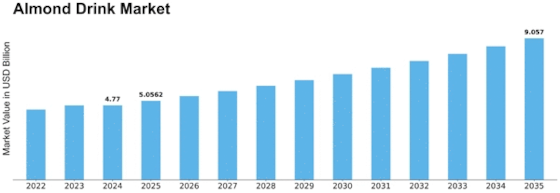

Almond Drink Size

Almond Drink Market Growth Projections and Opportunities

The global online grocery market is poised for substantial growth in the foreseeable future, propelled by key drivers that shape consumer behavior and industry dynamics. A notable factor contributing to this growth is the significant surge in promotional activities and discount offers initiated by major players in the market. This strategic approach not only attracts customers but also fosters loyalty, driving the adoption of online grocery shopping globally. Additionally, the steady rise in per capita disposable income plays a crucial role in fueling the market's expansion, as increased disposable income enhances consumer buying power and willingness to explore online grocery services. The emphasis on promotional activities and discounts is a pivotal strategy employed by major players in the online grocery sector. Offering incentives such as discounts, special promotions, and bundled deals serves as a powerful tool to attract new customers and retain existing ones. This approach not only differentiates online grocery platforms but also creates a competitive edge, contributing significantly to the industry's growth trajectory. The second driving force behind the global online grocery market is the escalating per capita disposable income. Per capita disposable income represents the portion of household income available for spending and saving after accounting for income taxes. As per capita disposable income increases, individuals have more financial resources at their disposal, influencing their purchasing decisions. In the context of online grocery shopping, rising disposable incomes translate to an increased willingness to pay for the convenience and time-saving aspects offered by online platforms. Despite these growth drivers, the underdeveloped online capabilities of certain online grocery players pose a potential challenge to the market's overall expansion. While the demand for online grocery services is high, some players may face limitations due to inadequate technological infrastructure or inefficient online interfaces. Overcoming these limitations is crucial for sustained growth and to meet the evolving expectations of tech-savvy consumers. An area of significant opportunity lies in the increased adoption of advanced technologies within the online grocery sector. The integration of innovative technologies, such as advanced data analytics, artificial intelligence, and improved user interfaces, can enhance the overall customer experience. This not only addresses the existing challenges related to underdeveloped online capabilities but also opens up new avenues for profitable growth. The effective use of technology can streamline operations, optimize supply chains, and offer personalized experiences, creating a win-win scenario for both online grocery service providers and consumers. the global online grocery market is on a trajectory of significant growth, driven by factors such as promotional activities, discount offers, and the rising per capita disposable income. While these factors fuel the expansion of the market, challenges related to underdeveloped online capabilities may hinder growth for some players. However, the adoption of advanced technologies presents a promising opportunity to overcome these challenges and further enhance the online grocery experience. As the market evolves, online grocery service providers that embrace innovation and leverage technology effectively are likely to carve a successful path in this dynamic and competitive landscape.

Leave a Comment