North America : Market Leader in ZLD Services

North America is poised to maintain its leadership in the Zero Liquid Discharge (ZLD) water treatment services market, holding a significant market share of $3.25 B in 2024. The region's growth is driven by stringent environmental regulations, increasing industrial water usage, and a rising demand for sustainable water management solutions. Government initiatives aimed at reducing water pollution and promoting recycling further catalyze market expansion.

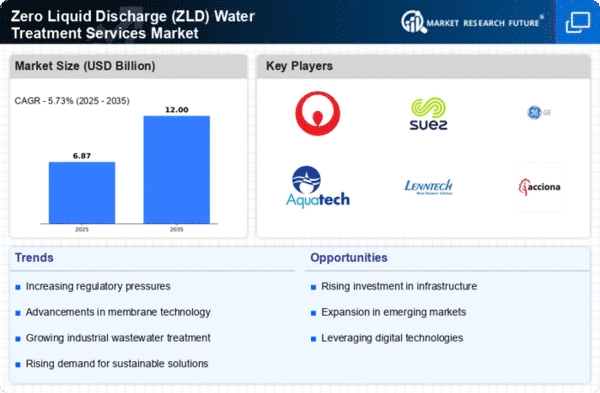

The United States and Canada are the leading countries in this sector, with major players like Veolia, SUEZ, and GE Water & Process Technologies establishing a strong presence. The competitive landscape is characterized by innovation and technological advancements, as companies invest in R&D to enhance ZLD systems. The focus on industrial applications, particularly in sectors like oil & gas and pharmaceuticals, is expected to drive further growth in the coming years.

Europe : Emerging Regulatory Frameworks

Europe is witnessing a growing emphasis on Zero Liquid Discharge (ZLD) water treatment services, with a market size of $1.8 B projected for 2025. The region's growth is fueled by stringent EU regulations aimed at water conservation and pollution reduction. Initiatives such as the European Green Deal are driving industries to adopt sustainable practices, thereby increasing the demand for ZLD technologies across various sectors.

Leading countries in Europe include Germany, France, and the Netherlands, where companies like Lenntech and Acciona are making significant strides. The competitive landscape is marked by collaborations between technology providers and industrial players to develop innovative ZLD solutions. As industries seek to comply with environmental standards, the market is expected to expand, supported by a robust regulatory framework that encourages investment in sustainable water management.

Asia-Pacific : Rapid Industrialization and Growth

Asia-Pacific is emerging as a significant player in the Zero Liquid Discharge (ZLD) water treatment services market, with a projected size of $1.7 B by 2025. The region's rapid industrialization, coupled with increasing water scarcity, is driving the demand for efficient water management solutions. Governments are implementing policies to promote ZLD technologies, particularly in water-intensive industries such as textiles and chemicals, which are crucial for sustainable development.

Countries like China, India, and Japan are at the forefront of this growth, with key players such as Doosan Heavy Industries and Xylem actively participating in the market. The competitive landscape is evolving, with a focus on technological innovation and partnerships to enhance ZLD systems. As awareness of environmental issues grows, the region is expected to see a surge in ZLD adoption, supported by both government initiatives and private sector investments.

Middle East and Africa : Resource-Rich Yet Challenged

The Middle East and Africa region is gradually recognizing the importance of Zero Liquid Discharge (ZLD) water treatment services, with a market size of $0.75 B anticipated by 2025. The region faces significant water scarcity challenges, prompting governments to explore sustainable solutions. Regulatory frameworks are beginning to emerge, encouraging industries to adopt ZLD technologies to mitigate environmental impacts and conserve water resources.

Leading countries in this region include the UAE and South Africa, where companies like IDE Technologies are making headway in ZLD implementation. The competitive landscape is characterized by a mix of local and international players, focusing on innovative solutions tailored to the region's unique challenges. As awareness of water management issues increases, the ZLD market is expected to grow, driven by both regulatory support and the need for sustainable practices.