Tassat Launches The Digital Interbank Network For Real-Time Payments

By Aarti Dhapte , 31 October, 2022

Tassat, the leading provider of private blockchain-based business-to-business (B2B) real-time payments and financial services solutions to banks headquartered in the US, unveiled its new blockchain product, the Digital Interbank Network, in October 2022. Over 400 transactions were completed without error in 8 hours, averaging USD 1.25 million per transaction, using Tassat-controlled accounts at Cogent Bank, Customers Bank, and Western Alliance Bank. Tassat's purpose is to develop the Network as a viable platform for B2B customers of member banks to perform real-time payments between businesses at different banks.

Speaking at the occasion Kevin R. Greene, Tassat’s Chairman, and CEO, said the company transacted for USD 500 million more than their expectations. They were excited to be a part of such a historic moment in the banking industry as blockchain technology transforms banking in America.

The blockchain payment network Signet from Signature Bank and the CBIT from Customers Bank is powered by Tassat technology. The Digital Interbank Network can enable payments between the consumers of member banks, while those white-labeled platforms cater to each bank's clients. Since the Federal Reserve intends to introduce the FedNow Service in 2023 to settle payments in real-time and round-the-clock, launching the Digital Interbank Network is another instance of banks investigating real-time payment applications. In addition, Tassat fully complies with the US banking system's current regulatory framework when using blockchain technology for banks.

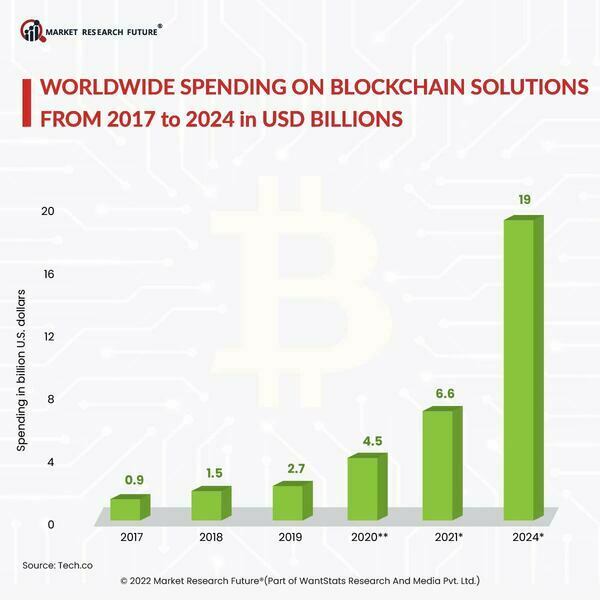

Furthermore, around the world, several interbank payment networks based on blockchain are being developed. For instance, the UK-based Fnality, which plans to debut this month, has received support from seventeen sizable institutions. JP Morgan and DBS Bank support Singapore's Partier interbank network for multi-currency payments. The USDF Consortium focuses on interbank payments for community banks in the United States. Due to this, the demand for the blockchain technology market is significantly growing.Worldwide Spending on Blockchain Solutions From 2027 to 2024 in USD Billions

Latest News

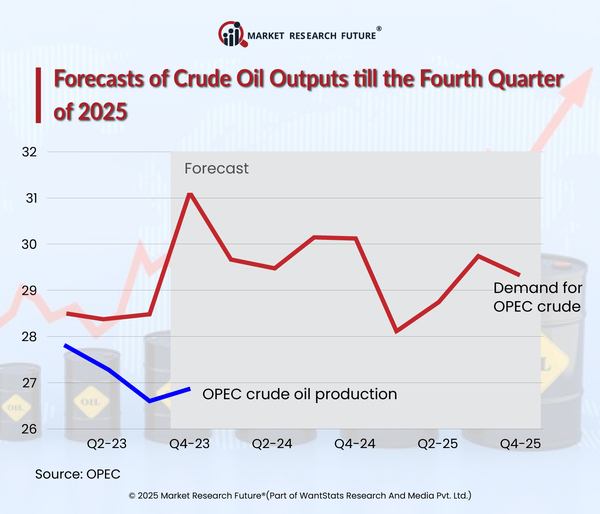

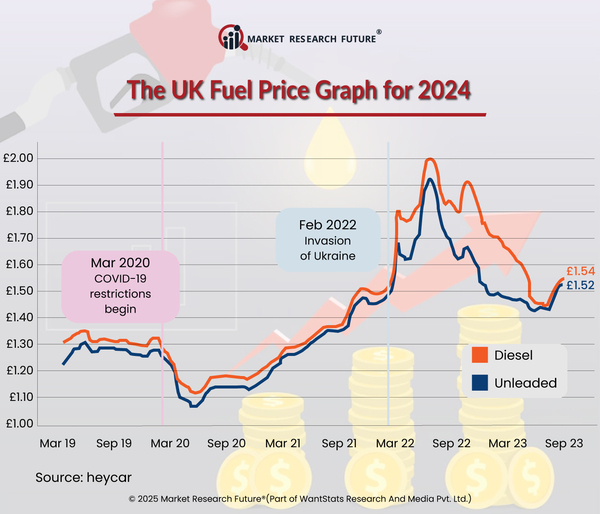

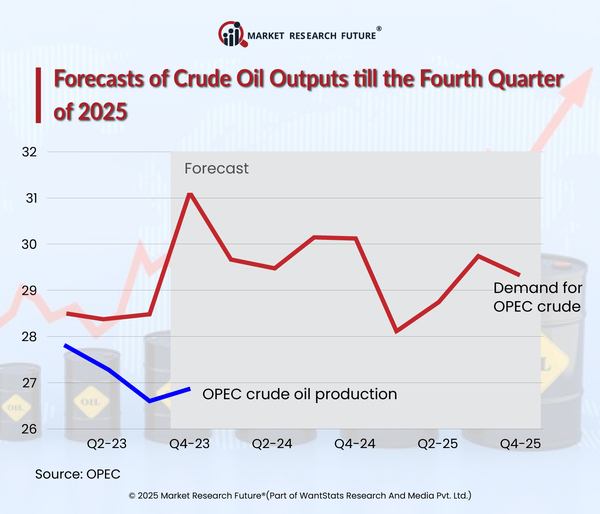

Asia has retained the position as the top oil importer in 2025, and continues to maintain that critical position in the energy sector that the world relies on. China has retained its top spot as the most prominent crude oil importer since 2013. The…

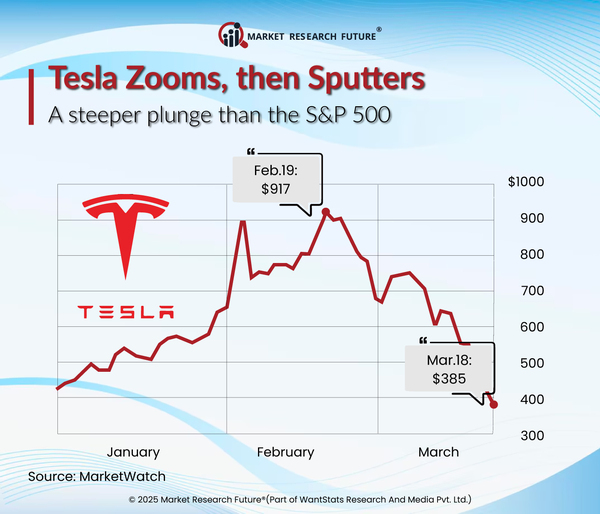

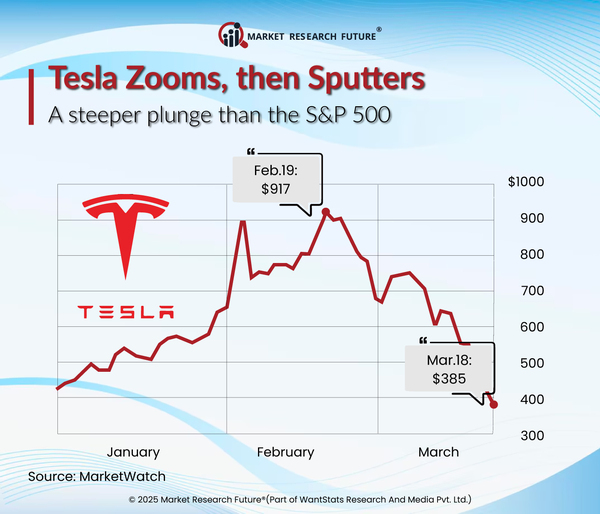

Once the clear leader in the electric vehicle (EV) sector, Tesla's European market is expected to be drastically declining in 2025. Although CEO Elon Musk is still divisive in the United States, recent registration numbers show a bleak image of…

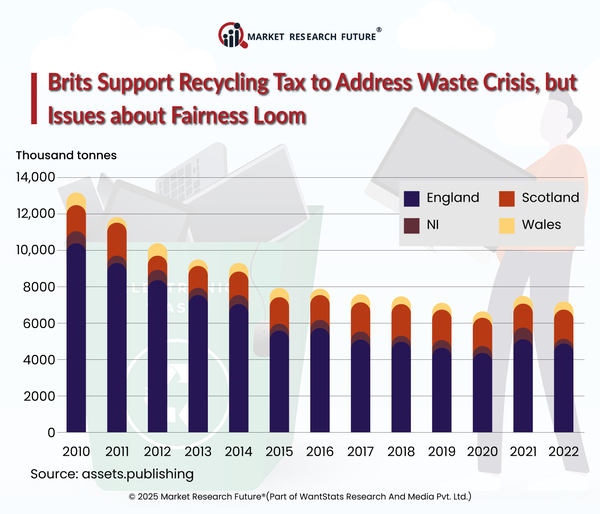

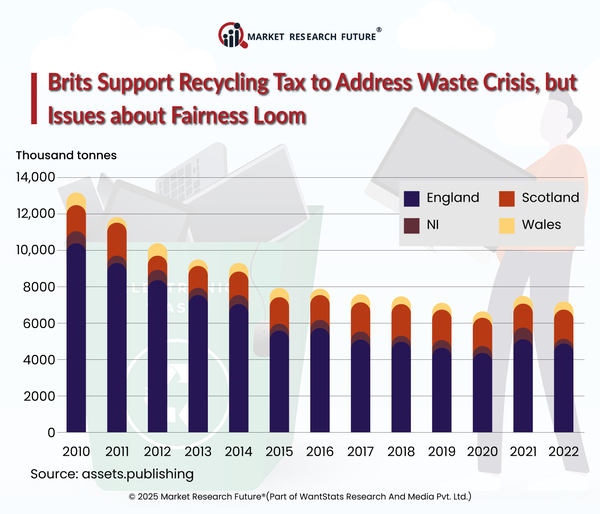

In 2025, the UK government unveiled many essential policies to address the growing trash situation, including a new plastic packaging tax and a landfill fee rise to lessen dependency on landfills. Studies show that over half of Britons support taxes…

Team Lead - Research

Latest News