RESEARCH PROCESS 21

- PRIMARY RESEARCH 22

- SECONDARY RESEARCH 23

- MARKET SIZE ESTIMATION 23

- FORECAST MODEL 25

- LIST OF ASSUMPTIONS 26

-

MARKET DYNAMICS

- OVERVIEW 27

-

DRIVERS 28

- GROWING RESEARCH AND DEVELOPMENT INITIATIVES IN THE PHARMACEUTICAL INDUSTRY 28

- RISE IN ADOPTION OF LIQUID HANDLING SYSTEMS 28

- INCREASING PREVALENCE OF CANCER AND OTHER CHRONIC DISEASES 29

-

RESTRAINTS 30

- HIGH MAINTAINANCE COST 30

-

OPPORTUNITIES 31

- RISING FOCUS ON REGENERATIVE MEDICINE 31

-

MARKET FACTOR ANALYSIS

-

PORTER’S FIVE FORCES MODEL 32

- BARGAINING POWER OF SUPPLIERS 33

- BARGAINING POWER OF BUYERS 33

- THREAT OF NEW ENTRANTS 33

- THREAT OF SUBSTITUTES 33

- INTENSITY OF RIVALRY 33

-

VALUE CHAIN ANALYSIS 34

- R&D AND DESIGNING 35

- MANUFACTURING 35

- DISTRIBUTION & SALES 35

- POST-SALES MONITORING 35

-

PORTER’S FIVE FORCES MODEL 32

-

AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY LAB AUTOMATION TYPE

- OVERVIEW 36

- MODULAR AUTOMATION 38

- WHOLE LAB AUTOMATION 38

-

AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY PRODUCT TYPE

- OVERVIEW 39

- CONSUMABLES 42

- EQUIPMENT 42

- SOFTWARE 43

-

AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY APPLICATION

- OVERVIEW 44

- BIOPHARMACEUTICAL PRODUCTION 46

- TISSUE ENGINEERING 47

- VACCINE PRODUCTION 47

- DRUG SCREENING AND DEVELOPMENT 48

- GENE THERAPY & REGENERATIVE MEDICINE 48

- STEM CELL THERAPY 49

- TOXICITY TESTING 49

- DIAGNOSTICS 50

-

GLOBAL AUTOMATED CELL CULTURE EQUIPMENT MARKET, END USER

- OVERVIEW 51

- PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES 53

- RESEARCH AND ACADEMIC INSTITUTES 53

- HOSPITALS AND DIAGNOSTIC LABORATORIES 54

-

GLOBAL AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY REGION

- OVERVIEW 55

- AMERICAS 57

-

AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY LAB AUTOMATION TYPE

-

AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY PRODUCT TYPE

-

AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY APPLICATION

- NORTH AMERICA 61

-

AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY LAB AUTOMATION TYPE

-

AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY PRODUCT TYPE

-

AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY APPLICATION

- US 64

-

AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY LAB AUTOMATION TYPE

-

AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY PRODUCT TYPE

-

AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY APPLICATION

- CANADA 67

-

AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY LAB AUTOMATION TYPE

-

AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY PRODUCT TYPE

- LATIN AMERICA 70

-

AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY LAB AUTOMATION TYPE

-

AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY APPLICATION

-

EUROPE 74

- WESTERN EUROPE 78

-

EUROPE 74

-

AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY LAB AUTOMATION TYPE

- GERMANY 82

-

AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY PRODUCT TYPE

-

AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY APPLICATION

- UK 85

-

AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY LAB AUTOMATION TYPE

-

AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY PRODUCT TYPE

-

FRANCE 88

- ITALY 91

- EASTERN EUROPE 100

-

ASIA-PACIFIC 103

- JAPAN 107

- CHINA 110

- AUSTRALIA 113

- INDIA 116

- SOUTH KOREA 119

- REST OF ASIA-PACIFIC 122

- MIDDLE EAST & AFRICA 126

-

FRANCE 88

-

AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY LAB AUTOMATION TYPE

-

AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY PRODUCT TYPE

-

MIDDLE EAST 130

- AFRICA 133

-

MIDDLE EAST 130

-

Competitive Landscape

- INTRODUCTION 136

- COMPETITIVE ANALYSIS 136

-

COMPANY PROFILES

-

TECAN TRADING AG 137

- COMPANY OVERVIEW 137

- FINANCIAL OVERVIEW 138

- PRODUCTS/SERVICES OFFERED 139

- KEY DEVELOPMENTS 140

- SWOT ANALYSIS 141

- KEY STRATEGIES 141

-

SIEMENS 142

- COMPANY OVERVIEW 142

- FINANCIAL OVERVIEW 142

- PRODUCTS/SERVICES OFFERED 143

- KEY DEVELOPMENTS 143

- SWOT ANALYSIS 144

- KEY STRATEGIES 144

-

HITACHI, LTD 145

- COMPANY OVERVIEW 145

- FINANCIAL OVERVIEW 145

- PRODUCTS/SERVICES OFFERED 146

- KEY DEVELOPMENTS 146

- SWOT ANALYSIS 147

- KEY STRATEGIES 147

-

THERMO FISHER SCIENTIFIC INC. 148

- COMPANY OVERVIEW 148

- FINANCIAL OVERVIEW 148

- PRODUCTS/SERVICES OFFERED 149

- KEY DEVELOPMENTS 149

- SWOT ANALYSIS 150

- KEY STRATEGIES 150

-

SARTORIUS AG 151

- COMPANY OVERVIEW 151

- FINANCIAL OVERVIEW 151

- PRODUCTS/SERVICES OFFERED 152

- KEY DEVELOPMENTS 152

- SWOT ANALYSIS 153

- KEY STRATEGIES 153

-

HAMILTON COMPANY 154

- COMPANY OVERVIEW 154

- FINANCIAL OVERVIEW 154

- PRODUCTS/SERVICES OFFERED 154

- KEY DEVELOPMENTS 154

- SWOT ANALYSIS 155

- KEY STRATEGIES 155

-

BECKMAN COULTER, INC. 156

- COMPANY OVERVIEW 156

- FINANCIAL OVERVIEW 156

- PRODUCTS/SERVICES OFFERED 157

- KEY DEVELOPMENTS 157

- SWOT ANALYSIS 158

- KEY STRATEGIES 158

-

F. HOFFMANN-LA ROCHE LTD 159

- COMPANY OVERVIEW 159

- FINANCIAL OVERVIEW 160

- PRODUCTS/SERVICES OFFERED 160

- KEY DEVELOPMENTS 161

- SWOT ANALYSIS 161

- KEY STRATEGIES 161

-

PERKINELMER, INC. 162

- COMPANY OVERVIEW 162

- FINANCIAL OVERVIEW 162

- PRODUCTS/SERVICES OFFERED 163

- KEY DEVELOPMENTS 163

- SWOT ANALYSIS 164

- KEY STRATEGIES 164

-

ANTON PAAR GMBH 165

- COMPANY OVERVIEW 165

- FINANCIAL OVERVIEW 165

- PRODUCTS/SERVICES OFFERED 165

- KEY DEVELOPMENTS 165

- SWOT ANALYSIS 166

- KEY STRATEGIES 166

-

TECAN TRADING AG 137

-

APPENDIX

- REFERENCES 167

- RELATED REPORTS 167

-

List of Tables and Figures

- 14 List of Tables

- TABLE 1 LIST OF ASSUMPTIONS 26

- TABLE 2 GLOBAL AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY LAB AUTOMATION TYPE, 2020–2027 (USD MILLION) 37

- TABLE 3 GLOBAL AUTOMATED CELL CULTURE EQUIPMENT MARKET FOR MODULAR AUTOMATION, BY REGION, 2020–2027 (USD MILLION) 38

- TABLE 4 GLOBAL AUTOMATED CELL CULTURE EQUIPMENT MARKET FOR WHOLE LAB AUTOMATION, BY REGION, 2020–2027 (USD MILLION) 38

- TABLE 5 GLOBAL AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION) 40

- TABLE 6 GLOBAL AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR CONSUMABLES, BY TYPE, 2020–2027 (USD MILLION) 40

- TABLE 7 GLOBAL AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR EQUIPMENT, BY TYPE, 2020–2027 (USD MILLION) 41

- TABLE 8 GLOBAL AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR SOFTWARE, BY TYPE, 2020–2027 (USD MILLION) 41

- TABLE 9 GLOBAL AUTOMATED CELL CULTURE EQUIPMENT MARKET FOR CONSUMABLES, BY REGION, 2020–2027 (USD MILLION) 42

- TABLE 10 GLOBAL AUTOMATED CELL CULTURE EQUIPMENT MARKET FOR EQUIPMENT, BY REGION, 2020–2027 (USD MILLION) 42

- TABLE 11 GLOBAL AUTOMATED CELL CULTURE EQUIPMENT MARKET FOR SOFTWARE, BY REGION, 2020–2027 (USD MILLION) 43

- TABLE 12 GLOBAL AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY APPLICATION, 2020–2027 (USD MILLION) 46

- TABLE 13 GLOBAL AUTOMATED CELL CULTURE EQUIPMENT MARKET FOR BIOPHARMACEUTICAL PRODUCTION, BY REGION, 2020–2027 (USD MILLION) 46

- TABLE 14 GLOBAL AUTOMATED CELL CULTURE EQUIPMENT MARKET FOR TISSUE ENGINEERING, BY REGION, 2020–2027 (USD MILLION) 47

- TABLE 15 GLOBAL AUTOMATED CELL CULTURE EQUIPMENT MARKET FOR VACCINE PRODUCTION, BY REGION, 2020–2027 (USD MILLION) 47

- TABLE 16 GLOBAL AUTOMATED CELL CULTURE EQUIPMENT MARKET FOR DRUG SCREENING AND DEVELOPMENT, BY REGION, 2020–2027 (USD MILLION) 48

- TABLE 17 GLOBAL AUTOMATED CELL CULTURE EQUIPMENT MARKET FOR GENE THERAPY & REGENERATIVE MEDICINE, BY REGION, 2020–2027 (USD MILLION) 48

- TABLE 18 GLOBAL AUTOMATED CELL CULTURE EQUIPMENT MARKET FOR STEM CELL THERAPY, BY REGION, 2020–2027 (USD MILLION) 49

- TABLE 19 GLOBAL AUTOMATED CELL CULTURE EQUIPMENT MARKET FOR TOXICITY TESTING, BY REGION, 2020–2027 (USD MILLION) 49

- TABLE 20 GLOBAL AUTOMATED CELL CULTURE EQUIPMENT MARKET FOR DIAGNOSTICS, BY REGION, 2020–2027 (USD MILLION) 50

- TABLE 21 GLOBAL AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY END USER, 2020–2027 (USD MILLION) 52

- TABLE 22 GLOBAL AUTOMATED CELL CULTURE EQUIPMENT MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2020–2027 (USD MILLION) 53

- TABLE 23 GLOBAL AUTOMATED CELL CULTURE EQUIPMENT MARKET FOR RESEARCH AND ACADEMIC INSTITUTES, BY REGION, 2020–2027 (USD MILLION) 53

- TABLE 24 GLOBAL AUTOMATED CELL CULTURE EQUIPMENT MARKET FOR HOSPITALS AND DIAGNOSTIC LABORATORIES, BY REGION, 2020–2027 (USD MILLION) 54

- TABLE 25 AMERICAS: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY REGION, 2020–2027 (USD MILLION) 57

- TABLE 26 AMERICAS: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY LAB AUTOMATION TYPE, 2020–2027 (USD MILLION) 58

- TABLE 27 AMERICAS: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY PRODUCT TYPE 2020–2027 (USD MILLION) 58

- TABLE 28 AMERICAS: AUTOMATED CELL CULTURE EQUIPMENT MARKET FOR CONSUMABLES, BY TYPE, 2020–2027 (USD MILLION) 58

- TABLE 29 AMERICAS: AUTOMATED CELL CULTURE EQUIPMENT MARKET FOR EQUIPMENT, BY TYPE, 2020–2027 (USD MILLION) 59

- TABLE 30 AMERICAS: AUTOMATED CELL CULTURE EQUIPMENT MARKET FOR SOFTWARE, BY TYPE, 2020–2027 (USD MILLION) 59

- TABLE 31 AMERICAS: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY APPLICATION 2020–2027 (USD MILLION) 60

- TABLE 32 AMERICAS: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY END USER 2020–2027 (USD MILLION) 60

- TABLE 33 NORTH AMERICA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION) 61

- TABLE 34 NORTH AMERICA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY LAB AUTOMATION TYPE, 2020–2027 (USD MILLION) 61

- TABLE 35 NORTH AMERICA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY PRODUCT TYPE 2020–2027 (USD MILLION) 62

- TABLE 36 NORTH AMERICA: AUTOMATED CELL CULTURE EQUIPMENT MARKET FOR CONSUMABLES, BY TYPE, 2020–2027 (USD MILLION) 62

- TABLE 37 NORTH AMERICA: AUTOMATED CELL CULTURE EQUIPMENT MARKET FOR EQUIPMENT, BY TYPE, 2020–2027 (USD MILLION) 62

- TABLE 38 NORTH AMERICA: AUTOMATED CELL CULTURE EQUIPMENT MARKET FOR SOFTWARE, BY TYPE, 2020–2027 (USD MILLION) 63

- TABLE 39 NORTH AMERICA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY APPLICATION 2020–2027 (USD MILLION) 63

- TABLE 40 NORTH AMERICA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY END USER 2020–2027 (USD MILLION) 64

- TABLE 41 US: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY LAB AUTOMATION TYPE, 2020–2027 (USD MILLION) 64

- TABLE 42 US: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY PRODUCT TYPE 2020–2027 (USD MILLION) 64

- TABLE 43 US: AUTOMATED CELL CULTURE EQUIPMENT MARKET FOR CONSUMABLES, BY TYPE, 2020–2027 (USD MILLION) 65

- TABLE 44 US: AUTOMATED CELL CULTURE EQUIPMENT MARKET FOR EQUIPMENT, BY TYPE, 2020–2027 (USD MILLION) 65

- TABLE 45 US: AUTOMATED CELL CULTURE EQUIPMENT MARKET FOR SOFTWARE, BY TYPE, 2020–2027 (USD MILLION) 66

- TABLE 46 US: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY APPLICATION 2020–2027 (USD MILLION) 66

- TABLE 47 US: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY END USER 2020–2027 (USD MILLION) 67

- TABLE 48 CANADA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY LAB AUTOMATION TYPE, 2020–2027 (USD MILLION) 67

- TABLE 49 CANADA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY PRODUCT TYPE 2020–2027 (USD MILLION) 67

- TABLE 50 CANADA: AUTOMATED CELL CULTURE EQUIPMENT MARKET FOR CONSUMABLES, BY TYPE, 2020–2027 (USD MILLION) 68

- TABLE 51 CANADA: AUTOMATED CELL CULTURE EQUIPMENT MARKET FOR EQUIPMENT, BY TYPE, 2020–2027 (USD MILLION) 68

- TABLE 52 CANADA: AUTOMATED CELL CULTURE EQUIPMENT MARKET FOR SOFTWARE, BY TYPE, 2020–2027 (USD MILLION) 69

- TABLE 53 CANADA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY APPLICATION 2020–2027 (USD MILLION) 69

- TABLE 54 CANADA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY END USER 2020–2027 (USD MILLION) 70

- TABLE 55 LATIN AMERICA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY LAB AUTOMATION TYPE, 2020–2027 (USD MILLION) 70

- TABLE 56 LATIN AMERICA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY PRODUCT TYPE 2020–2027 (USD MILLION) 70

- TABLE 57 LATIN AMERICA: AUTOMATED CELL CULTURE EQUIPMENT MARKET FOR CONSUMABLES, BY TYPE, 2020–2027 (USD MILLION) 71

- TABLE 58 LATIN AMERICA: AUTOMATED CELL CULTURE EQUIPMENT MARKET FOR EQUIPMENT, BY TYPE, 2020–2027 (USD MILLION) 71

- TABLE 59 LATIN AMERICA: AUTOMATED CELL CULTURE EQUIPMENT MARKET FOR SOFTWARE, BY TYPE, 2020–2027 (USD MILLION) 72

- TABLE 60 LATIN AMERICA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY APPLICATION 2020–2027 (USD MILLION) 72

- TABLE 61 LATIN AMERICA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY END USER 2020–2027 (USD MILLION) 73

- TABLE 62 EUROPE: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY REGION, 2020–2027 (USD MILLION) 74

- TABLE 63 EUROPE: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY LAB AUTOMATION TYPE, 2020–2027 (USD MILLION) 75

- TABLE 64 EUROPE: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY PRODUCT TYPE 2020–2027 (USD MILLION) 75

- TABLE 65 EUROPE: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR CONSUMABLES, BY TYPE 2020–2027 (USD MILLION) 75

- TABLE 66 EUROPE: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR EQUIPMENT, BY TYPE 2020–2027 (USD MILLION) 76

- TABLE 67 EUROPE: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR SOFTWARE, BY TYPE 2020–2027 (USD MILLION) 76

- TABLE 68 EUROPE: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY APPLICATION 2020–2027 (USD MILLION) 77

- TABLE 69 EUROPE: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY END USER 2020–2027 (USD MILLION) 77

- TABLE 70 WESTERN EUROPE: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION) 78

- TABLE 71 EUROPE: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY LAB AUTOMATION TYPE, 2020–2027 (USD MILLION) 79

- TABLE 72 EUROPE: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY PRODUCT TYPE 2020–2027 (USD MILLION) 79

- TABLE 73 EUROPE: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR CONSUMABLES, BY TYPE 2020–2027 (USD MILLION) 79

- TABLE 74 EUROPE: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR EQUIPMENT, BY TYPE 2020–2027 (USD MILLION) 80

- TABLE 75 EUROPE: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR SOFTWARE, BY TYPE 2020–2027 (USD MILLION) 80

- TABLE 76 EUROPE: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY APPLICATION 2020–2027 (USD MILLION) 81

- TABLE 77 EUROPE: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY END USER 2020–2027 (USD MILLION) 81

- TABLE 78 GERMANY: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY LAB AUTOMATION TYPE, 2020–2027 (USD MILLION) 82

- TABLE 79 GERMANY: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY PRODUCT TYPE 2020–2027 (USD MILLION) 82

- TABLE 80 GERMANY: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR CONSUMABLES, BY TYPE 2020–2027 (USD MILLION) 82

- TABLE 81 GERMANY: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR EQUIPMENT, BY TYPE 2020–2027 (USD MILLION) 83

- TABLE 82 GERMANY: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR SOFTWARE, BY TYPE 2020–2027 (USD MILLION) 83

- TABLE 83 GERMANY: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY APPLICATION 2020–2027 (USD MILLION) 84

- TABLE 84 GERMANY: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY END USER 2020–2027 (USD MILLION) 84

- TABLE 85 UK: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY LAB AUTOMATION TYPE, 2020–2027 (USD MILLION) 85

- TABLE 86 UK: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY PRODUCT TYPE 2020–2027 (USD MILLION) 85

- TABLE 87 UK: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR CONSUMABLES, BY TYPE 2020–2027 (USD MILLION) 85

- TABLE 88 UK: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR EQUIPMENT, BY TYPE 2020–2027 (USD MILLION) 86

- TABLE 89 UK: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR SOFTWARE, BY TYPE 2020–2027 (USD MILLION) 86

- TABLE 90 UK: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY APPLICATION 2020–2027 (USD MILLION) 87

- TABLE 91 UK: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY END USER 2020–2027 (USD MILLION) 87

- TABLE 92 FRANCE: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY LAB AUTOMATION TYPE, 2020–2027 (USD MILLION) 88

- TABLE 93 FRANCE: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY PRODUCT TYPE 2020–2027 (USD MILLION) 88

- TABLE 94 FRANCE: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR CONSUMABLES, BY TYPE 2020–2027 (USD MILLION) 88

- TABLE 95 FRANCE: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR EQUIPMENT, BY TYPE 2020–2027 (USD MILLION) 89

- TABLE 96 FRANCE: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR SOFTWARE, BY TYPE 2020–2027 (USD MILLION) 89

- TABLE 97 FRANCE: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY APPLICATION 2020–2027 (USD MILLION) 90

- TABLE 98 FRANCE: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY END USER 2020–2027 (USD MILLION) 90

- TABLE 99 ITALY: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY LAB AUTOMATION TYPE, 2020–2027 (USD MILLION) 91

- TABLE 100 ITALY: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY PRODUCT TYPE 2020–2027 (USD MILLION) 91

- TABLE 101 ITALY: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR CONSUMABLES, BY TYPE 2020–2027 (USD MILLION) 91

- TABLE 102 ITALY: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR EQUIPMENT, BY TYPE 2020–2027 (USD MILLION) 92

- TABLE 103 ITALY: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR SOFTWARE, BY TYPE 2020–2027 (USD MILLION) 92

- TABLE 104 ITALY: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY APPLICATION 2020–2027 (USD MILLION) 93

- TABLE 105 ITALY: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY END USER 2020–2027 (USD MILLION) 93

- TABLE 106 SPAIN: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY LAB AUTOMATION TYPE, 2020–2027 (USD MILLION) 94

- TABLE 107 SPAIN: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY PRODUCT TYPE 2020–2027 (USD MILLION) 94

- TABLE 108 SPAIN: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR CONSUMABLES, BY TYPE 2020–2027 (USD MILLION) 94

- TABLE 109 SPAIN: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR EQUIPMENT, BY TYPE 2020–2027 (USD MILLION) 95

- TABLE 110 SPAIN: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR SOFTWARE, BY TYPE 2020–2027 (USD MILLION) 95

- TABLE 111 SPAIN: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY APPLICATION 2020–2027 (USD MILLION) 96

- TABLE 112 SPAIN: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY END USER 2020–2027 (USD MILLION) 96

- TABLE 113 REST OF WESTERN EUROPE: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY LAB AUTOMATION TYPE, 2020–2027 (USD MILLION) 97

- TABLE 114 REST OF WESTERN EUROPE: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY PRODUCT TYPE 2020–2027 (USD MILLION) 97

- TABLE 115 REST OF WESTERN EUROPE: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR CONSUMABLES, BY TYPE 2020–2027 (USD MILLION) 97

- TABLE 116 REST OF WESTERN EUROPE: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR EQUIPMENT, BY TYPE 2020–2027 (USD MILLION) 98

- TABLE 117 REST OF WESTERN EUROPE: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR SOFTWARE, BY TYPE 2020–2027 (USD MILLION) 98

- TABLE 118 REST OF WESTERN EUROPE: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY APPLICATION 2020–2027 (USD MILLION) 99

- TABLE 119 REST OF WESTERN EUROPE: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY END USER 2020–2027 (USD MILLION) 99

- TABLE 120 EASTERN EUROPE: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY LAB AUTOMATION TYPE, 2020–2027 (USD MILLION) 100

- TABLE 121 EASTERN EUROPE: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY PRODUCT TYPE 2020–2027 (USD MILLION) 100

- TABLE 122 EASTERN EUROPE: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR CONSUMABLES, BY TYPE 2020–2027 (USD MILLION) 100

- TABLE 123 EASTERN EUROPE: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR EQUIPMENT, BY TYPE 2020–2027 (USD MILLION) 101

- TABLE 124 EASTERN EUROPE: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR SOFTWARE, BY TYPE 2020–2027 (USD MILLION) 101

- TABLE 125 EASTERN EUROPE: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY APPLICATION 2020–2027 (USD MILLION) 102

- TABLE 126 EASTERN EUROPE: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY END USER 2020–2027 (USD MILLION) 102

- TABLE 127 ASIA-PACIFIC: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION) 104

- TABLE 128 ASIA-PACIFIC: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY LAB AUTOMATION TYPE, 2020–2027 (USD MILLION) 104

- TABLE 129 ASIA-PACIFIC: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY PRODUCT TYPE 2020–2027 (USD MILLION) 104

- TABLE 130 ASIA-PACIFIC: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR CONSUMABLES, BY TYPE 2020–2027 (USD MILLION) 105

- TABLE 131 ASIA-PACIFIC: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR EQUIPMENT, BY TYPE 2020–2027 (USD MILLION) 105

- TABLE 132 ASIA-PACIFIC: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR SOFTWARE, BY TYPE 2020–2027 (USD MILLION) 106

- TABLE 133 ASIA-PACIFIC: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY APPLICATION 2020–2027 (USD MILLION) 106

- TABLE 134 ASIA-PACIFIC: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY END USER 2020–2027 (USD MILLION) 107

- TABLE 135 JAPAN: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY LAB AUTOMATION TYPE, 2020–2027 (USD MILLION) 107

- TABLE 136 JAPAN: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY PRODUCT TYPE 2020–2027 (USD MILLION) 107

- TABLE 137 JAPAN: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR CONSUMABLES, BY TYPE 2020–2027 (USD MILLION) 108

- TABLE 138 JAPAN: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR EQUIPMENT, BY TYPE 2020–2027 (USD MILLION) 108

- TABLE 139 JAPAN: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR SOFTWARE, BY TYPE 2020–2027 (USD MILLION) 109

- TABLE 140 JAPAN: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY APPLICATION 2020–2027 (USD MILLION) 109

- TABLE 141 JAPAN: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY END USER 2020–2027 (USD MILLION) 110

- TABLE 142 CHINA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY LAB AUTOMATION TYPE, 2020–2027 (USD MILLION) 110

- TABLE 143 CHINA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY PRODUCT TYPE 2020–2027 (USD MILLION) 110

- TABLE 144 CHINA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR CONSUMABLES, BY TYPE 2020–2027 (USD MILLION) 111

- TABLE 145 CHINA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR EQUIPMENT, BY TYPE 2020–2027 (USD MILLION) 111

- TABLE 146 CHINA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR SOFTWARE, BY TYPE 2020–2027 (USD MILLION) 112

- TABLE 147 CHINA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY APPLICATION 2020–2027 (USD MILLION) 112

- TABLE 148 CHINA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY END USER 2020–2027 (USD MILLION) 113

- TABLE 149 AUSTRALIA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY LAB AUTOMATION TYPE, 2020–2027 (USD MILLION) 113

- TABLE 150 AUSTRALIA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY PRODUCT TYPE 2020–2027 (USD MILLION) 113

- TABLE 151 AUSTRALIA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR CONSUMABLES, BY TYPE 2020–2027 (USD MILLION) 114

- TABLE 152 AUSTRALIA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR EQUIPMENT, BY TYPE 2020–2027 (USD MILLION) 114

- TABLE 153 AUSTRALIA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR SOFTWARE, BY TYPE 2020–2027 (USD MILLION) 115

- TABLE 154 AUSTRALIA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY APPLICATION 2020–2027 (USD MILLION) 115

- TABLE 155 AUSTRALIA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY END USER 2020–2027 (USD MILLION) 116

- TABLE 156 INDIA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY LAB AUTOMATION TYPE, 2020–2027 (USD MILLION) 116

- TABLE 157 INDIA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY PRODUCT TYPE 2020–2027 (USD MILLION) 117

- TABLE 158 INDIA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR CONSUMABLES, BY TYPE 2020–2027 (USD MILLION) 117

- TABLE 159 INDIA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR EQUIPMENT, BY TYPE 2020–2027 (USD MILLION) 117

- TABLE 160 INDIA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR SOFTWARE, BY TYPE 2020–2027 (USD MILLION) 118

- TABLE 161 INDIA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY APPLICATION 2020–2027 (USD MILLION) 118

- TABLE 162 INDIA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY END USER 2020–2027 (USD MILLION) 119

- TABLE 163 SOUTH KOREA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY LAB AUTOMATION TYPE, 2020–2027 (USD MILLION) 119

- TABLE 164 SOUTH KOREA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY PRODUCT TYPE 2020–2027 (USD MILLION) 119

- TABLE 165 SOUTH KOREA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR CONSUMABLES, BY TYPE 2020–2027 (USD MILLION) 120

- TABLE 166 SOUTH KOREA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR EQUIPMENT, BY TYPE 2020–2027 (USD MILLION) 120

- TABLE 167 SOUTH KOREA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR SOFTWARE, BY TYPE 2020–2027 (USD MILLION) 121

- TABLE 168 SOUTH KOREA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY APPLICATION 2020–2027 (USD MILLION) 121

- TABLE 169 SOUTH KOREA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY END USER 2020–2027 (USD MILLION) 122

- TABLE 170 REST OF ASIA-PACIFIC: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY LAB AUTOMATION TYPE, 2020–2027 (USD MILLION) 122

- TABLE 171 REST OF ASIA-PACIFIC: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY PRODUCT TYPE 2020–2027 (USD MILLION) 122

- TABLE 172 REST OF ASIA-PACIFIC: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR CONSUMABLES, BY TYPE 2020–2027 (USD MILLION) 123

- TABLE 173 REST OF ASIA-PACIFIC: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR EQUIPMENT, BY TYPE 2020–2027 (USD MILLION) 123

- TABLE 174 REST OF ASIA-PACIFIC: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR SOFTWARE, BY TYPE 2020–2027 (USD MILLION) 124

- TABLE 175 REST OF ASIA-PACIFIC: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY APPLICATION 2020–2027 (USD MILLION) 124

- TABLE 176 REST OF ASIA-PACIFIC: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY END USER 2020–2027 (USD MILLION) 125

- TABLE 177 MIDDLE EAST & AFRICA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY REGION, 2020–2027 (USD MILLION) 126

- TABLE 178 MIDDLE EAST & AFRICA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY LAB AUTOMATION TYPE, 2020–2027 (USD MILLION) 127

- TABLE 179 MIDDLE EAST & AFRICA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY PRODUCT TYPE 2020–2027 (USD MILLION) 127

- TABLE 180 MIDDLE EAST & AFRICA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR CONSUMABLES, BY TYPE 2020–2027 (USD MILLION) 127

- TABLE 181 MIDDLE EAST & AFRICA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR EQUIPMENT, BY TYPE 2020–2027 (USD MILLION) 128

- TABLE 182 MIDDLE EAST & AFRICA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR SOFTWARE, BY TYPE 2020–2027 (USD MILLION) 128

- TABLE 183 MIDDLE EAST & AFRICA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY APPLICATION 2020–2027 (USD MILLION) 129

- TABLE 184 MIDDLE EAST & AFRICA: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY END USER 2020–2027 (USD MILLION) 129

- TABLE 185 MIDDLE EAST: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY LAB AUTOMATION TYPE, 2020–2027 (USD MILLION) 130

- TABLE 186 MIDDLE EAST: AUTOMATED CELL CULTURE EQUIPMENT MARKET, BY PRODUCT TYPE 2020–2027 (USD MILLION) 130

- TABLE 187 MIDDLE EAST: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR CONSUMABLES, BY TYPE 2020–2027 (USD MILLION) 130

- TABLE 188 MIDDLE EAST: AUTOMATED CELL CULTURE EQUIPMENT MARKET, FOR EQUIPMENT, BY TYPE 2020–2027 (U

Automated Cell Culture Equipment Market Segmentation

Market Segmentation Overview

- Detailed segmentation data will be available in the full report

- Comprehensive analysis by multiple parameters

- Regional and country-level breakdowns

- Market size forecasts by segment

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment