Increasing number of residential builders are using glass coating to accelerate market growth

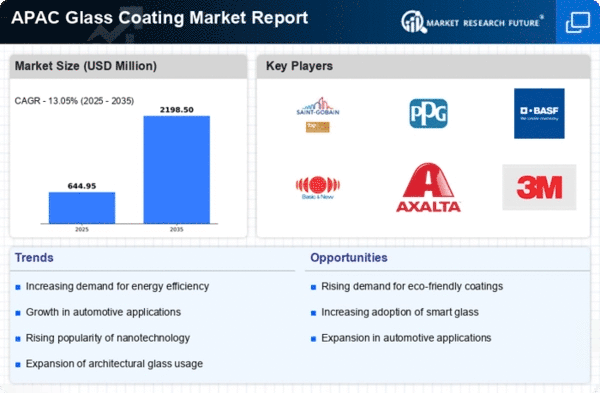

The growing need for energy-efficient vehicles, buildings, and other structures is one of the main factors propelling the glass coating sector. Because they improve insulation and limit heat transfer through the glass, glass coatings are essential for cutting down on energy use. One of the major companies in the industry, P.P.G. Industries, Inc., for instance, provides Solar ban glass coatings, which can cut building energy use by up to 20%. Buildings can become more energy-efficient by using glass coatings to reduce heat gain, minimize glare, and enhance thermal insulation.

Because they may reflect infrared radiation and lessen heat loss through windows, low-emissivity (low-E) coatings are a popular option because they lessen the demand for heating and cooling systems. Furthermore, buildings contribute more than 30% of the world's energy consumption and almost 20% of greenhouse gas emissions, according to a report by the International Energy Agency (IEA). Globally, there is a growing need for energy-efficient buildings due to factors such rising energy costs, stringent building rules and regulations, and growing worries about climate change. These factors are also driving the glass coating market.

Glass coatings also make glass surfaces more resilient to dents and scratches, increasing their longevity. In the automotive sector, where coated glass is utilized for windows, mirrors, and windshields, it is very important. Because coated glass is so frequently used in windshields, windows, and mirrors, the automotive industry is a major consumer of scratch-resistant coatings. Additionally, there is a rising need in a number of businesses for sustainable and environmentally friendly products. Glass coatings produced using natural and environmentally friendly ingredients can help businesses meet this need and gain a competitive edge.

Glass coatings manufactured from natural and sustainable materials can help businesses meet this need and gain a competitive edge. Thus, driving the glass coating market revenue.

Leave a Comment