-

Global Aircraft Tire Market, By Platform

-

Global Aircraft Tire Market, By Product Type

-

Global Aircraft Tire Market, By Aircraft Type

-

Global Aircraft Tire Market, By End User

-

Global Aircraft Tire Market, By Region

-

Market Definition

-

Scope Of The Study

-

Market Structure

-

Key Buying Criteria

-

Market Factor Indicator Analysis

-

Research Process

-

Primary Research

-

Secondary Research

-

Market Size Estimation

-

Forecast Model

-

List Of Assumptions

-

Introduction

-

Drivers

-

Restraints

-

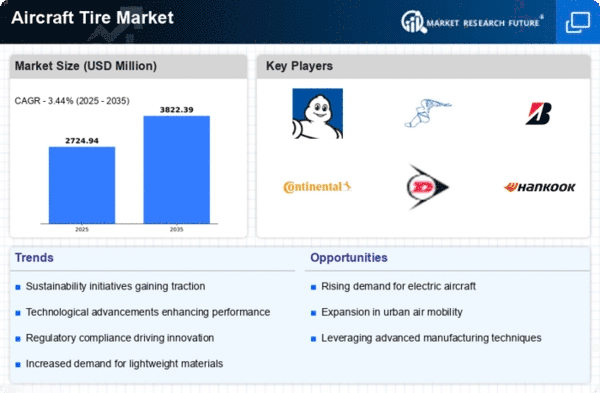

Opportunities

-

Challenges

-

Market/Technological Trends

-

Patent Trends

-

Regulatory Landscape/Standards

-

Value Chain/Supply Chain Analysis

- R&D

- Manufacturing

- Distribution & Sales

- Post-Sales Monitoring

-

Porter’s Five Forces Analysis

- Threat Of New Entrants

- Bargaining Power Of Buyers

- Threat Of Substitutes

- Intensity Of Rivalry

- Bargaining Power Of Suppliers

-

Introduction

-

Fixed-Wing

- Market Estimates & Forecast, 2025-2034

- Market Estimates

-

& Forecast, By Region, 2025-2034

-

Rotary-Wing

- Market Estimates & Forecast, 2025-2034

- Market Estimates

-

& Forecast, By Region, 2025-2034

-

Global Aircraft Tire Market, By Aircraft Type

-

Introduction

-

Commercial Aircraft

- Market Estimates & Forecast, 2025-2034

- Market Estimates & Forecast, By Region

-

Military Aircraft

- Market Estimates & Forecast, 2025-2034

- Market Estimates & Forecast, By Region

-

Business & General Aviation Aircraft

- Market Estimates & Forecast, 2025-2034

- Market Estimates

-

& Forecast, By Region, 2025-2034

-

Global Aircraft Tire Market, By Product Type

-

Introduction

-

Bias Ply

- Market Estimates & Forecast, 2025-2034

- Market Estimates & Forecast, By Region, 2025-2034

-

Radial Ply

-

Market Estimates & Forecast, 2025-2034

-

Market Estimates & Forecast, By Region, 2025-2034

-

Introduction

-

OEM

- Market Estimates & Forecast, 2025-2034

- Market Estimates & Forecast, By Region

-

Aftermarket

- Market Estimates & Forecast, 2025-2034

- Market Estimates & Forecast, By Region, 2025-2034

-

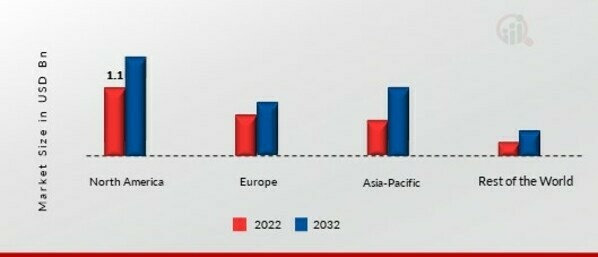

Introduction

-

North America

-

Market Estimates & Forecast, By Country, 2025-2034

-

Market Estimates & Forecast, By Platform, 2025-2034

- Market Estimates & Forecast, By Product Type, 2025-2034

- Market Estimates

-

& Forecast, By End User, 2025-2034

-

Market Estimates & Forecast, By Aircraft Type, 2025-2034

-

US

- Market

-

Estimates & Forecast, By Platform, 2025-2034

-

Market Estimates & Forecast, By Product Type, 2025-2034

-

Market Estimates & Forecast, By End User, 2025-2034

- Market Estimates & Forecast, By Aircraft Type, 2025-2034

- Canada

-

Forecast, By Product Type, 2025-2034

-

Market Estimates & Forecast, By End User, 2025-2034

-

Market Estimates & Forecast, By Aircraft Type, 2025-2034

-

Europe

-

Market Estimates & Forecast, By Country, 2025-2034

-

Market Estimates & Forecast, By Platform, 2025-2034

- Market Estimates & Forecast, By Product Type, 2025-2034

- Market Estimates

-

& Forecast, By End User, 2025-2034

-

UK

- Market Estimates & Forecast, By Platform, 2025-2034

-

Estimates & Forecast, By Product Type, 2025-2034

-

Market Estimates & Forecast, By End User, 2025-2034

- Market Estimates & Forecast, By Aircraft Type, 2025-2034

- Germany

-

Forecast, By Product Type, 2025-2034

-

Market Estimates & Forecast, By End User, 2025-2034

-

Market Estimates & Forecast, By Aircraft Type, 2025-2034

- France

-

Market Estimates & Forecast, By Platform, 2025-2034

-

Market Estimates & Forecast, By Product Type, 2025-2034

- Market Estimates & Forecast, By End User, 2025-2034

-

& Forecast, By Aircraft Type, 2025-2034

-

Spain

- Market Estimates

-

Forecast, By Platform, 2025-2034

-

Market Estimates & Forecast, By Product Type, 2025-2034

-

Market Estimates & Forecast, By End User, 2025-2034

- Market Estimates & Forecast, By Aircraft Type, 2025-2034

- Rest Of Europe

-

Forecast, By Product Type, 2025-2034

-

Market Estimates & Forecast, By End User, 2025-2034

-

Market Estimates & Forecast, By Aircraft Type, 2025-2034

-

Asia-Pacific

- Market Estimates & Forecast, By Country, 2025-2034

- Market Estimates & Forecast, By Platform

- Market Estimates

-

Forecast, By Product Type, 2025-2034

-

Market Estimates & Forecast, By End User, 2025-2034

-

Market Estimates & Forecast, By Aircraft Type, 2025-2034

- China

-

Market Estimates & Forecast, By Platform, 2025-2034

-

Market Estimates & Forecast, By Product Type, 2025-2034

- Market Estimates & Forecast, By End User, 2025-2034

-

& Forecast, By Aircraft Type, 2025-2034

-

Japan

- Market Estimates

-

Forecast, By Platform, 2025-2034

-

Market Estimates & Forecast, By Product Type, 2025-2034

-

Market Estimates & Forecast, By End User, 2025-2034

- Market Estimates & Forecast, By Aircraft Type, 2025-2034

- India

-

Forecast, By Product Type, 2025-2034

-

Market Estimates & Forecast, By End User, 2025-2034

-

Market Estimates & Forecast, By Aircraft Type, 2025-2034

- South Korea

-

& Forecast, By End User, 2025-2034

-

Market Estimates & Forecast, By Aircraft Type, 2025-2034

-

Rest Of Asia-Pacific

-

Market Estimates & Forecast, By Platform, 2025-2034

-

Market Estimates & Forecast, By Product Type, 2025-2034

- Market Estimates & Forecast, By End User, 2025-2034

-

& Forecast, By Aircraft Type, 2025-2034

-

Middle East & Africa

-

Market

-

Estimates & Forecast, By Country, 2025-2034

-

Market Estimates & Forecast, By Platform, 2025-2034

-

Market Estimates & Forecast, By Product Type, 2025-2034

- Market Estimates & Forecast, By End User

- Market Estimates

-

Forecast, By Aircraft Type, 2025-2034

-

UAE

- Market Estimates & Forecast, By Platform, 2025-2034

-

Estimates & Forecast, By Product Type, 2025-2034

-

Market Estimates & Forecast, By End User, 2025-2034

- Market Estimates & Forecast, By Aircraft Type, 2025-2034

- Saudi Arabia

-

Forecast, By Product Type, 2025-2034

-

Market Estimates & Forecast, By End User, 2025-2034

-

Market Estimates & Forecast, By Aircraft Type, 2025-2034

- Rest Of The Middle East & Africa

-

Forecast, By Product Type, 2025-2034

-

Market Estimates & Forecast, By End User, 2025-2034

-

Market Estimates & Forecast, By Aircraft Type, 2025-2034

-

Latin America

- Market Estimates & Forecast, By Country, 2025-2034

- Market Estimates & Forecast, By Platform

- Market Estimates

-

Forecast, By Product Type, 2025-2034

-

Market Estimates & Forecast, By End User, 2025-2034

-

Market Estimates & Forecast, By Aircraft Type, 2025-2034

- Brazil

-

Market Estimates & Forecast, By Platform, 2025-2034

-

Market Estimates & Forecast, By Product Type, 2025-2034

- Market Estimates & Forecast, By End User, 2025-2034

-

& Forecast, By Aircraft Type, 2025-2034

-

Mexico

- Market Estimates

-

Forecast, By Platform, 2025-2034

-

Market Estimates & Forecast, By Product Type, 2025-2034

-

Market Estimates & Forecast, By End User, 2025-2034

- Market Estimates & Forecast, By Aircraft Type, 2025-2034

- Rest Of Latin America

-

Forecast, By Product Type, 2025-2034

-

Market Estimates & Forecast, By End User, 2025-2034

-

Market Estimates & Forecast, By Aircraft Type, 2025-2034

-

Competitive Overview

-

Competitor Dashboard

-

Major Growth

-

Strategies In The Global Aircraft Tire Market

-

Competitive Benchmarking

-

Market Share Analysis

-

Bridgestone Corporation:

-

The Leading Player In Terms Of Number Of Developments In The Global Aircraft Tire Market

-

Key Developments & Growth Strategies

- Product Type Launches/Service Deployments

- Mergers & Acquisitions

- Joint Ventures

-

Bridgestone Corporation

- Company Overview

- Products/Services Offered

- Financial Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Dunlop Aircraft Tyres Limited

- Company Overview

- Products/Services Offered

- Financial Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Desser Tire & Rubber Co., LLC

- Company Overview

- Products/Services Offered

- Financial Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Michelin Group

- Company Overview

- Products/Services Offered

- Financial Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Petlas

- Company Overview

- Products/Services Offered

- Financial Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Qingdao Sentury Tire Co., Ltd.

-

Company Overview

- Products/Services Offered

- Financial Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Sentury Tire

- Company Overview

- Products/Services Offered

- Financial Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Specialty Tires Of America, Inc.

-

Company Overview

- Products/Services Offered

- Financial Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

The Goodyear Tire & Rubber Company

- Company Overview

- Products/Services Offered

- Financial Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

WILKERSON COMPANY, INC.

- Company Overview

- Products/Services Offered

- Financial Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

References

-

Related Reports

-

List Of Abbreviations

-

Aircraft Tire Market, By Region, 2025-2034

-

Aircraft Tire Market, By Country, 2025-2034

-

Tire Market Size, By Country, 2025-2034

-

Tire Market Size, By Country, 2025-2034

-

Aircraft Tire Platform Market, By Country, 2025-2034 Country, 2025-2034

-

Aircraft Tire Platform Market, By Country, 2025-2034

-

Market, By Country, 2025-2034

-

Europe: Aircraft Tire Product Type Market, By Country, 2025-2034

-

Aircraft Tire Product Type Market, By Country, 2025-2034

-

End User Market, By Region, 2025-2034

-

Aircraft Tire End User Market, By Country, 2025-2034 Country, 2025-2034

-

Aircraft Tire End User Market, By Country, 2025-2034

-

Market, By Country, 2025-2034

-

Europe: Aircraft Tire Aircraft Type Market, By Country, 2025-2034

-

Aircraft Tire Aircraft Type Market, By Country, 2025-2034

-

Market, By Region, 2025-2034

-

Aircraft Tire Market, By Platform, 2025-2034

-

Aircraft Tire Market, By Country, 2025-2034

-

Aircraft Tire Market, By Aircraft Type, 2025-2034

-

Market, By Product Type, 2025-2034

-

Tire Market, By Platform, 2025-2034

-

Africa: Aircraft Tire Market, By Country, 2025-2034

-

Aircraft Tire Market, By Product Type, 2025-2034

-

Market, By Aircraft Type, 2025-2034

-

America: Aircraft Tire Market, By End User, 2025-2034

-

2024 (%)

-

Market, By Platform, 2025-2034 (USD Billion)

-

Market Share, By End User, 2024 (%)

-

Type, 2025-2034 (USD Billion)

-

Global Aircraft Tire Market Share (%), By Region, 2024 (%), 2024

-

Tire Market, By Country, 2025-2034 (USD Billion)

-

Country, 2025-2034 (USD Billion)

-

2025-2034 (USD Billion)

-

America: Aircraft Tire Market Share (%), 2024

Leave a Comment