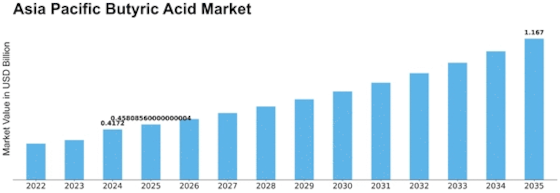

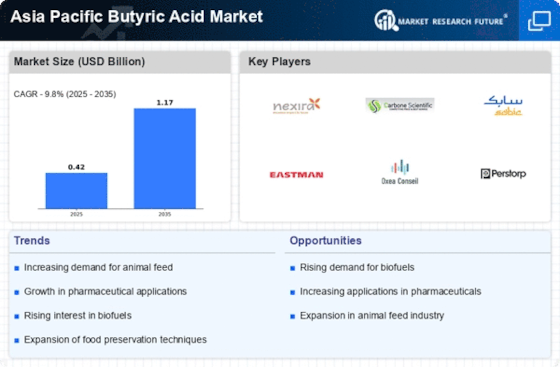

Asia Pacific Butyric Acid Size

Asia Pacific Butyric Acid Market Growth Projections and Opportunities

The Asia-Pacific Butyric Acid Market is a dynamic market with many factors that affect its dynamics. The main market driver for this market is the increasing demand for butyric acid across different industries in the region. Moreover, a steady increase in demand has been a result of the food sector using it as a flavoring agent and preservative, as well as as an animal feed additive, among others. In addition, increased population and rising per capita incomes in many Asia-Pacific countries have led to an increase in the consumption of processed foods that need butyric acid. Another driving force is that people are becoming increasingly health conscious while knowing that this compound has health benefits such as antimicrobial and anti-inflammatory abilities. The Asia-Pacific Butyric Acid Market is influenced by regulatory factors apart from being driven by forces of demand. Moreover, strict regulations concerning food safety standards push manufacturers to use butyric acid to preserve food safely. Consequently, firms strive towards meeting these regulations, resulting in their growth and propelling the entire market forward with high-quality products that can meet growing consumer demands. At the same time, competition on the Asian continent, along with key players' presence, shapes the landscape of this regional industry, otherwise known as the Asia Pacific Butyric Acid Market. There are numerous big makers and sellers of butyric acid within this area, making it quite competitive. Companies focus more on research; hence, they are able to introduce new products through innovation, thus improving their positions within the markets where they operate. This nature promotes technological advancements regarding cost efficiency and product quality during production processes. Economic factors also have an impact on how markets behave. The economic growth, together with industrialization in countries around Asia-Pacific region, significantly influences how butyric acid is consumed within them directly or indirectly. On a global scale, environmental concern has become another factor influencing purchasing decisions made by buyers within the Asian-Pacific Butyric Acid Marketspace. In relation to this development globally, there has been a growing demand for bio-based butyric acid as the world shifts to eco-friendly alternatives. Moreover, geopolitical factors and trade policies also affect the market dynamics of this product. Given that Asia-Pacific area has close economic connections with other world markets, the import-export of butyric acid is greatly affected by them, thereby affecting the entire supply chain and prices in the market. The market growth direction may change because of situations like recent changes in international trading agreements or geopolitical events.

Leave a Comment