全球军事卫星市场概览

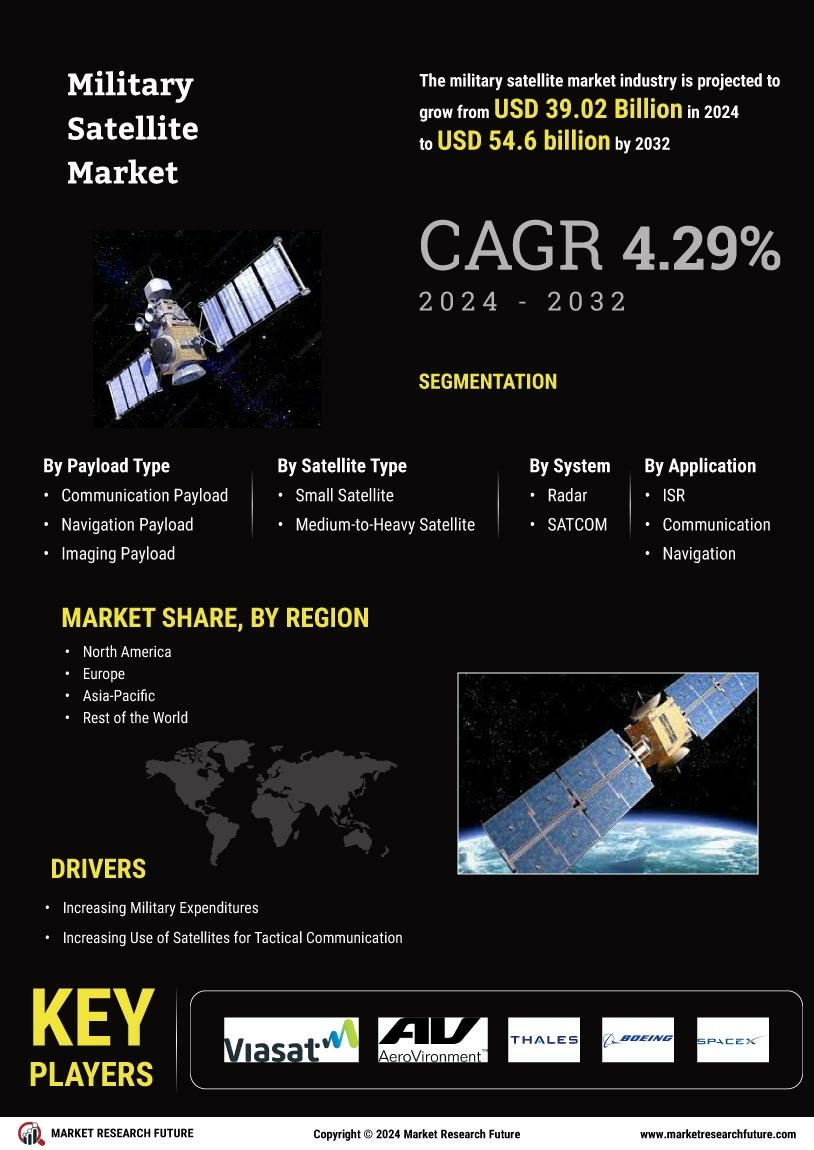

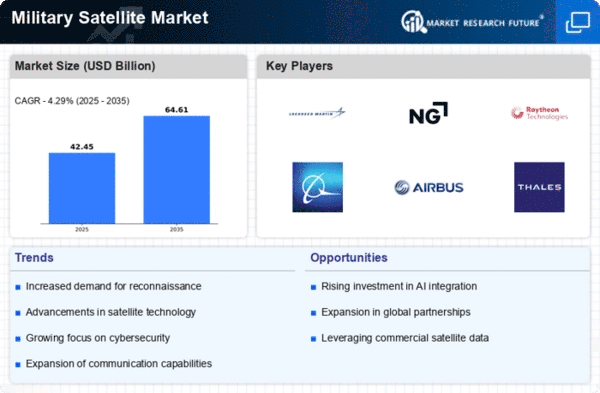

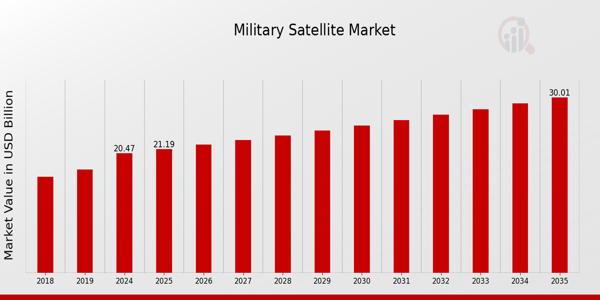

2024 年军用卫星市场规模为 406.9 亿美元。军用卫星市场行业预计将从 2025 年的 424.4 亿美元增长到 2034 年的 619.6 亿美元,在预测期内(2025 - 2034 年)复合年增长率 (CAGR) 为 4.3%。对可靠监控的需求不断增长、卫星制造中铝的使用增加以及日益增长的安全担忧是促进市场增长的关键市场驱动力。

来源二次研究、主要研究、MRFR 数据库和分析师评论

军事卫星市场趋势

- 安全问题日益严重,需要可靠的监控来推动市场增长

对恐怖主义、国际战争和政治动荡的担忧日益加剧,推动了军事卫星市场的复合年增长率。由于日益增长的安全问题,世界各地的国防军必须实施战术通信系统。军队可以通过战术通信系统访问安全通信平台。许多防御任务都得到这些卫星提供的实时情报数据、导航和通信的帮助。

此外,人工智能 (Al) 的融入给航天领域带来了重大变化。人工智能用于对新开发的军用侦察卫星捕获的图像进行分析和分类。此外,人工智能自动学习系统和智能地面站改进了CubeSat星座控制。

此外,基于物联网的设备和服务的互联性是基于物联网的设备和服务的互联性所必需的,这对于优化航空领域的各种运营至关重要。 IoT 设备和组件之间的实时数据共享需要卫星连接。因此,卫星通信将在物联网服务和航空业中发挥重要作用,推动预测期内的市场增长。

例如,2019 年 11 月,美国国防部 (DoD) 与通用动力公司签署了价值 7.318 亿美元的合同,用于维护下一代军事卫星通信系统移动用户目标系统 (MUOS)。从而带动军用卫星市场收入。

军事卫星市场细分洞察

- 军事卫星轨道类型见解

图 1:按轨道类型划分的军用卫星市场,2025 年和 2025 年2035 年(十亿美元)

来源二次研究、主要研究、MRFR 数据库和分析师评论

- 军事卫星有效载荷类型见解

军用卫星市场分为有效载荷类型,包括通信有效载荷、导航有效载荷、成像有效载荷等。印度区域导航卫星系统(IRNSS)正在携带卫星导航有效载荷。 IRNSS 计划混合使用 GEO 和 GSO(地球同步轨道)航天器来建立区域导航系统。 IRNSS系统预计将在印度上空以及印度以外约1500公里的区域提供超过20米的定位精度。 IRNSS 技术现在被称为“NAVIC”,代表使用印度星座导航。下面列出了 IRNSS 航天器的导航有效载荷。此外,该市场拥有相当大的市场份额。

- 军事卫星类型见解

军用卫星市场按卫星类型划分包括小型卫星、中型卫星和重型卫星。小型卫星占有相当大的市场份额;此外,小型卫星的质量和尺寸适中,通常小于 1,200 公斤(2,600 磅)。虽然所有此类卫星都被归类为“小型”卫星,但根据质量采用了多种分类。可以制造适度尺寸的卫星,以降低运载火箭的高昂经济成本和建造成本。

- 军事卫星系统见解

基于系统的军用卫星市场细分包括电光/红外、传感器(EO/IS)、雷达、卫星通信。卫星通信类别主要用于天气监测、军事监视、导航和电信应用。此外,卫星通信公司在市场上占有重要份额。在战斗中,该设备会收集实时数据来定位隐藏的隧道、跟踪运动并整合目标等。对高吞吐量卫星服务的需求不断增长,以及地面移动平台中基于云的服务的激增,将支持卫星通信市场在预测期内的增长。

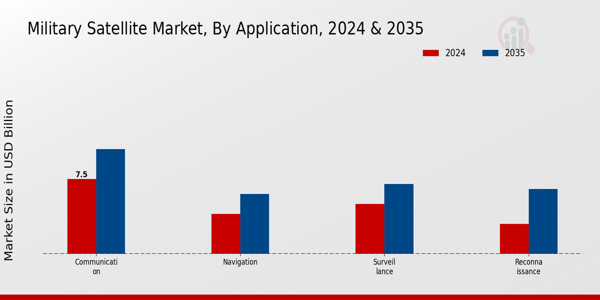

- 军事卫星应用洞察

ISR、通信和导航是军用卫星市场基于应用的细分的一部分。最大的市场份额属于通信领域。这是因为战场上最先进的通信系统已经开发出来。军事通信卫星在战术通信系统、战术数据链、当代以网络为中心的作战部队能力和先进卫星通信的开发中具有重要用途。

- 军事卫星区域洞察

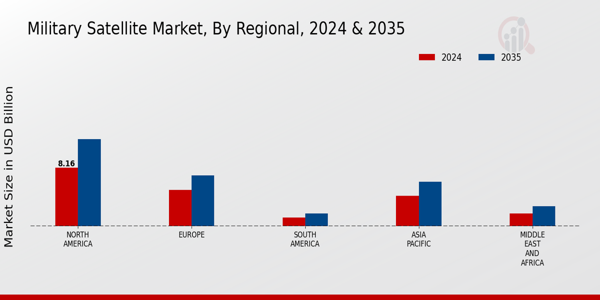

按地区划分,该研究提供了北美、欧洲、亚太地区和世界其他地区的市场洞察。亚太地区在收入份额方面占据市场主导地位,占总收入的40.0%以上。由于对卫星通信服务的需求不断增长,该地区可能在预测期内保持其主导地位。 此外,波音和空客等公司增加的投资预计将促进该地区的增长。

此外,市场报告研究的主要国家包括美国、加拿大、德国、法国、英国、意大利、西班牙、中国、日本、印度、澳大利亚、韩国和巴西。

图 2:2025 年按地区划分的军用卫星市场份额 (%)

来源二次研究、主要研究、MRFR 数据库和分析师评论

由于航天机构投资不断增加,欧洲军用卫星市场占据第二大市场份额。其中,德国军用卫星市场占有最大市场份额,英国军用卫星市场是欧洲地区增长最快的市场。

预计从 2024 年到 2032 年,北美军事卫星市场将以最快的复合年增长率增长。这是由于阿富汗和伊拉克等国家的军费开支增加。此外,中国军用卫星市场占有最大市场份额,印度军用卫星市场是北美地区增长最快的市场。

军事卫星主要市场参与者和市场参与者竞争洞察

领先的市场参与者正在大力投资研发以扩大其产品线,这将有助于军用卫星市场进一步增长。市场参与者还开展各种战略活动来扩大其足迹,重要的市场发展包括新产品发布、合同协议、并购、更高的投资以及与其他组织的合作。为了在竞争更加激烈和不断发展的市场环境中扩张和生存,军用卫星行业必须提供具有成本效益的产品。

本地制造以最大限度地降低运营成本是军用卫星行业制造商为使客户受益并扩大市场份额而采用的关键业务策略之一。近年来,军事卫星工业为医学提供了一些最显着的优势。军用卫星市场的主要参与者,包括波音公司(美国)、SpaceX(美国)、洛克希德·马丁公司(美国)、通用电气航空集团(美国)、雷神公司(美国)等,都试图通过投资研发业务来增加市场需求。

韩华集团是韩国大型商业集团。 该公司成立于 1952 年,当时名为韩国炸药公司 (Korea Explosives Co.),现已发展成为一家多元化的大型商业集团,业务涵盖核心业务炸药、能源、材料、航空航天、机电一体化、金融、零售和生活服务。 1992 年,该公司将其缩写更名为“Hanwha”。 2021 年 9 月,韩华系统公司和 LIG Nex1 宣布,他们已从韩国国防采办计划管理局 (DAPA) 获得价值 3.07 亿美元的合同,该合同与韩国首颗专用军事通信卫星 ANASIS-II 相关。

CERES 是一个法国天基电子监视网络,旨在收集地球上任何地方的电磁情报。它由空中客车防务航天公司和泰雷兹阿莱尼亚航天公司为法国国防采购局(DGA)设计,由三颗编队飞行卫星组成。它是法国收集电磁情报的战略工具。 CNES 创建并推出了 ELISA 和 Essaim,以努力掌握这项技术。这些示威者建立了一个名为 CERES 的功能性计划。 2021年11月,法国宣布发射三颗谷神星卫星(军用电磁监测卫星),以提高其太空监视能力。为了寻找敌方雷达、防空防御炮台或通信中心,卫星以三角形模式运行。

军用卫星市场的主要公司包括

- Viasat Inc.(美国)。

- AeroVironment(美国)

- 泰雷兹集团(法国)

- 波音公司(美国)

- SpaceX(美国)

- 洛克希德·马丁公司(美国)

- GE 航空/(美国)

- 雷神公司(美国)

- 诺斯罗普·格鲁曼公司(美国)

军事卫星产业发展

2022 年 2 月,

2021 年 10 月,法国宣布已成功将一颗最先进的卫星送入轨道,据该国称,该卫星旨在让法国所有武装部队跨越全球进行快速、安全的沟通。该卫星旨在抵御军事侵略以及地面和太空干扰。

2021年11月,据中国航天科技集团公司消息,中国利用长征二号丙运载火箭发射了两颗遥感32级军用卫星,用于遥感应用。

军事卫星市场细分

军用卫星市场轨道类型展望

- 近地轨道

- 中地球轨道地球同步轨道

军事卫星市场有效载荷类型展望

- 通信负载

- 导航有效负载

- 成像负载

- 其他

军用卫星市场卫星类型展望

- 小卫星

- 中重型卫星

军用卫星市场系统展望

- 光电/红外传感器 (EO/IS)

- 雷达

- 卫星通信

军用卫星市场应用展望

- ISR

- 沟通

- 导航

军事卫星区域展望

- 北美

- 美国

- 加拿大

- 欧洲

- 德国

- 法国

- 英国

- 意大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 澳大利亚

- 韩国

- 澳大利亚

- 亚太地区其他地区

- 世界其他地区

- 中东

- 非洲

- 拉丁美洲

FAQs

What was at a the projected Market Was at a the Military Satellite Market in 2024?

The Military Satellite Market Size Value was 40.70 Billion USD by 2024

Research Approach

Research Methodology on Military Satellite Market

Introduction

The global military satellite market is projected to register a steady CAGR during the forecast period (2023-2030). The global military satellite market is expected to witness significant growth attracted by factors such as the increasing focus of various governments in providing integrated solutions for defence and security, rising demand for real-time data from diverse geographic locations, and the increasing demand for communication and surveillance satellites. The market in the Americas is likely to dominate the military satellite market in terms of revenue, owing to the significant investments made by the Defence Advanced Research Projects Agency (DARPA) and the US Air Force.

Research Methodology

This research aims to provide a detailed analysis of the military satellite market and forecast its development in the coming years. This research is based on a unique methodology that includes both qualitative and quantitative analysis of the current and expected industry trends.

The first step of this research study includes collecting data from primary and secondary sources such as industry journals, market reports, trade journals, and other related information sources. market data from open sources such as trade journals, industry surveys and workshops, press releases and company websites were used as the primary source. Secondary sources included press releases and company product brochures.

The data collected is then analyzed and consolidated for inclusion in the study. Quantitative data is collected from industry surveys and usage statistics, while qualitative data is gathered from interviews, industry experts and market surveys. The results from these surveys and interviews are then validated to form an accurate representation of the market trends.

The analysis of the primary and secondary data collected includes the current and expected market size (in terms of revenue and volume) of the global military satellite market, the growth rate trends, the regional market breakdowns, competitor analysis, the emerging application areas, the technological advancements, product features and the research and development activities of leading players in the industry.

Furthermore, the market attractiveness assessment of each segment is conducted based on the current market dynamics. All these data points have been consolidated to form a comprehensive market analysis. To supplement this study further, a SWOT analysis has been conducted.

For the analysis of the global military satellite market, detailed market segmentation has been developed. The global market is divided into four regions, namely, North America, Europe, Asia-Pacific and Rest of the World (RoW). According to this segmentation, several sub-segments have been identified based on the various application areas, technologies, and products.

The data points collected were then used to calculate the market size (in terms of value and volume) of the global military satellite market. The market size has been calculated based on the number of end-users in each industry. Furthermore, consideration was also given to the geographic spread and application areas of the market.

The segmental data was then re-validated using the triangulation method with the help of industry experts. The market sizing and segmentation data were further used to calculate the CAGR and the expected growth of the military satellite market during the forecast period 2023 to 2030.

The gathered data was further used to calculate the share of each segment in the global military satellite market. The market share analysis was conducted based on the total number of end-users and their geographical spread. Furthermore, the competitive landscape was evaluated by studying the strategies being adopted by the key players, their market presence and technological offerings.

Finally, this study assesses the macroeconomic factors that are likely to have an impact on the global military satellite market. The factors analyzed include interest rates, inflation, corruption, and economic reforms. The global military satellite market is assessed based on the trends in the overall military satellite landscape and the expected change in the economic landscape and its impacts during the forecast period.

Conclusion

This research has provided an in-depth analysis and an estimated size of the military satellite market. The increasing demand for real-time data from far-flung areas, the ambitions of global governments to provide an array of integrated solutions for defence and security, and the demand for communication and surveillance satellites are some of the factors driving the global military satellite market. The report also provides an analysis of the competitive landscape of the industry and the key strategies being adopted by the leading players.

请填写以下表格以获取本报告的免费样本

Customer Stories

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”