Semiconductor Industry Released Statement on the U.S. Outbound Statement

By Shubham Munde , 20 September, 2023

The Semiconductor Industry Association (SIA) in the United States has released a statement to set up new rules and actions for the outbound investment screening in August 2023. The US has targeted China, with developments coming further on releasing this statement.

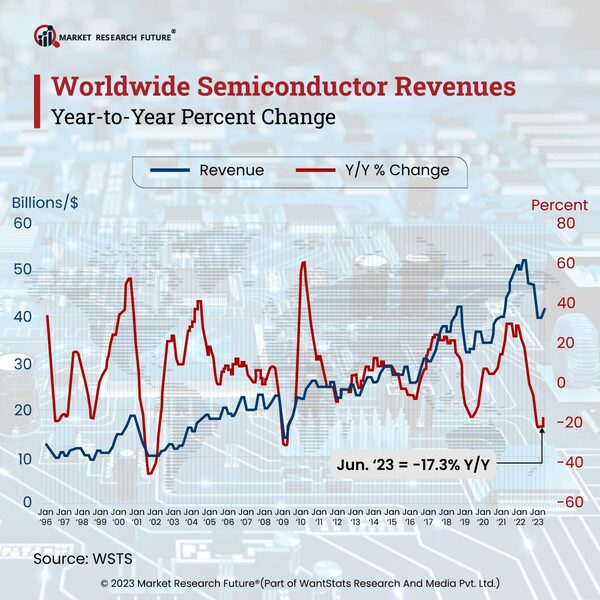

The US administration launched an executive order in August 2023, citing prohibitions and specific product and technology rules. It prohibited outbound investments in semiconductors, microelectronics, artificial intelligence fields, and others. China is identified as the country of concern in these recently released reports from the US administration, followed by Hongkong and Macao as the other two countries on the list. Thus, the order also included notification focusing on a broader set of transactions for China. Analysts also expect that the administration will further increase the scope of controls on outbound investment, as visualized in the executive order signed recently in the US in 2023. The sales of semiconductors globally is recorded to be increased by 4.7% as compared to the first quarter, according to the Semiconductor Industry Association (SIA) reports.

Thus, the semiconductor industry said in response to this newly released outbound investment that the sector will contribute towards protecting the united states' competitive semiconductor industry as a part of safeguarding national security in 2023. The organization also added that it welcomes the new proposal with opportunities to give back feedback based on specific changes the industry may undergo. The Semiconductor Industry Association (SIA) hopes that new rules will allow the United States based chip firms to approach key global markets better. It looks forward to competing on an equal platform with other countries, including China. The organization also thinks of maintaining the strength of the US semiconductor industry long term and developing caliber to shine more among other global competitors in 2023.Worldwide Semiconductor Revenues

Latest News

Asia has retained the position as the top oil importer in 2025, and continues to maintain that critical position in the energy sector that the world relies on. China has retained its top spot as the most prominent crude oil importer since 2013. The…

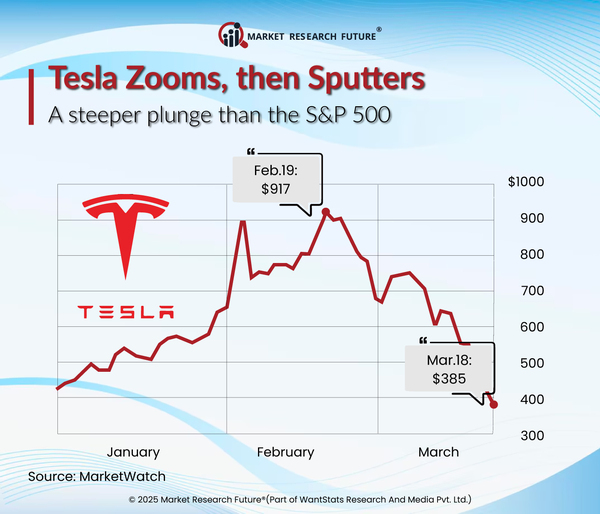

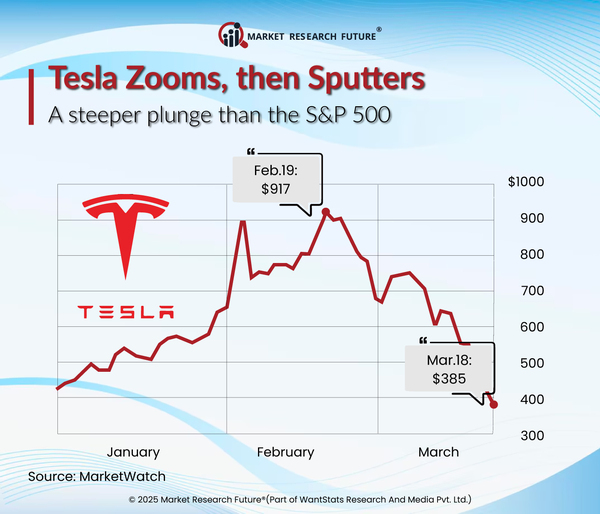

Once the clear leader in the electric vehicle (EV) sector, Tesla's European market is expected to be drastically declining in 2025. Although CEO Elon Musk is still divisive in the United States, recent registration numbers show a bleak image of…

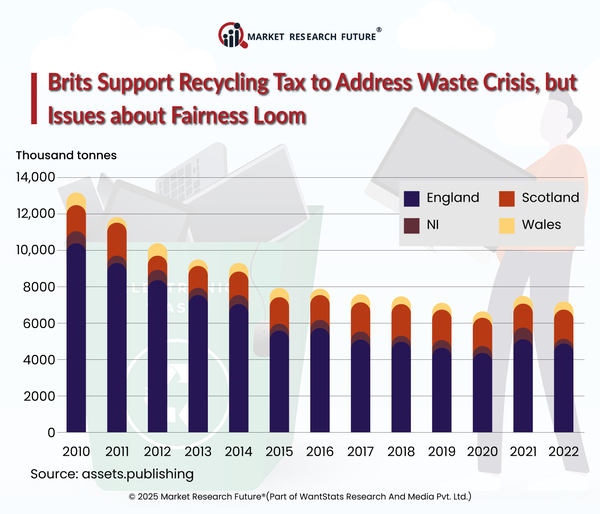

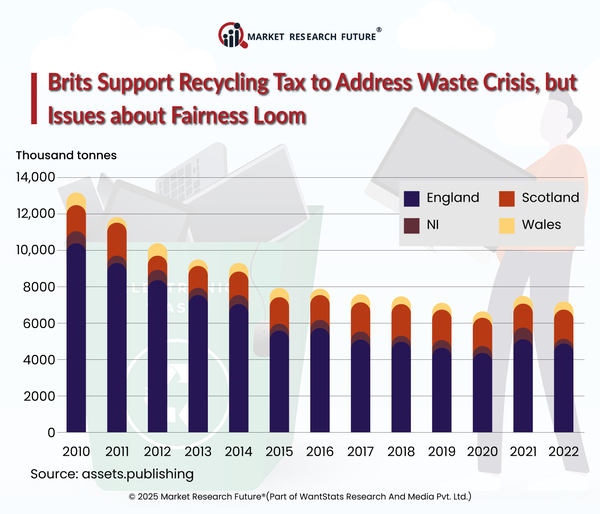

In 2025, the UK government unveiled many essential policies to address the growing trash situation, including a new plastic packaging tax and a landfill fee rise to lessen dependency on landfills. Studies show that over half of Britons support taxes…

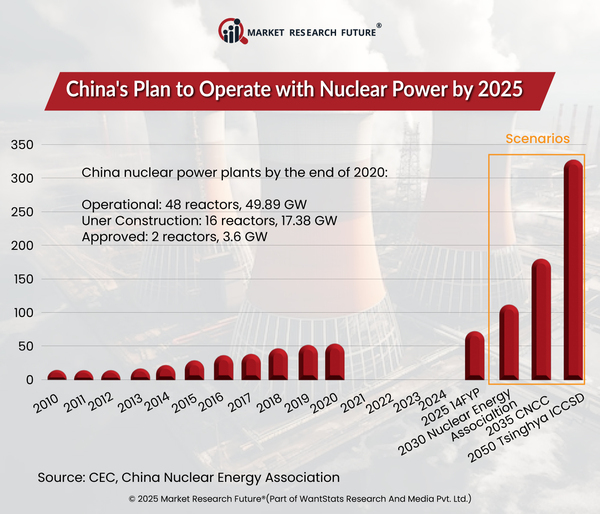

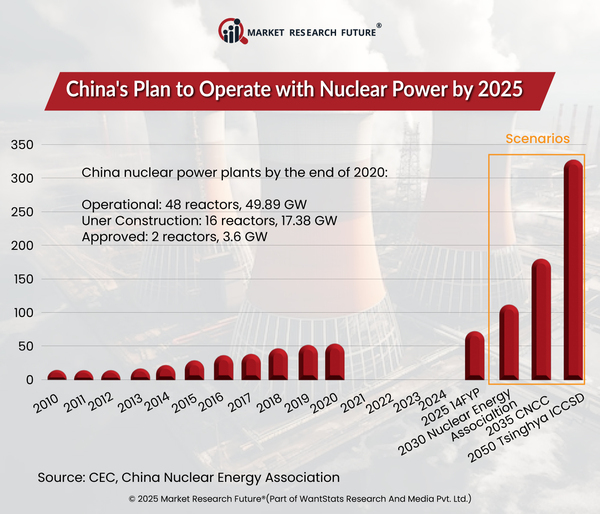

Nuclear energy capacity is growing significantly from the beginning of 2025. It is due to increasing concerns over climate change, and energy security amidst fluctuating fuel prices followed by net-zero targets set up by nations globally. Further…

Research Analyst Level II

Latest News