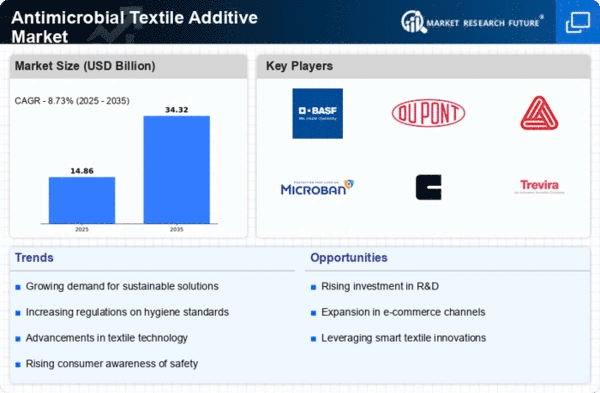

Market Share

Antimicrobial Textile Additive Market Share Analysis

The Antimicrobial Textile Additive Market segment within textiles and healthcare industries is quite competitive, which has resulted in various market share positioning strategies. Indeed, one strategic approach entails differentiation through technology and innovation. Businesses operating in the antimicrobial textile additive market often spend heavily on research into new formulas and special features. Such innovations can involve more efficient anti-microbials or even ones that can withstand multiple washes without affecting other characteristics found only on certain materials. Market Share Positioning Strategies: Collaboration & Strategic Partnerships plays an important role in determining who gets what portion of the market share within Antimicrobial Textile Additive Industry? In many cases alliances are formed between a company looking for ways to reach customers worldwide through intermediaries like; textile manufacturers who are also involved in producing hospital linens etc., health care providers including hospitals themselves but primarily those which employ doctors or nurses specially trained working conjunctions with their counterparts throughout country while retailers may offer such items online at different prices.

In the antimicrobial textile additive market, a customer-focused approach is becoming increasingly important. Understanding and addressing customers’ needs, including preference for particular antimicrobial properties in terms of safety concerns and regulatory compliance, are crucial components of a sustainable such as market share growth. Companies invest in research and development to produce antimicrobial textile additives that meet changing regulatory standards and industry requirements. Zapping all the customer service bells and whistles with good technical support, timely product delivery strengthens bonds with customers leading to loyalty and positive word-of-mouth which further contributes to increased market shares.

Environmental sustainability is an emerging issue in the antimicrobial textile additive market; hence companies are adopting green positioning strategies. Customers want textile additives that resonate with their awareness levels concerning environmental impacts on products used by them. Some other players in the market for these types of textiles are working on formulations using eco-friendly approaches like biodegradable materials or recycled waste materials for example. That way, they position themselves as eco-friendly minded organizations that target a section of people who consider sustainable alternatives before making their buying decisions thus expanding into new markets while maintaining positive corporate images.

Leave a Comment