洗车系统市场概览:

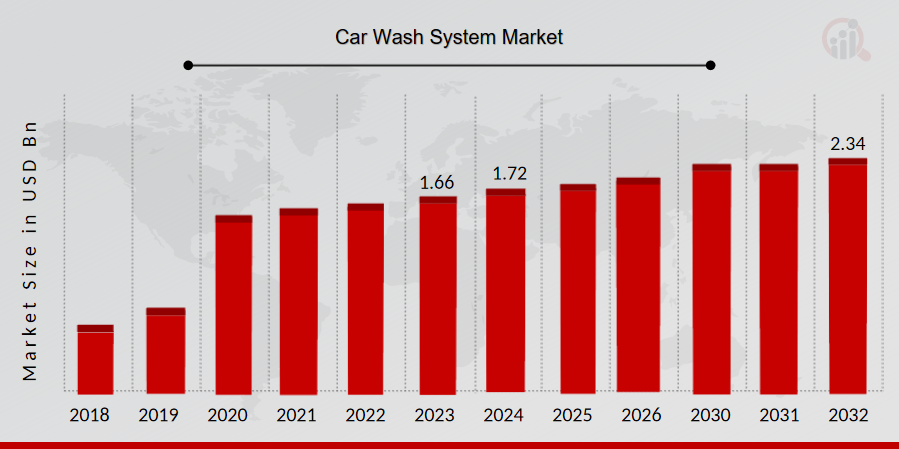

p2023 年洗车系统市场规模价值 16.6 亿美元。洗车系统市场行业预计将从 2024 年的 17.2 亿美元增长到 2032 年的 23.4 亿美元,预测期内(2024 - 2032 年)的复合年增长率 (CAGR) 为 3.87%。人们对专业和自动化洗车系统的偏好日益增长,以及由于其多种优势而对洗车服务的需求不断增长,是推动市场增长的关键市场驱动力。

来源:二手资料研究、一手资料研究、MRFR 数据库和分析师评论

洗车系统市场趋势

ul-

人们对专业洗车服务的偏好日益增长,推动了市场的增长。

洗车技术的进步,例如先进的水循环系统、非接触式混合洗车技术以及经济创新,也是预计将推动市场增长的原因。由于车漆表面娇嫩,非接触式洗车系统在外部洗车系统中越来越受消费者的青睐。它提供高效的清洁以及快速且经济实惠的洗车服务,预计在未来一段时间内将使市场需求最大化。由于购买力的提高,许多车主要求维护和维修服务快捷方便。与传统洗车相比,他们选择自动化洗车系统,从而增加了“替我洗车”的趋势。此外,随着环保意识的不断增强,客户也开始选择能够提供可持续解决方案的供应商。

对高效洗车用水方法的需求促使创新者们设计出一种耗水量更少的洗车系统。传统的免下车洗车方法会造成大量的水资源浪费,并将有害废水直接排放到环境中。另一方面,由于自动化洗车涉及预先定义的清洁程序和固定费用,其利润和可持续性几乎是自助洗车系统的十六倍。因此,自动化洗车推动了洗车系统市场的收入增长。

洗车系统市场细分洞察:

h3洗车系统类型洞察 p洗车系统市场细分基于类型,包括隧道式、翻滚式/车内式和自助式。滚洗/车内洗车细分市场占据了市场主导地位,占据了最大的市场收入,因为与隧道式洗车相比,滚洗/车内洗车的运行成本更低,因为滚洗/车内洗车每辆车仅消耗 10-50 加仑水,而隧道式洗车则消耗 14-60 加仑水。这一细分市场利润最高,因为它可以为客户节省金钱和时间。非接触式洗车利用高压水,配备车内自动系统来清洁车辆并提供摩擦力,并使用软布刷将清洁剂涂抹并清洁,并在洗掉车辆之前对其进行上光。洗车系统支付方式洞察

p根据支付方式,洗车系统市场细分包括现金支付和非现金支付。非现金支付细分市场占据市场主导地位,因为千禧一代希望以对他们来说最方便的方式付款,例如借记卡、代币、会员卡、智能手机支付和支持 EMV 的信用卡支付。在整个付费站安装集成支付解决方案或销售点系统有助于洗车企业提高效率、增加销售额并深入了解客户。图 1:2024 年和 2032 年按支付方式划分的洗车系统市场(十亿美元)

p来源:二手资料研究、一手资料研究、MRFR 数据库和分析师评论

洗车系统区域洞察

p按地区划分,该研究提供了对北美、欧洲、亚太地区和世界其他地区的市场洞察。北美洗车系统市场占据主导地位,这得益于消费者在舒适休闲方面的支出不断增长,以及专业洗车服务的广泛使用。此外,该地区消费者对车辆及时保养的意识不断增强,汽车行业也蓬勃发展。美国是北美地区洗车服务市场增长的最大贡献者。此外,市场报告研究的主要国家包括美国、加拿大、德国、法国、英国、意大利、西班牙、日本、印度、中国、澳大利亚、韩国和巴西。

图 2:2022 年各地区洗车系统市场份额(十亿美元)

p来源:二手研究、一手研究、MRFR 数据库和分析师评论

欧洲洗车系统市场占据第二大市场收入,这得益于对专业洗车服务广泛使用的需求以及该地区车主数量的增加地区。此外,德国洗车系统市场占有最大的市场份额,英国洗车系统市场是欧洲地区增长最快的市场。

预计亚太地区洗车系统市场将在 2023 年至 2032 年期间实现快速复合年增长率。这得益于汽车行业的增长以及该地区个人可支配收入的增长。此外,中国洗车系统市场占有最大的市场份额,印度洗车系统市场是亚太地区增长最快的市场。

洗车系统主要市场参与者和竞争洞察

p领先的市场参与者正在大力投资研发,以扩大其产品线,这将有助于洗车系统市场进一步增长。市场参与者也在开展各种战略活动以扩大其影响力,重要的市场发展包括新产品发布、合同协议、并购、增加投资以及与其他组织的合作。为了在竞争日益激烈、蓬勃发展的市场环境中扩张和生存,洗车系统行业必须提供具有成本效益的产品。本地化生产以最大限度地降低运营成本是洗车系统行业制造商为客户带来利益并扩大市场份额的关键商业策略之一。近年来,洗车系统行业为洗车行业带来了一些最重要的优势。洗车系统市场的主要参与者,包括 Mister Car Wash Holdings Inc.、Wilcomatic、Splash Car Wash、International Car Wash Group、Wash Depot Holdings Inc.、Magic Hands Car Wash、True Blue Car Wash LLC、Autobell Car Wash、Super Star Car Wash、Hoffman Car Wash 等,正试图通过投资研发业务来增加市场需求。

Mister Car Wash Holdings Inc. 成立于 1969 年,是北美最大的洗车公司,在全球拥有 425 多个门店。该公司提供快速的内部和外部清洁服务。该公司提供洗车服务和一系列相关产品,包括 N1 Protectant、HotShine、Tire Shine、Repel Shield 和 Wheel Polish。该公司还提供无限制洗车俱乐部、客户忠诚度计划和 Mister Express 润滑油,提供换油和预防性维护服务。2022 年 6 月,该公司宣布在佛罗里达州奥维耶多开设新店。这家新店提供白金套餐,提供公司的招牌产品,包括Repel Shield和铂金密封剂以及瀑布式Hotshine巴西棕榈蜡。新店配备公司专有的清洁系统,提供先进的隧道式体验。

Wilcomatic是一家在英国和印度均有运营的成熟企业。该公司的业务涉及多个市场,包括卡车和巴士清洗、轿车清洗、轨道清洗以及商用和军用车辆的重型工业清洗和维护。该公司提供一系列洗车设备,例如便携式或静态高压清洗机、卡车清洗机和免下车清洗机。该公司还为洗车运营商、汽车制造商、前院业主、流浪汉、火车和商业运营提供设备。2019年,该公司被Westbridge Capital收购,以支持其发展。该公司为众多行业提供更广泛的服务,在全球范围内拥有超过 2,000 个洗车设施。

洗车系统市场的主要公司包括

ul- Mister Car Wash Holdings Inc.

- Splash Car Wash

- International Car Wash Group

- Wash Depot Holdings Inc.

- Magic Hands Car Wash

- True Blue Car Wash LLC

- Autobell Car Wash

- 霍夫曼洗车店

2019 年 2 月:

洗车系统市场细分:

洗车系统类型展望

- 隧道式洗车

- 翻车式/车内式洗车

- 自助式洗车

洗车系统支付方式展望

- 现金支付

- 非现金支付

洗车系统区域展望

- 北美

- 美国

- 加拿大

- 欧洲

- 德国

- 法国

- 英国

- 意大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 澳大利亚

- 韩国

- 澳大利亚

- 其余部分亚太地区

- 世界其他地区

- 中东

- 非洲

- 拉丁美洲

FAQs

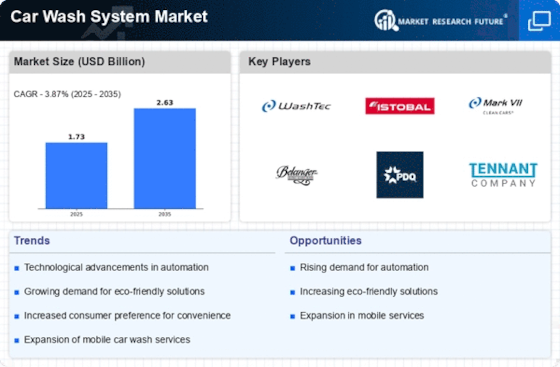

What is the current valuation of the Car Wash System Market?

As of 2024, the Car Wash System Market was valued at 1.73 USD Billion.

What is the projected market valuation for the Car Wash System Market in 2035?

The market is projected to reach a valuation of 2.627 USD Billion by 2035.

What is the expected CAGR for the Car Wash System Market during the forecast period 2025 - 2035?

The expected CAGR for the Car Wash System Market during 2025 - 2035 is 3.87%.

Which segments are included in the Car Wash System Market?

The market segments include Tunnels, Roll-Over/In-Bay, and Self-Service car wash systems.

What were the valuations for the Tunnels segment in 2024?

In 2024, the Tunnels segment was valued at 0.69 USD Billion.

How does the Roll-Over/In-Bay segment perform in terms of valuation?

The Roll-Over/In-Bay segment had a valuation of 0.52 USD Billion in 2024.

Research Approach

Secondary Research

The secondary research process involved comprehensive analysis of regulatory databases, industry standards repositories, trade publications, and authoritative automotive infrastructure organizations. Key sources included the International Carwash Association (ICA), European Committee for Standardization (CEN), SAE International, International Organization for Standardization (ISO) technical committees for vehicle cleaning systems, US Environmental Protection Agency (EPA) water discharge and recycling regulations, Occupational Safety and Health Administration (OSHA) workplace safety standards for automated equipment, US Department of Transportation (DOT) commercial vehicle maintenance guidelines, European Environment Agency (EEA) water stewardship databases, US Census Bureau County Business Patterns for car wash facility counts, Eurostat structural business statistics, OECD transport infrastructure data, Statista automotive aftermarket databases, International Council on Clean Transportation (ICCT) commercial fleet maintenance reports, National Carwash Solutions (NCS) industry whitepapers, WashTec AG, Daifuku Co., Ltd., and Otto Christ AG annual filings. These sources were used to collect installation statistics, water reclamation compliance data, equipment shipment volumes, regulatory certification timelines, and competitive landscape analysis for tunnel systems, in-bay automatics, self-service equipment, and water recycling technologies.

Primary Research

Qualitative and quantitative insights were obtained by interviewing supply-side and demand-side stakeholders during the primary research process. The supply-side sources consisted of CEOs, VPs of Manufacturing, chief technology officers, and directors of commercial operations from car wash equipment OEMs, conveyor system manufacturers, water reclamation technology providers, and chemical dosing system suppliers. Fleet maintenance directors from logistics and rental car companies, procurement leads from automotive dealership service centers, owner-operators of multi-site car wash chains, facility managers from petroleum convenience stores with integrated car wash operations, and municipal transportation department officials overseeing public vehicle maintenance facilities were the demand-side sources. Primary research verified market segmentation across automatic, self-service, and mobile platforms, confirmed product development roadmaps for touchless and hybrid brush systems, and collected insights on the adoption of water conservation technology, pricing dynamics for installation versus aftermarket service contracts, and the equipment requirements of subscription-based wash models.

Primary Respondent Breakdown:

By Company Tier: Tier 1 (38%), Tier 2 (32%), Tier 3 (30%)

By Designation: C-level Primaries (40%), Director Level (30%), Others (30%)

By Region: North America (32%), Europe (30%), Asia-Pacific (28%), Rest of World (10%)

[Note: Tier 1 = >USD 500M revenue; Tier 2 = USD 100M-500M; Tier 3 =

Market Size Estimation

Global market valuation was derived through revenue mapping and equipment installation volume analysis. The methodology included:

Identification of 50+ key manufacturers across North America, Europe, Asia-Pacific, and Latin America specializing in tunnel conveyor systems, roll-over/in-bay equipment, self-service bay components, and water recycling systems

Product mapping across touchless technology, cloth friction systems, hybrid wash systems, high-pressure components, drying systems, and water reclamation equipment categories

Analysis of reported and modeled annual revenues specific to car wash equipment portfolios, including direct equipment sales, installation services, and recurring chemical/consumables revenue streams

Coverage of manufacturers representing 75-80% of global market share in 2024, including regional leaders such as WashTec AG (Germany), Daifuku (Japan), Otto Christ (Germany), Istobal (Spain), Sonny's Enterprises (US), and PDQ Manufacturing (US)

Extrapolation using bottom-up (installation volume × Average Selling Price by country/region, factoring for self-service vs. tunnel system ASP variations) and top-down (manufacturer revenue validation against ICA industry shipment data) approaches to derive segment-specific valuations for OEM versus aftermarket channels

Data triangulation was implemented through cross-referencing supply-side production data with demand-side facility census figures from the US Census Bureau and national car wash operator associations to ensure accuracy within 3-5% variance thresholds.

Reference

请填写以下表格以获取本报告的免费样本

Customer Stories

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”