Surge in Surgical Procedures

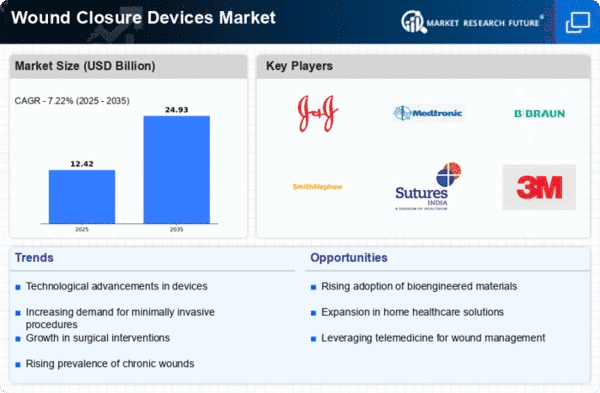

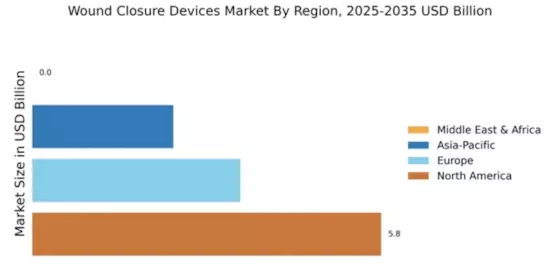

The surge in surgical procedures worldwide is a critical driver of the Global Wound Closure Devices Market Industry. As surgical techniques advance and become more widespread, the need for reliable wound closure solutions becomes paramount. This trend is particularly evident in regions with expanding healthcare services, where the number of surgeries continues to rise. The anticipated growth in the market, reaching 8 USD Billion by 2035, reflects the increasing reliance on advanced wound closure devices in surgical settings. Additionally, the focus on minimizing postoperative complications and enhancing recovery times further underscores the importance of effective wound closure technologies in modern healthcare.

Increasing Healthcare Expenditure

The Global Wound Closure Devices Market Industry benefits from increasing healthcare expenditure across various regions. Governments and private sectors are investing heavily in healthcare infrastructure, which includes advanced wound care solutions. This trend is particularly evident in developing countries, where rising disposable incomes and improved access to healthcare services are driving demand for effective wound closure devices. The anticipated compound annual growth rate (CAGR) of 3.66% from 2025 to 2035 suggests a sustained investment in healthcare technologies. As healthcare systems evolve, the focus on patient-centered care and innovative wound management solutions will likely propel market growth, ensuring better health outcomes for patients.

Rising Incidence of Chronic Wounds

The Global Wound Closure Devices Market Industry experiences a notable increase in demand due to the rising incidence of chronic wounds, such as diabetic ulcers and pressure sores. As the global population ages, the prevalence of these conditions escalates, necessitating effective wound management solutions. In 2024, the market is projected to reach 5.39 USD Billion, reflecting the urgent need for advanced closure devices. Healthcare providers are increasingly adopting innovative technologies to enhance healing rates and improve patient outcomes. This trend is likely to continue, as the World Health Organization indicates that chronic wounds affect millions globally, further driving the market's growth.

Growing Awareness of Advanced Wound Care

Growing awareness of advanced wound care among healthcare professionals and patients significantly influences the Global Wound Closure Devices Market Industry. Educational initiatives and training programs are increasingly emphasizing the importance of effective wound management strategies. This heightened awareness leads to the adoption of advanced closure devices, which are essential for optimal healing. As healthcare providers recognize the benefits of using modern wound closure technologies, the demand for these products is expected to rise. The market's growth is further supported by the increasing prevalence of surgical procedures, which necessitate effective wound closure solutions to minimize complications and enhance recovery.

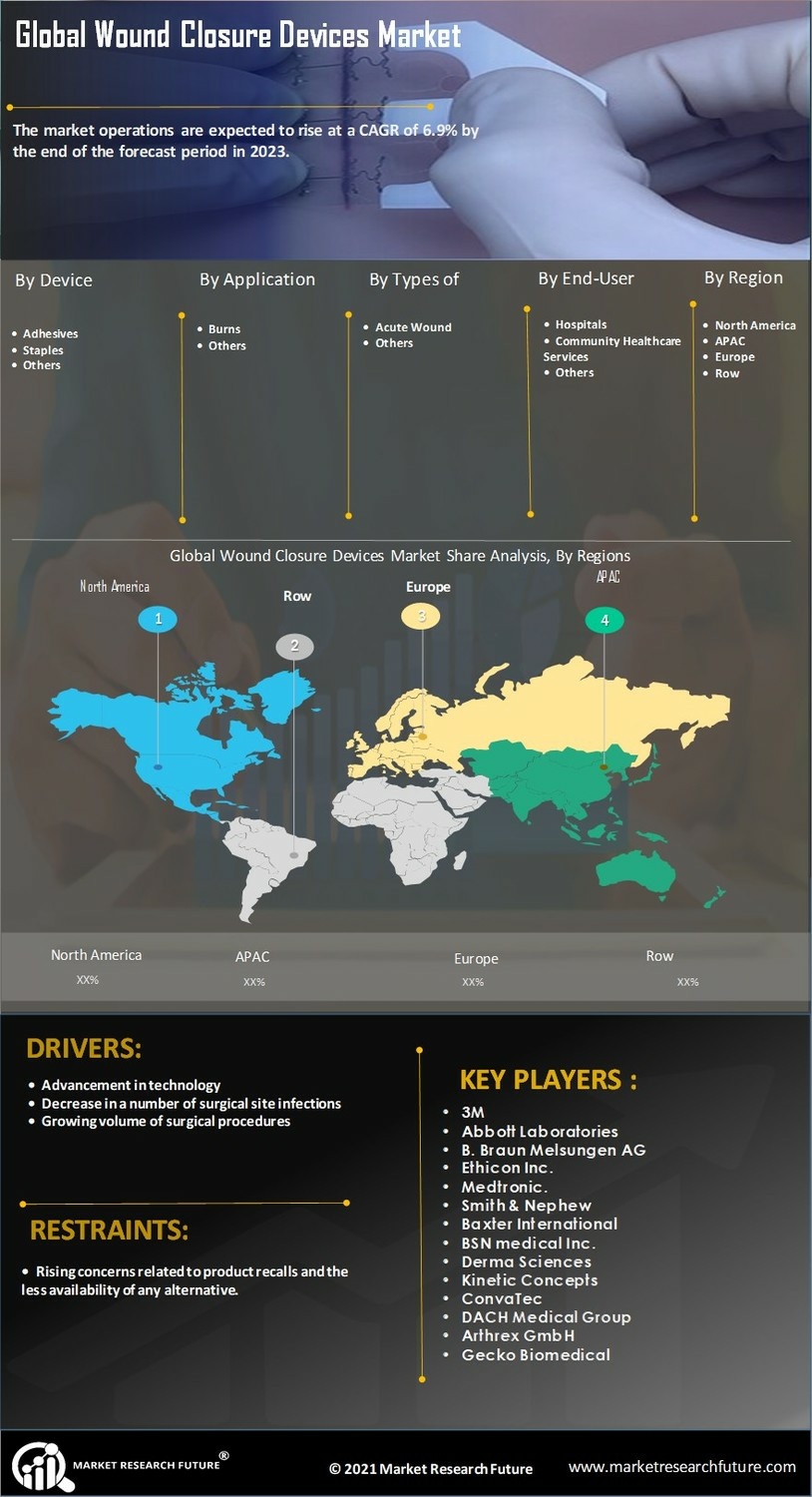

Technological Advancements in Wound Closure

Technological advancements play a pivotal role in shaping the Global Wound Closure Devices Market Industry. Innovations such as bioengineered skin substitutes, advanced suturing techniques, and adhesive technologies are revolutionizing wound management. These advancements not only enhance the efficiency of wound closure but also improve patient comfort and reduce recovery times. As healthcare facilities increasingly adopt these technologies, the market is expected to grow significantly. The projected market value of 8 USD Billion by 2035 underscores the impact of these innovations. Furthermore, the integration of smart technologies in wound care devices may further streamline the healing process, indicating a promising future for the industry.