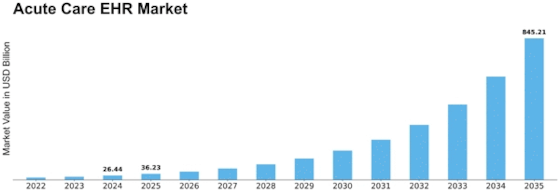

Acute Care Ehr Size

Acute Care EHR Market Growth Projections and Opportunities

One element affecting the industry is the growing focus on interoperability across healthcare IT systems. Acute care EHR solutions that enable seamless information interchange across healthcare departments, providers, and systems improve patient care integration and coordination. Acute Care Electronic Health Record (EHR) business regulations, such as those set by government healthcare authorities, have a major influence. Mandates that promote or require healthcare institutions to employ EHRs are growing the sector. Because providers work hard to follow regulatory agency requirements. Continuous technical advances in electronic health record systems drive commercial innovation. Artificial intelligence, predictive analytics, and mobile access may enhance acute care EHR systems. These attributes appeal to healthcare professionals seeking modern patient care and data management technologies. The industry-wide trend toward patient-centered care is affecting the market. Patient engagement elements like customized health records and secured patient portals improve medical professional-patient contact in acute care electronic health record (EHR) systems. This increases patient engagement in treatment decisions. Customers' growing worries about patient data privacy and safety affect the industry. Acute care EHR providers that use robust security, encryption, and data protection requirements gain healthcare organizations' confidence and boost their products' marketability. These providers provide a safer atmosphere for patients. Due to the sector-wide trend toward value-based care, acute care EHR systems are becoming increasingly popular. These technologies allow healthcare providers to monitor and report quality measures, enhance patient outcomes, and conform with value-based compensation schemes. Cloud-hosted EHR solutions are in demand for acute care. Cloud technology lets healthcare institutions securely access patient data from several locations. This technology's versatility, scalability, and accessibility allow this. This makes it easier for healthcare workers to collaborate, improving operational efficiency. The acute care EHR market in the healthcare information technology sector is affected by supplier consolidation and collaboration. EHR technology vendors' mergers, acquisitions, and alliances with other healthcare technology providers affect the sector's dynamics. These actions provide more complete and integrated solutions.

Leave a Comment