Aluminum Flat Rolled Products Market Share

Aluminum Flat-Rolled Products Market Research Report Information By Product Type (Plates, Sheets, Standard GEQ, Circles, Foil Stock, Can Stock, and Fin Stock), By End-Use Industry (Building & Construction, Automotive & Transportation, Consumer Goods, Electrical & Electronics, Industrial, and Packaging) And By Region (North America, Europe, Asia-Pacific, And Rest Of The World) –Marke...

Market Summary

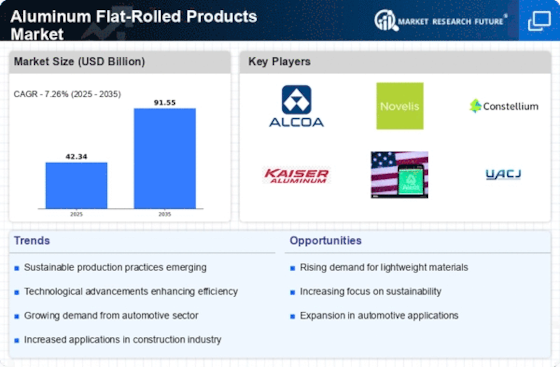

As per Market Research Future Analysis, the Global Aluminum Flat-Rolled Products Market was valued at USD 42.34 Billion in 2024 and is projected to grow to USD 91.55 Billion by 2035, with a CAGR of 7.26% from 2025 to 2035. Key drivers include the growing aerospace and automotive industries, along with rising demand in the packaging sector. The market is characterized by innovations in product offerings and increasing adoption of lightweight metals in automotive applications. The Asia-Pacific region is expected to dominate the market due to rapid urbanization and demand from various end-user industries, particularly aerospace and defense.

Key Market Trends & Highlights

The Aluminum Flat-Rolled Products market is witnessing significant growth driven by various factors.

- Market Size in 2024: USD 42.34 Billion

- Projected Market Size by 2035: USD 91.55 Billion

- CAGR from 2025 to 2035: 7.26%

- Foil stock segment expected to grow significantly due to rising demand for lightweight packaging.

Market Size & Forecast

| 2024 Market Size | USD 42.34 Billion |

| 2035 Market Size | USD 91.55 Billion |

| CAGR (2024-2035) | 7.26% |

| 2024 Projected Market Size | USD 42.34 Billion |

| 2032 Projected Market Size | USD 69.15 Billion |

| Largest Regional Market | Asia-Pacific. |

Major Players

Key players include Hindalco Industries Limited (India), Alcoa Corporation (US), Constellium (The Netherlands), Norsk Hydro ASA (Norway), Aluminum Corporation of China (Chalco) (China), Arconic (US), NALCO (India), UACJ Corporation (Japan), Elvalhalcor Hellenic Copper Aluminum Industry S.A. (Greece), JW Aluminum (US).

Market Trends

Growing demand from automotive & packaging industries is driving the market growth

Market CAGR for aluminum flat-rolled products is being driven by the rising adoption from end-use industries. Thick aluminum slabs are rolled between steel rolls to reduce thickness before being extended using hot and cold rolling methods to achieve the desired final thickness to create aluminum flat-rolled goods. The two main categories of aluminum flat-rolled products—cold rolling and hot rolling—are based on their manufacturing techniques. Each has a unique set of traits and advantages, and a particular industry welcomes them all.

Due to its corrosion resistance and lack of maintenance requirements, the industry may experience a surge in demand. Manufacturers try to increase innovation in their product offerings in order to compete in the market. Government policies encouraging the use of lightweight metals in automobiles have raised the market value of aluminum flat-rolled products due to their distinctive combination of lightness and strength. The most important growth element for these products is the rising demand for them in packaging and automotive applications.

In addition, the market expansion for aluminum flat-rolled products is anticipated to be fueled by the increasing demand from end-use industries, technological developments in the aluminum sector, and enhanced driving dynamics.

One of the market development factors for aluminum flat-rolled products that is expanding the fastest is the rising demand for these products in the automobile industry. Growing demand for public transit, including metro trains, bullet trains, buses, and other industrial vehicles, results in increasing use of these goods, which helps to maintain the automobile’s lightweight. These elements are expected to drive the market expansion of aluminum flat-rolled products.

The market will have much potential to expand as a result of the significant growth in demand for recycled and value-added aluminum products as well as the development in aluminum demand in emerging nations.

Market participants have been taking essential actions to enhance the items' accuracy and general functionality. With the aid of contemporary technologies, the major producers of aluminum flat-rolled products are aiming to create new aluminum products that are more aesthetically pleasing. Further emphasizing quality and service while making sure to satisfy customers' demands and expectations, market participants. Thus, driving the Aluminum Flat-Rolled Products market revenue.

The demand for aluminum flat-rolled products is anticipated to rise as industries increasingly prioritize lightweight materials for enhanced energy efficiency and sustainability.

U.S. Geological Survey

Aluminum Flat Rolled Products Market Market Drivers

Market Growth Projections

The Global Aluminum Flat-Rolled Products Market Industry is projected to experience substantial growth over the next decade. With a market value of 42.3 USD Billion in 2024, it is anticipated to reach approximately 85.3 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 6.58% from 2025 to 2035. Various factors, including rising demand from key sectors such as automotive, construction, and packaging, are expected to drive this expansion. The market's resilience and adaptability to changing consumer preferences and technological advancements indicate a promising outlook for stakeholders in the aluminum flat-rolled products sector.

Growth in Construction Activities

The Global Aluminum Flat-Rolled Products Market Industry is significantly influenced by the expanding construction sector, particularly in emerging economies. The demand for aluminum flat-rolled products in construction applications, such as roofing, cladding, and window frames, is on the rise. This trend is supported by urbanization and infrastructure development initiatives, which are expected to propel the market forward. As cities expand and new buildings are erected, the versatility and durability of aluminum make it a preferred choice among builders. This growth in construction activities is likely to sustain the market's upward trajectory, contributing to the anticipated CAGR of 6.58% from 2025 to 2035.

Expanding Applications in Packaging

The Global Aluminum Flat-Rolled Products Market Industry is witnessing a notable expansion in applications within the packaging sector. Aluminum foil and sheets are increasingly utilized in food and beverage packaging due to their excellent barrier properties and lightweight nature. As consumer preferences shift towards convenient and sustainable packaging solutions, the demand for aluminum flat-rolled products is expected to grow. This trend is particularly evident in the food industry, where aluminum packaging helps extend shelf life and reduce waste. The packaging segment is poised for growth, contributing to the overall market expansion and aligning with the projected market value of 85.3 USD Billion by 2035.

Rising Demand from Automotive Sector

The Global Aluminum Flat-Rolled Products Market Industry experiences a notable surge in demand from the automotive sector, driven by the industry's shift towards lightweight materials to enhance fuel efficiency. In 2024, the market is valued at approximately 42.3 USD Billion, with projections indicating a robust growth trajectory. The automotive sector's increasing adoption of aluminum flat-rolled products, such as sheets and foils, is anticipated to contribute significantly to this growth. As manufacturers seek to comply with stringent emissions regulations, the lightweight properties of aluminum are becoming increasingly attractive, suggesting a sustained demand through the coming years.

Sustainability and Recycling Initiatives

The Global Aluminum Flat-Rolled Products Market Industry is increasingly influenced by sustainability and recycling initiatives. Aluminum is known for its recyclability, with recycled aluminum requiring significantly less energy to produce than primary aluminum. As industries and consumers become more environmentally conscious, the demand for recycled aluminum flat-rolled products is likely to rise. This trend aligns with global efforts to reduce carbon footprints and promote circular economies. Companies that prioritize sustainable practices may gain a competitive edge in the market, as they cater to the growing preference for eco-friendly materials. The emphasis on sustainability is expected to drive innovation and investment in recycling technologies.

Technological Advancements in Manufacturing

Technological advancements in the manufacturing processes of aluminum flat-rolled products are reshaping the Global Aluminum Flat-Rolled Products Market Industry. Innovations such as advanced rolling techniques and improved alloy compositions enhance product quality and performance. These advancements not only increase production efficiency but also reduce waste, making the manufacturing process more sustainable. As manufacturers adopt these technologies, they can meet the evolving demands of various industries, including aerospace and packaging. The continuous improvement in manufacturing capabilities is expected to play a crucial role in driving market growth, as companies strive to offer high-performance products that meet stringent industry standards.

Market Segment Insights

Aluminum Flat-Rolled Products, Product Type Insights

The Aluminum Flat-Rolled Products market segmentation, based on product type includes plates, sheets, standard GEQ, circles, foil stock, can stock, and fin stock. During the projection period, it is anticipated that the category for foil stock would expand at a significant rate due to rising customer demand for simple, lightweight packaging, secure product packaging, and products with longer shelf lives. Due to their insulation qualities, such as resistance to light, oxygen, and moisture, these foil stocks are also used in the pharmaceutical industry.

By protecting the drugs from contamination and deterioration and by providing greater patient security, these properties are ultimately driving the market for aluminum flat products.

Aluminum Flat-Rolled Products End-Use Industry Insights

The Aluminum Flat-Rolled Products market segmentation, based on the end-use Industry, includes building & construction, automotive & transportation, consumer goods, electrical & electronics, industrial, and packaging. Due to the lightweight nature of aluminum flat goods, which improves fuel efficiency by using less energy to move the vehicle, its use in the automotive & transportation category is anticipated to rise over the next few years.

The market for aluminum flat products is anticipated to expand more quickly than average over the course of the forecast period as a result of factors such as the rising demand for public transportation, including metro trains, buses, bullet trains, and other industrial transportation vehicles, which use these products to increase efficiency. Another factor is the use of aluminum sheets in fuel tanks, which prevents corrosion and chemical reactions with external materials.

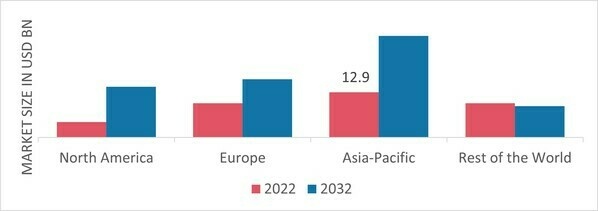

Figure 1: Aluminum Flat-Rolled Products Market, by End-Use Industry, 2022 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Get more detailed insights about Aluminum Flat-Rolled Products Market Research Report - Global Forecast till 2032

Regional Insights

By region, the study provides market insights into North America, Europe, Asia-Pacific, and Rest of the World. The Asia Pacific Flat-Rolled Products market area will dominate this market, because there is a growing demand for aluminum flat-rolled products from a variety of end-user industries, including the aerospace and defense sectors, and because urbanization is expanding quickly and construction activity is increasing. In addition, the growing number of established health clubs and fitness facilities will boost market growth in this region.

Further, the major countries studied in the market report are The US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: ALUMINUM FLAT-ROLLED PRODUCTS MARKET SHARE BY REGION 2022 (USD Billion)

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Europe’s Aluminum Flat-Rolled Products market accounts for the second-largest market share because of firms' increasing production capacities and the significant demand for flat-rolled aluminum goods. Further, the German Aluminum Flat-Rolled Products market held the largest market share, and the UK Aluminum Flat-Rolled Products market was the quickest-growing market in the European region

The North America Aluminum Flat-Rolled Products Market is expected to expand at the quickest CAGR from 2023 to 2032. This is due to the growing demand for aluminum from the automotive industry. Moreover, China’s Aluminum Flat-Rolled Products market held the largest market share, and the Indian Aluminum Flat-Rolled Products market was the quickest-growing market in the Asia-Pacific region.

Key Players and Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Aluminum Flat-Rolled Products market, grow even more. Market players are adopting various strategies to extend their footprint, with important market developments including new product developments, contracts & agreements, mergers & acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the Aluminum Flat-Rolled Products industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the Aluminum Flat-Rolled Products industry to benefit clients and increase the market sector. In recent years, the Aluminum Flat-Rolled Products industry has offered some of the most significant advantages to medicine.

Major players in the Aluminum Flat-Rolled Products market, including Hindalco Industries Limited (India), Alcoa Corporation (US), Constellium (The Netherlands), Norsk Hydro ASA (Norway), Aluminum Corporation of China (Chalco) (China), Arconic (US), NALCO (India), UACJ Corporation (Japan), Elvalhalcor Hellenic Copper, Aluminum Industry S.A. (Greece), JW Aluminum (US), and others, are attempting to increase market demand by investing in research and development operations.

Aluminum is produced and exported by National Aluminum Co Ltd (NALCO). It conducts bauxite mining, alumina refining, Aluminum smelting and casting, power production, rail, and port operations. The company's main goods include chemicals and metals made of Aluminum. It runs bauxite mining in the Koraput district of Odisha's Panchpatmali Hills, an alumina refinery at Damanjodi, an Aluminum smelter, and a 1200 MW captive power plant in Angul.

Additionally, it runs four wind farms: a 50.4 MW wind farm in Gandikota, Andhra Pradesh; a 47.6 MW wind farm in Ludarva, Jaisalmer, Rajasthan; a 50 MW wind farm in Devikot, Jaisalmer, Rajasthan; and a 50.4 MW wind farm in Jath, Sangli, Maharastra. In December 2021, The share price of National Aluminum Company increased by 5.77%.

The Department of Revenue, Ministry of Finance, Government of India stated in a notification dated December 6, 2021 that the dumping margin for the subject goods from the subject country is positive and important in the case of certain flat rolled Aluminum products originating in or exported from China. The ministry claims that the domestic industry has been materially harmed as a result of the dumping of Chinese goods.

Manufacturers and distributors of specialised rolled and extruded Aluminum products include Constellium SE (Constellium). Packaging, automotive rolled goods, aerospace, transportation, defence, end markets, automotive structures, and industrial items are all available. The business produces plates and sheets for the aerospace industry, as well as wing skins, general engineering plates, transportation sheets, packaging, and automotive rolled goods. Constellium also makes extruded items including automobile frames, huge profiles, and soft and hard alloys.

In January 2023, Constellium SE and Daher have a multi-year agreement under which the latter will receive a variety of flat-rolled Aluminum products from Constellium SE's factory in Issoire, France. In particular, the TBM and Kodiak versions of light aircraft will employ the Aluminum. Constellium can increase its customer base in the commercial and regional planes industry by joining Daher as a strategic Aluminum supplier.

Key Companies in the Aluminum Flat Rolled Products Market market include

Industry Developments

November 2020: Alcoa Corporation announced a deal with Kaiser Aluminum Corporation to sell its rolling mill operations, which are currently owned by Alcoa Warrick LLC, for a total price of about $670 million.

July 2022: The Board of Directors of Steel Dynamics, Inc. approved the company's request to build and run a 650,000-ton low-carbon, recycled Aluminum flat-rolled mill with two auxiliary satellite recycled Aluminum slab centers. Commercial production is anticipated to start in the first quarter of 2025, with an estimated capital investment of $2.2 billion for the three sites.

Future Outlook

Aluminum Flat Rolled Products Market Future Outlook

The Aluminum Flat-Rolled Products Market is projected to grow at a 7.26% CAGR from 2025 to 2035, driven by increasing demand in automotive and aerospace sectors, along with sustainability initiatives.

New opportunities lie in:

- Invest in advanced manufacturing technologies to enhance production efficiency and reduce costs.

- Develop lightweight aluminum solutions for electric vehicles to capture emerging market segments.

- Explore strategic partnerships with renewable energy firms to promote sustainable aluminum sourcing.

By 2035, the market is expected to achieve robust growth, positioning itself as a leader in sustainable materials.

Market Segmentation

Aluminum Flat-Rolled Products Regional Outlook

- US

- Canada

Aluminum Flat-Rolled Products Product type Outlook (USD Billion, 2019-2032)

- Plates

- Sheets

- Standard GEQ

- Circles

- Foil Stock

- Can Stock

- Fin Stock

Aluminum Flat-Rolled Products End-use Industry Outlook (USD Billion, 2019-2032)

- Building & Construction

- Automotive & Transportation

- Consumer goods

- Electrical & Electronics

- Industrial

- Packaging

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2024 | USD 42.34 Billion |

| Market Size 2035 | 91.55 (Value (USD Billion)) |

| Compound Annual Growth Rate (CAGR) | 7.26% (2025 - 2035) |

| Base Year | 2024 |

| Market Forecast Period | 2025 - 2035 |

| Historical Data | 2018- 2022 |

| Market Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Product Type, End-Use Industry, and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered | The US, Canada, German, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled | Hindalco Industries Limited (India), Alcoa Corporation (US), Constellium (The Netherlands), Norsk Hydro ASA (Norway), Aluminum Corporation of China (Chalco) (China), Arconic (US), NALCO (India), UACJ Corporation (Japan) |

| Key Market Opportunities | Growing automotive and aerospace industries. |

| Key Market Dynamics | Rising adoption across various end-use industries. |

| Market Size 2025 | 45.41 (Value (USD Billion)) |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How much is the Aluminum Flat-Rolled Products Market?

The Aluminum Flat-Rolled Products Market size was valued at USD 39.47 Billion in 2023.

What is the growth rate of the Aluminum Flat-Rolled Products Market?

The Aluminum Flat-Rolled Products Market is projected to grow at a CAGR of 7.26% during the forecast period, 2024-2032.

Which region held the largest market share in the Aluminum Flat-Rolled Products Market?

Asia Pacific had the largest share in the Aluminum Flat-Rolled Products Market.

Who are the key players in the Aluminum Flat-Rolled Products market?

The key players in the Aluminum Flat-Rolled Products Market are Hindalco Industries Limited (India), Alcoa Corporation (US), Constellium (The Netherlands), Norsk Hydro ASA (Norway), Aluminum Corporation of China (Chalco) (China), Arconic (US), NALCO (India), UACJ Corporation (Japan).

Which product type led the Aluminum Flat-Rolled Products Market?

The foil stock category dominated the Aluminum Flat-Rolled Products Market in 2023.

Which end-use industry had the largest market share in the Aluminum Flat-Rolled Products market?

The automotive & transportation had the largest share in the Aluminum Flat-Rolled Products Market.

-

Executive Summary

-

Market Attractiveness Analysis 19

- Global Aluminum Flat-Rolled Products Market, By Product Type 19

- Global Aluminum Flat-Rolled Products Market, End-Use Industry 20

- Global Aluminum Flat-Rolled Products Market, By Region 21

-

Market Attractiveness Analysis 19

-

Market Introduction

- Definition 22

- Scope of the Study 22

- Market Structure 23

- Key Buying Criteria 23

-

Market Insights

-

Research Methodology

- Research Process 27

- Primary Research 28

- Secondary Research 29

- Market Size Estimation 29

- Forecast Model 30

- List Of Assumptions 31

-

Market Dynamics

- Introduction 32

-

Drivers 33

- Increasing Demand For Aluminum Flat-Rolled Products In The Automotive And Aerospace Industries 33

- High Demand For Aluminum Foils In The Packaging Industry 34

- Drivers Impact Analysis 35

-

Restraints 35

- Environmental Hazards Associated With Bauxite Mining 35

- Restraints Impact Analysis 36

-

Opportunities 36

- Expanding Construction Industry 36

-

Challenges 37

- Fluctuating Raw Material Prices 37

-

Market Factor Analysis

-

Supply Chain Analysis 38

- Raw Material Suppliers 39

- Aluminum Flat-Rolled Product Manufacturers 39

- Distribution Channel 39

- End-Use Industries 39

-

Porter’s Five Forces Model 40

- Threat Of New Entrants 40

- Intensity Of Competitive Rivalry 41

- Threat Of Substitutes 41

- Bargaining Power Of Suppliers 41

- Bargaining Power Of Buyers 41

- Cost Analysis Of Aluminum Flat-Rolled Plates 42

-

Supply Chain Analysis 38

-

Global Aluminum Flat-Rolled Products Market, By Product Type

- Introduction 43

- Plates 45

- Sheets 47

- Standard GEQ 48

- Circles 49

- Foil Stock 50

- Can Stock 51

- Fin Stock 52

- Others 53

-

Global Aluminum Flat-Rolled Products Market, By End-Use Industry

- Introduction 55

- Building & Construction 57

- Automotive & Transportation 58

- Consumer Goods 60

- Electrical & Electronics 61

- Industrial 62

- Packaging 63

- Others 64

-

Global Aluminum Flat-Rolled Products Market, By Region

- Introduction 66

-

North America 70

- US 73

- Canada 76

-

Europe 78

- Germany 82

- Russia 84

- UK 87

- France 89

- Spain 92

- Italy 94

- The Netherlands 96

- Belgium 99

- Poland 101

- Rest Of Europe 103

-

Asia-Pacific 106

- China 110

- Japan 112

- India 114

- South Korea 117

- Indonesia 119

- Thailand 121

- Australia & New Zealand 124

- Malaysia 127

- Rest Of Asia-Pacific 129

-

Latin America 132

- Mexico 135

- Brazil 137

- Argentina 140

- Rest Of Latin America 142

-

The Middle East & Africa 144

- North Africa 148

- Turkey 150

- GCC 152

- Israel 155

- Rest Of Middle East & Africa 157

-

Competitive Landscape

- Introduction 70

-

North America 76

- US 79

- Canada 82

-

Europe 86

- Germany 90

- UK 93

- Russia 96

- France 99

- Spain 102

- Italy 105

- Poland 108

- Belgium 111

- The Netherlands 114

- Rest Of The Europe 117

-

Asia-Pacific 121

- China 125

- Japan 128

- India 131

- South Korea 134

- Australia & New Zealand 137

- Malaysia 140

- Thailand 143

- Indonesia 146

- Rest Of The Asia-Pacific 149

-

The Middle East & Africa 153

- Saudi Arabia 157

- UAE 160

- Israel 163

- Turkey 166

- Rest Of The Middle East & Africa 169

-

Latin America 172

- Mexico 176

- Brazil 179

- Argentina 182

- Rest Of Latin America 185

-

Company Profiles

-

Hindalco Industries Limited 165

- Company Overview 165

- Financial Overview 166

- Products/Services Offered 166

- Key Developments 167

- SWOT Analysis 167

- Key Strategies 167

-

Alcoa Corporation 168

- Company Overview 168

- Financial Overview 168

- Products/Services Offered 169

- Key Developments 169

- SWOT Analysis 169

- Key Strategies 169

-

Constellium 170

- Company Overview 170

- Financial Overview 170

- Products/Services Offered 171

- Key Developments 171

- SWOT Analysis 171

- Key Strategies 171

-

Norsk Hydro ASA 172

- Company Overview 172

- Financial Overview 172

- Products/Services Offered 173

- Key Developments 173

- SWOT Analysis 174

- Key Strategies 174

-

Aluminum Corporation Of China (Chalco) 175

- Company Overview 175

- Financial Overview 175

- Products/Services Offered 176

- Key Developments 176

- SWOT Analysis 176

- Key Strategies 176

-

Arconic 177

- Company Overview 177

- Financial Overview 177

- Products/Services Offered 178

- Key Developments 178

- SWOT Analysis 178

- Key Strategies 178

-

NALCO 179

- Company Overview 179

- Financial Overview 179

- Products/Services Offered 180

- Key Developments 180

- SWOT Analysis 180

- Key Strategies 180

-

UACJ Corporation 181

- Company Overview 181

- Financial Overview 181

- Products/Services Offered 182

- Key Developments 182

- SWOT Analysis 183

- Key Strategies 183

-

Elvalhalcor Hellenic Copper And Aluminum Industry S.A. 184

- Company Overview 184

- Financial Overview 184

- Products Offering 185

- Key Developments 185

- SWOT Analysis 185

- Key Strategies 185

-

JW Aluminum 186

- Company Overview 186

- Financial Overview 186

- Products/Services Offered 186

- Key Developments 186

- SWOT Analysis 187

- Key Strategies 187

-

Hindalco Industries Limited 165

-

Appendix

-

List of Tables and Figures

- 13 List Of Tables

- TABLE 1 LIST OF ASSUMPTIONS 31

- TABLE 2 ALUMINUM FLAT-ROLLED PLATES, COST ANALYSIS, 2023 42

- TABLE 3 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS, BY PRODUCT TYPE, 2023-2032 (USD MILLION) 44

- TABLE 4 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 45

- TABLE 5 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR PLATES, BY REGION, 2023-2032 (USD MILLION) 46

- TABLE 6 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR PLATES, BY REGION, 2023-2032 (KILO TONS) 46

- TABLE 7 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR SHEETS, BY REGION, 2023-2032 (USD MILLION) 47

- TABLE 8 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR SHEETS, BY REGION, 2023-2032 (KILO TONS) 47

- TABLE 9 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR STANDARD GEQ, BY REGION, 2023-2032 (USD MILLION) 48

- TABLE 10 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR STANDARD GEQ, BY REGION, 2023-2032 (KILO TONS) 48

- TABLE 11 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR CIRCLES, BY REGION, 2023-2032 (USD MILLION) 49

- TABLE 12 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR CIRCLES, BY REGION, 2023-2032 (KILO TONS) 49

- TABLE 13 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR FOIL STOCK, BY REGION, 2023-2032 (USD MILLION) 50

- TABLE 14 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR FOIL STOCK, BY REGION, 2023-2032 (KILO TONS) 51

- TABLE 15 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR CAN STOCK, BY REGION, 2023-2032 (USD MILLION) 51

- TABLE 16 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR CAN STOCK, BY REGION, 2023-2032 (KILO TONS) 52

- TABLE 17 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR FIN STOCK, BY REGION, 2023-2032 (USD MILLION) 52

- TABLE 18 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR FIN STOCK, BY REGION, 2023-2032 (KILO TONS) 53

- TABLE 19 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR OTHERS, BY REGION, 2023-2032 (USD MILLION) 53

- TABLE 20 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR OTHERS, BY REGION, 2023-2032 (KILO TONS) 54

- TABLE 21 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 56

- TABLE 22 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 57

- TABLE 23 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR BUILDING & CONSTRUCTION, BY REGION, 2023-2032 (USD MILLION) 57

- TABLE 24 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR BUILDING & CONSTRUCTION, BY REGION, 2023-2032 (KILO TONS) 58

- TABLE 25 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY REGION, 2023-2032 (USD MILLION) 59

- TABLE 26 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY REGION, 2023-2032 (KILO TONS) 59

- TABLE 27 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR CONSUMER GOODS, BY REGION, 2023-2032 (USD MILLION) 60

- TABLE 28 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR CONSUMER GOODS, BY REGION, 2023-2032 (KILO TONS) 60

- TABLE 29 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR ELECTRICAL & ELECTRONICS, BY REGION, 2023-2032 (USD MILLION) 61

- TABLE 30 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR ELECTRICAL & ELECTRONICS, BY REGION, 2023-2032 (KILO TONS) 61

- TABLE 31 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR INDUSTRIAL, BY REGION, 2023-2032 (USD MILLION) 62

- TABLE 32 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR INDUSTRIAL, BY REGION, 2023-2032 (KILO TONS) 62

- TABLE 33 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR PACKAGING, BY REGION, 2023-2032 (USD MILLION) 63

- TABLE 34 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR PACKAGING, BY REGION, 2023-2032 (KILO TONS) 64

- TABLE 35 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR OTHERS, BY REGION, 2023-2032 (USD MILLION) 64

- TABLE 36 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR OTHERS, BY REGION, 2023-2032 (KILO TONS) 65

- TABLE 37 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY REGION, 2023-2032 (USD MILLION) 67

- TABLE 38 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY REGION, 2023-2032 (KILO TONS) 67

- TABLE 39 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 68

- TABLE 40 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 68

- TABLE 41 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 ( USD MILLION) 69

- TABLE 42 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 69

- TABLE 43 NORTH AMERICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY COUNTRY, 2023-2032 (USD MILLION) 70

- TABLE 44 NORTH AMERICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY COUNTRY, 2023-2032 (KILO TONS) 70

- TABLE 45 NORTH AMERICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 71

- TABLE 46 NORTH AMERICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 71

- TABLE 47 NORTH AMERICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 72

- TABLE 48 NORTH AMERICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 72

- TABLE 49 US ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 73

- TABLE 50 US ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 74

- TABLE 51 US ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 74

- TABLE 52 US ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 75

- TABLE 53 CANADA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 76

- TABLE 54 CANADA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 76

- TABLE 55 CANADA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 77

- TABLE 56 CANADA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 77

- TABLE 57 EUROPE ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY COUNTRY, 2023-2032 (USD MILLION) 78

- TABLE 58 EUROPE ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY COUNTRY, 2023-2032 (KILO TONS) 79

- TABLE 59 EUROPE ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 79

- TABLE 60 EUROPE ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 80

- TABLE 61 EUROPE ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 81

- TABLE 62 EUROPE ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 81

- TABLE 63 GERMANY ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 82

- TABLE 64 GERMANY ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 82

- TABLE 65 GERMANY ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 83

- TABLE 66 GERMANY ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 83

- TABLE 67 RUSSIA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 84

- TABLE 68 RUSSIA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 85

- TABLE 69 RUSSIA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 85

- TABLE 70 RUSSIA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 86

- TABLE 71 UK ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 87

- TABLE 72 UK ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 87

- TABLE 73 UK ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 88

- TABLE 74 UK ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 89

- TABLE 75 FRANCE ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 89

- TABLE 76 FRANCE ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 90

- TABLE 77 FRANCE ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 91

- TABLE 78 FRANCE ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 91

- TABLE 79 SPAIN ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 92

- TABLE 80 SPAIN ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 92

- TABLE 81 SPAIN ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 93

- TABLE 82 SPAIN ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 93

- TABLE 83 ITALY ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 94

- TABLE 84 ITALY ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 95

- TABLE 85 ITALY ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 95

- TABLE 86 ITALY ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 96

- TABLE 87 THE NETHERLANDS ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 96

- TABLE 88 THE NETHERLANDS ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 97

- TABLE 89 THE NETHERLANDS ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 98

- TABLE 90 THE NETHERLANDS ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 98

- TABLE 91 BELGIUM ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 99

- TABLE 92 BELGIUM ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 99

- TABLE 93 BELGIUM ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 100

- TABLE 94 BELGIUM ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 100

- TABLE 95 POLAND ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 101

- TABLE 96 POLAND ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 102

- TABLE 97 POLAND ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 102

- TABLE 98 POLAND ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 103

- TABLE 99 REST OF EUROPE ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 103

- TABLE 100 REST OF EUROPE ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 104

- TABLE 101 REST OF EUROPE ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 105

- TABLE 102 REST OF EUROPE ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 105

- TABLE 103 ASIA-PACIFIC ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY COUNTRY, 2023-2032 (USD MILLION) 106

- TABLE 104 ASIA-PACIFIC ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY COUNTRY, 2023-2032 (KILO TONS) 107

- TABLE 105 ASIA-PACIFIC ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 107

- TABLE 106 ASIA-PACIFIC ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 108

- TABLE 107 ASIA-PACIFIC ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 109

- TABLE 108 ASIA-PACIFIC ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 109

- TABLE 109 CHINA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 110

- TABLE 110 CHINA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 110

- TABLE 111 CHINA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 111

- TABLE 112 CHINA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 111

- TABLE 113 JAPAN ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 112

- TABLE 114 JAPAN ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 113

- TABLE 115 JAPAN ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 113

- TABLE 116 JAPAN ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 114

- TABLE 117 INDIA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 114

- TABLE 118 INDIA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 115

- TABLE 119 INDIA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 116

- TABLE 120 INDIA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 116

- TABLE 121 SOUTH KOREA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 117

- TABLE 122 SOUTH KOREA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 117

- TABLE 123 SOUTH KOREA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 118

- TABLE 124 SOUTH KOREA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 118

- TABLE 125 INDONESIA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 119

- TABLE 126 INDONESIA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 120

- TABLE 127 INDONESIA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 120

- TABLE 128 INDONESIA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 121

- TABLE 129 THAILAND ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 121

- TABLE 130 THAILAND ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 122

- TABLE 131 THAILAND ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 123

- TABLE 132 THAILAND ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 123

- TABLE 133 AUSTRALIA & NEW ZEALAND ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 124

- TABLE 134 AUSTRALIA & NEW ZEALAND ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 125

- TABLE 135 AUSTRALIA & NEW ZEALAND ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 125

- TABLE 136 AUSTRALIA & NEW ZEALAND ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 126

- TABLE 137 MALAYSIA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 127

- TABLE 138 MALAYSIA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 127

- TABLE 139 MALAYSIA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 128

- TABLE 140 MALAYSIA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 128

- TABLE 141 REST OF ASIA-PACIFIC ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 129

- TABLE 142 REST OF ASIA-PACIFIC ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 130

- TABLE 143 REST OF ASIA-PACIFIC ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 130

- TABLE 144 REST OF ASIA-PACIFIC ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 131

- TABLE 145 LATIN AMERICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY COUNTRY, 2023-2032 (USD MILLION) 132

- TABLE 146 LATIN AMERICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY COUNTRY, 2023-2032 (KILO TONS) 132

- TABLE 147 LATIN AMERICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 133

- TABLE 148 LATIN AMERICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 133

- TABLE 149 LATIN AMERICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 134

- TABLE 150 LATIN AMERICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 134

- TABLE 151 MEXICO ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (USD MILLION) 135

- TABLE 152 MEXICO ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 136

- TABLE 153 MEXICO ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 136

- TABLE 154 MEXICO ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 137

- TABLE 155 BRAZIL ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 137

- TABLE 156 BRAZIL ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 138

- TABLE 157 BRAZIL ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 139

- TABLE 158 BRAZIL ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 139

- TABLE 159 ARGENTINA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 140

- TABLE 160 ARGENTINA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 140

- TABLE 161 ARGENTINA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 141

- TABLE 162 ARGENTINA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 141

- TABLE 163 REST OF LATIN AMERICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 142

- TABLE 164 REST OF LATIN AMERICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 143

- TABLE 165 REST OF LATIN AMERICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 143

- TABLE 166 REST OF LATIN AMERICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 144

- TABLE 167 THE MIDDLE EAST & AFRICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY COUNTRY, 2023-2032 (USD MILLION) 144

- TABLE 168 THE MIDDLE EAST & AFRICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY COUNTRY, 2023-2032 (KILO TONS) 145

- TABLE 169 THE MIDDLE EAST & AFRICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (USD MILLION) 145

- TABLE 170 THE MIDDLE EAST & AFRICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 146

- TABLE 171 THE MIDDLE EAST & AFRICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 147

- TABLE 172 THE MIDDLE EAST & AFRICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 147

- TABLE 173 NORTH AFRICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (USD MILLION) 148

- TABLE 174 NORTH AFRICA. ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 148

- TABLE 175 NORTH AFRICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 149

- TABLE 176 NORTH AFRICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 149

- TABLE 177 TURKEY ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 150

- TABLE 178 TURKEY ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 151

- TABLE 179 TURKEY ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 151

- TABLE 180 TURKEY ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 152

- TABLE 181 GCC ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 152

- TABLE 182 GCC ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 153

- TABLE 183 GCC ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 154

- TABLE 184 GCC ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 154

- TABLE 185 ISRAEL ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 155

- TABLE 186 ISRAEL ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 156

- TABLE 187 ISRAEL ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 156

- TABLE 188 ISRAEL ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 157

- TABLE 189 REST OF MIDDLE EAST & AFRICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (USD MILLION) 157

- TABLE 190 REST OF MIDDLE EAST & AFRICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 158

- TABLE 191 REST OF MIDDLE EAST & AFRICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 159

- TABLE 192 REST OF MIDDLE EAST & AFRICA ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 159

- TABLE 193 MERGER & ACQUISITION 161

- TABLE 194 AGREEMENTS 162

- TABLE 195 EXPANSION 162

- TABLE 196 INVESTMENTS 163

- TABLE 197 COLLABORATION 163

- TABLE 198 JOINT VENTURE 164 14 List Of Figures

- FIGURE 1 MARKET SYNOPSIS 18

- FIGURE 2 MARKET ATTRACTIVENESS ANALYSIS: GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET 19

- FIGURE 3 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET ANALYSIS, BY PRODUCT TYPE 19

- FIGURE 4 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET ANALYSIS, END-USE INDUSTRY 20

- FIGURE 5 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET ANALYSIS, BY REGION 21

- FIGURE 6 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET: MARKET STRUCTURE 23

- FIGURE 7 KEY BUYING CRITERIA IN THE GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET 23

- FIGURE 8 NORTH AMERICA MARKET SIZE & MARKET SHARE, BY COUNTRY, (2023-2032) 24

- FIGURE 9 EUROPE MARKET SIZE & MARKET SHARE, BY COUNTRY, (2023-2032) 24

- FIGURE 10 ASIA-PACIFIC SIZE & MARKET SHARE, BY COUNTRY, (2023-2032) 25

- FIGURE 11 LATIN AMERICA SIZE & MARKET SHARE, BY COUNTRY, (2023-2032) 25

- FIGURE 12 MIDDLE EAST & AFRICA MARKET SIZE & MARKET SHARE, BY COUNTRY, (2023-2032) 26

- FIGURE 13 RESEARCH PROCESS OF MRFR 27

- FIGURE 14 TOP-DOWN & Bottom-up Approach 30

- FIGURE 15 MARKET DYNAMICS OVERVIEW 32

- FIGURE 16 GLOBAL AUTOMOBILE PRODUCTION, MILLION UNITS (2023-2032) 33

- FIGURE 17 GROWTH OF THE GLOBAL METAL PACKAGING INDUSTRY 34

- FIGURE 18 DRIVERS IMPACT ANALYSIS 35

- FIGURE 19 RESTRAINTS IMPACT ANALYSIS 36

- FIGURE 20 GLOBAL SPENDING ON THE CONSTRUCTION INDUSTRY (2023-2032) 37

- FIGURE 21 ALUMINUM PRICES, USD PER TON, (2023-2032) 37

- FIGURE 22 SUPPLY CHAIN: GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET 38

- FIGURE 23 Porter's Five Forces Analysis OF THE GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET 40

- FIGURE 24 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023 (% SHARE) 43

- FIGURE 25 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 44

- FIGURE 26 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023 (% SHARE) 55

- FIGURE 27 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 56

- FIGURE 28 GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET BY REGION, 2023-2032 (USD MILLION) 66

Aluminum Flat-Rolled Products Product type Outlook (USD Billion, 2019-2032)

- Plates

- Sheets

- Standard GEQ

- Circles

- Foil Stock

- Can Stock

- Fin Stock

Aluminum Flat-Rolled Products End-use Industry Outlook (USD Billion, 2019-2032)

- Building & Construction

- Automotive & Transportation

- Consumer goods

- Electrical & Electronics

- Industrial

- Packaging

Aluminum Flat-Rolled Products Regional Outlook (USD Billion, 2019-2032)

North America Outlook (USD Billion, 2019-2032)

- North America Aluminum Flat-Rolled Products by Product type

- Plates

- Sheets

- Standard GEQ

- Circles

- Foil Stock

- Can Stock

- Fin Stock

- North America Aluminum Flat-Rolled Products by End-use industry

- Building & construction

- Automotive & Transportation

- Consumer goods

- Electrical & Electronics

- Industrial

- Packaging

US Outlook (USD Billion, 2019-2032)

- US Aluminum Flat-Rolled Products by Product type

- Plates

- Sheets

- Standard GEQ

- Circles

- Foil Stock

- Can Stock

- Fin Stock

- US Aluminum Flat-Rolled Products by End-use industry

- Building & construction

- Automotive & transportation

- Consumer goods

- Electrical & Electronics

- Industrial

- Packaging

CANADA Outlook (USD Billion, 2019-2032)

- CANADA Aluminum Flat-Rolled Products by Product type

- Plates

- Sheets

- Standard GEQ

- Circles

- Foil Stock

- Can Stock

- Fin Stock

- CANADA Aluminum Flat-Rolled Products by End-use industry

- Building & construction

- Automotive & transportation

- Consumer goods

- Electrical & Electronics

- Industrial

- Packaging

- North America Aluminum Flat-Rolled Products by Product type

Europe Outlook (USD Billion, 2019-2032)

- Europe Aluminum Flat-Rolled Products by Product type

- Plates

- Sheets

- Standard GEQ

- Circles

- Foil Stock

- Can Stock

- Fin Stock

- Europe Aluminum Flat-Rolled Products by End-use industry

- Building & construction

- Automotive & transportation

- Consumer goods

- Electrical & Electronics

- Industrial

- Packaging

Germany Outlook (USD Billion, 2019-2032)

- Germany Aluminum Flat-Rolled Products by Product type

- Plates

- Sheets

- Standard GEQ

- Circles

- Foil Stock

- Can Stock

- Fin Stock

- Germany Aluminum Flat-Rolled Products by End-use industry

- Building & construction

- Automotive & transportation

- Consumer goods

- Electrical & Electronics

- Industrial

- Packaging

France Outlook (USD Billion, 2019-2032)

- France Aluminum Flat-Rolled Products by Product type

- Plates

- Sheets

- Standard GEQ

- Circles

- Foil Stock

- Can Stock

- Fin Stock

- France Aluminum Flat-Rolled Products by End-use industry

- Building & construction

- Automotive & transportation

- Consumer goods

- Electrical & Electronics

- Industrial

- Packaging

UK Outlook (USD Billion, 2019-2032)

- UK Aluminum Flat-Rolled Products by Product type

- Plates

- Sheets

- Standard GEQ

- Circles

- Foil Stock

- Can Stock

- Fin Stock

- UK Aluminum Flat-Rolled Products by End-use industry

- Building & construction

- Automotive & transportation

- Consumer goods

- Electrical & Electronics

- Industrial

- Packaging

ITALY Outlook (USD Billion, 2019-2032)

- ITALY Aluminum Flat-Rolled Products by Product type

- Plates

- Sheets

- Standard GEQ

- Circles

- Foil Stock

- Can Stock

- Fin Stock

- ITALY Aluminum Flat-Rolled Products by End-use industry

- Building & construction

- Automotive & transportation

- Consumer goods

- Electrical & Electronics

- Industrial

- Packaging

SPAIN Outlook (USD Billion, 2019-2032)

- Spain Aluminum Flat-Rolled Products by Product type

- Plates

- Sheets

- Standard GEQ

- Circles

- Foil Stock

- Can Stock

- Fin Stock

- Spain Aluminum Flat-Rolled Products by End-use industry

- Building & construction

- Automotive & transportation

- Consumer goods

- Electrical & Electronics

- Industrial

- Packaging

Rest Of Europe Outlook (USD Billion, 2019-2032)

- Rest Of Europe Aluminum Flat-Rolled Products by Product type

- Plates

- Sheets

- Standard GEQ

- Circles

- Foil Stock

- Can Stock

- Fin Stock

- REST OF EUROPE Aluminum Flat-Rolled Products by End-use industry

- Building & construction

- Automotive & transportation

- Consumer goods

- Electrical & Electronics

- Industrial

- Packaging

- Europe Aluminum Flat-Rolled Products by Product type

Asia-Pacific Outlook (USD Billion, 2019-2032)

- Asia-Pacific Aluminum Flat-Rolled Products by Product type

- Plates

- Sheets

- Standard GEQ

- Circles

- Foil Stock

- Can Stock

- Fin Stock

- Asia-Pacific Aluminum Flat-Rolled Products by End-use industry

- Building & construction

- Automotive & transportation

- Consumer goods

- Electrical & Electronics

- Industrial

- Packaging

China Outlook (USD Billion, 2019-2032)

- China Aluminum Flat-Rolled Products by Product type

- Plates

- Sheets

- Standard GEQ

- Circles

- Foil Stock

- Can Stock

- Fin Stock

- China Aluminum Flat-Rolled Products by End-use industry

- Building & construction

- Automotive & transportation

- Consumer goods

- Electrical & Electronics

- Industrial

- Packaging

Japan Outlook (USD Billion, 2019-2032)

- Japan Aluminum Flat-Rolled Products by Product type

- Plates

- Sheets

- Standard GEQ

- Circles

- Foil Stock

- Can Stock

- Fin Stock

- Japan Aluminum Flat-Rolled Products by End-use industry

- Building & construction

- Automotive & transportation

- Consumer goods

- Electrical & Electronics

- Industrial

- Packaging

India Outlook (USD Billion, 2019-2032)

- India Aluminum Flat-Rolled Products by Product type

- Plates

- Sheets

- Standard GEQ

- Circles

- Foil Stock

- Can Stock

- Fin Stock

- India Aluminum Flat-Rolled Products by End-use industry

- Building & construction

- Automotive & transportation

- Consumer goods

- Electrical & Electronics

- Industrial

- Packaging

Australia Outlook (USD Billion, 2019-2032)

- Australia Aluminum Flat-Rolled Products by Product type

- Plates

- Sheets

- Standard GEQ

- Circles

- Foil Stock

- Can Stock

- Fin Stock

- Australia Aluminum Flat-Rolled Products by End-use industry

- Building & construction

- Automotive & transportation

- Consumer goods

- Electrical & Electronics

- Industrial

- Packaging

Rest of Asia-Pacific Outlook (USD Billion, 2019-2032)

- Rest of Asia-Pacific Aluminum Flat-Rolled Products by Product type

- Plates

- Sheets

- Standard GEQ

- Circles

- Foil Stock

- Can Stock

- Fin Stock

- Rest of Asia-Pacific Aluminum Flat-Rolled Products by End-use industry

- Building & construction

- Automotive & transportation

- Consumer goods

- Electrical & Electronics

- Industrial

- Packaging

- Asia-Pacific Aluminum Flat-Rolled Products by Product type

Rest of the World Outlook (USD Billion, 2019-2032)

- Rest of the World Aluminum Flat-Rolled Products by Product type

- Plates

- Sheets

- Standard GEQ

- Circles

- Foil Stock

- Can Stock

- Fin Stock

- Rest of the World Aluminum Flat-Rolled Products by End-use industry

- Building & construction

- Automotive & transportation

- Consumer goods

- Electrical & Electronics

- Industrial

- Packaging

Middle East Outlook (USD Billion, 2019-2032)

- Middle East Aluminum Flat-Rolled Products by Product type

- Plates

- Sheets

- Standard GEQ

- Circles

- Foil Stock

- Can Stock

- Fin Stock

- Middle East Aluminum Flat-Rolled Products by End-use industry

- Building & construction

- Automotive & transportation

- Consumer goods

- Electrical & Electronics

- Industrial

- Packaging

Africa Outlook (USD Billion, 2019-2032)

- Africa Aluminum Flat-Rolled Products by Product type

- Plates

- Sheets

- Standard GEQ

- Circles

- Foil Stock

- Can Stock

- Fin Stock

- Africa Aluminum Flat-Rolled Products by End-use industry

- Building & construction

- Automotive & transportation

- Consumer goods

- Electrical & Electronics

- Industrial

- Packaging

Latin America Outlook (USD Billion, 2019-2032)

- Latin America Aluminum Flat-Rolled Products by Product type

- Plates

- Sheets

- Standard GEQ

- Circles

- Foil Stock

- Can Stock

- Fin Stock

- Latin America Aluminum Flat-Rolled Products by End-use industry

- Building & construction

- Automotive & transportation

- Consumer goods

- Electrical & Electronics

- Industrial

- Packaging

- Rest of the World Aluminum Flat-Rolled Products by Product type

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment