Market Analysis

In-depth Analysis of Asia Pacific Butyric Acid Market Industry Landscape

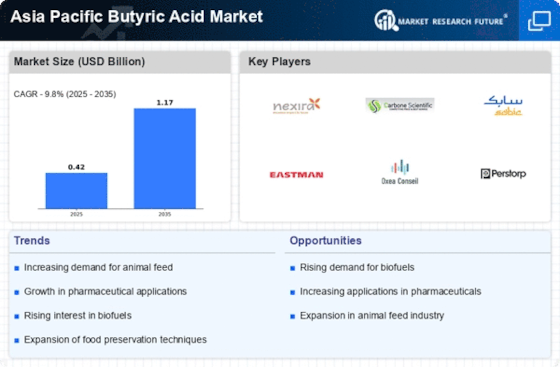

Asia-Pacific Butyric Acid Market is bestowed with dynamic evolving peculiarities of its growth trajectory greatly influenced by market dynamics. The four-carbon carboxylic acid known as butyric acid finds broad application across various sectors, including food & beverages, animal feed pharmaceuticals, and chemicals industries. The ever-changing tastes among consumers coupled with regulations guiding production activities have made this region highly dynamic, hence altering the entire nature of business operations within Asia-Pacific. One of the key drivers contributing to the growth of the Asia-Pacific Butyric Acid market is the rising demand for animal feed additives. This has, in turn, led to an increase in meat and dairy consumption as a result of a growing middle-class section and population in this area. Therefore, butyric acid is used as an additive in animal feeds to improve their nutritional value and overall wellness. Additionally, the food and beverage industry in the Asia-Pacific region shapes the Butyric Acid market dynamics. As people have become more health-conscious, they prefer clean-label or natural ingredients in their food items. Butyric acid is increasingly being used as a preservative and flavoring agent due to its antimicrobial properties, which are well-known within the food industry. Also worth mentioning is that, within the Asia-Pacific region, a strong pharmaceutical sector influences the market dynamics of butyric acid. It has been found very useful, especially because pharmaceutical companies can use it as a therapeutic agent for treating several gastrointestinal deficiencies. The high prevalence rates of digestive health disorders coupled with increasing knowledge about how beneficial butyric acid can be towards maintaining gut health have continued to drive its usage among pharmaceutical formulations, thereby creating attractive business prospects for marketers within Asia-Pacific. Nonetheless, the market dynamics are not smooth. The Asia-Pacific Butyric Acid market is limited by stringent regulatory norms that govern the use of chemical additives in various industries. Completing these rules will be a difficult task for manufacturers and may affect the growth of the market. Technological advancements and innovations play key roles in determining the future of the Asia Pacific Butyric Acid market. Continuous research and development activities are aimed at improving production processes, enhancing product quality, and exploring new applications. Market players are also investing in sustainable practices to address environmental concerns that lead to the positive evolution of market dynamics.

Leave a Comment