Market Trends

Key Emerging Trends in the Asia Pacific Butyric Acid Market

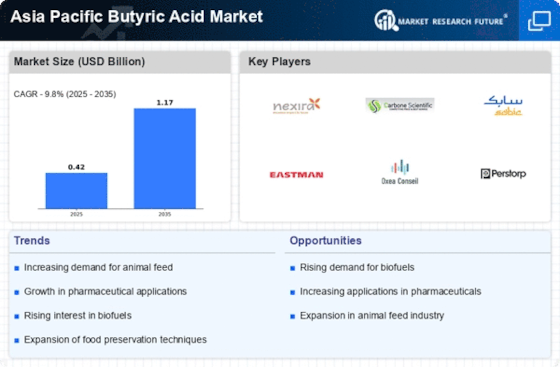

The Asia-Pacific Butyric Acid market has seen some interesting trends in recent times, which point to a dynamic landscape influenced by many forces. One of those major trends is an increasing demand for butyric acid across different industries within this region. A fatty acid with four carbon atoms called butyric acid is found within the pharmaceuticals, beverages & foodstuffs industry, including animal feed and other organic base chemical sectors. This preservative property that butyric acid possesses makes it find applications as food additives that hamper the growth of bacteria or fungi, hence extending the shelf life of products. Also, the unique butter taste explains why butyrate ester has been used globally for flavoring purposes in different foods, especially snacks, since its adoption by snack makers yields two other uses that come together, leading to higher sales volumes. Additionally, the pharmaceutical industry in Asia-Pacific is one of the major drivers behind this ever-increasing demand for butyric acid. Known for its potential therapeutic benefits, specifically regarding healthy gastric functioning, studies undertaken within this niche area have investigated multiple gastrointestinal disorders requiring treatment using butyrate, hence expanding its reachability further into markets overseas like China or India, whose citizens consume more traditional diets than we do here at home. Moreover, other industries have also intensified the usage of butyric acid in animal feeds. It plays a crucial role in improving the overall health and performance of livestock as a vital component in the formulation of feed additives. Animals with healthy intestinal tracts gain weight faster, thereby positively impacting their productivity and growth rates. Furthermore, butyric acid has been found to be used in the chemical industry across the Asia Pacific for the production of esters, plastics, and other chemicals. Its wide range of applications as a starting material for various types of synthesis makes it to be considered an essential raw material ingredient responsible for growth within this sector. However, market trends also reveal certain challenges that could potentially impact the Asia-Pacific Butyric Acid market. Manufacturers may be faced with difficulties due to price changes in raw materials they use, such as corn or sugar, which are used to produce butyric acid. Economic uncertainties, environmental regulations, and geopolitical factors may also influence market dynamics.

Leave a Comment