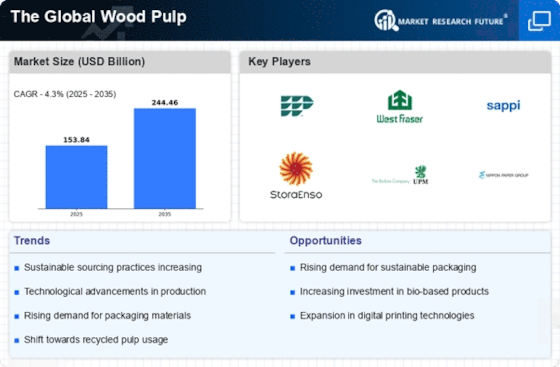

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the wood pulp market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, wood pulpindustry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the wood pulp industry to benefit clients and increase the market sector. In recent years, the wood pulp industry has offered some of the most significant advantages to medicine. Major players in the wood pulp market, including Oji Holdings Corporation, Nippon Paper, Sappi, International Paper., WestRock, .Metsä Group, Sonoco Products, Stora Enso., UPM-Kymmene Corporation., Svenska Cellulosa Aktiebolaget., and others, are attempting to increase market demand by investing in research and development operations.

Kimberly-Clark is a well-established company with a history dating back to the late 19th century. Headquartered in Dallas, Texas, the company has become a global leader in the production of various paper-based products. Kimberly-Clark's focus areas include personal care, consumer tissue, and professional products. The company's renowned brands include Kleenex, Scott, Huggies, Kotex, and many others, making it a household name worldwide.

In March Kimberly-Clark invested USD 120 million in Oklahoma Paper Mill to enhance the production of folded tissues and bath tissues.

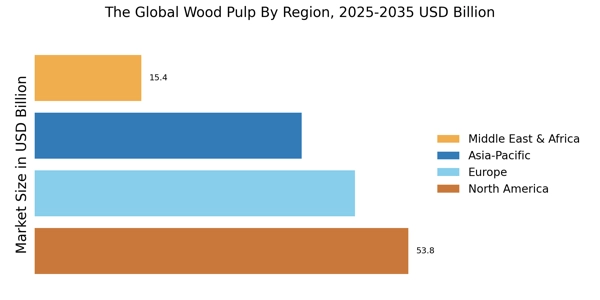

The business expects to achieve a strong market position in North America as a result of this growth.

Georgia-Pacific, headquartered in Atlanta, Georgia, is one of the world's leading manufacturers and distributors of tissue, pulp, paper, packaging, building products, and related chemicals. The company has a long history, dating back to its founding in 1927, and it has evolved into a prominent player in the forest products industry. Georgia-Pacific is a significant producer of pulp and paper products, including containerboard, corrugated packaging, office papers, and specialty papers. The company manufactures a variety of building materials, such as lumber, plywood, gypsum, and engineered wood products used in construction.

In April 2019, Georgia-Pacific Corporation began a USD 120 million investment at the Naheola Mill to streamline their bath tissue product assortment. In addition, the firm has invested in new production equipment and storage facilities.