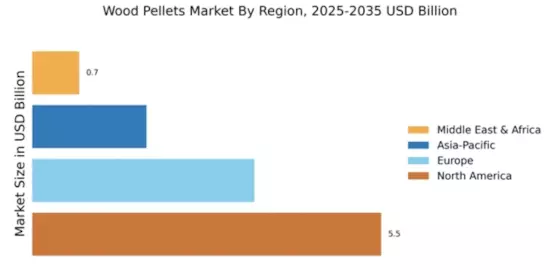

North America : Market Leader in Wood Pellets

North America continues to lead the wood pellets market, holding a significant share of 5.5 million tons in 2025. The region's growth is driven by increasing demand for renewable energy sources, stringent regulations promoting sustainability, and a robust infrastructure for production and distribution. The U.S. government has implemented various incentives to boost biomass energy, further catalyzing market expansion. Key players such as Enviva Holdings and Pinnacle Renewable Energy dominate the landscape, supported by a network of suppliers and distributors. The U.S. and Canada are the leading countries, with a strong focus on exporting wood pellets to Europe and Asia. The competitive environment is characterized by innovation in production technologies and a commitment to sustainable practices, ensuring a steady growth trajectory for the market.

Europe : Sustainable Energy Transition

Europe's wood pellets market is projected to reach 3.5 million tons by 2025, driven by the EU's commitment to reducing carbon emissions and transitioning to renewable energy sources. Regulatory frameworks, such as the Renewable Energy Directive, are pivotal in promoting biomass as a sustainable alternative. The increasing adoption of wood pellets in residential heating and industrial applications is further fueling market growth. Leading countries like Germany, Sweden, and Austria are at the forefront, with significant investments in biomass technology. Key players, including Drax Group and Austrian Bioenergy, are enhancing their production capabilities to meet rising demand. The competitive landscape is marked by a focus on sustainability and innovation, positioning Europe as a leader in The Wood Pellets.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific wood pellets market is estimated at 1.8 million tons in 2025, reflecting a growing interest in biomass energy solutions. Countries in this region are increasingly recognizing the importance of renewable energy to meet their energy needs and reduce reliance on fossil fuels. Government initiatives and incentives are encouraging the adoption of wood pellets for both residential and industrial applications, contributing to market growth. Leading countries such as Japan and South Korea are investing in biomass technologies, with a focus on sustainable sourcing and production. The competitive landscape includes key players like Pinnacle Renewable Energy, which are expanding their reach in the region. As awareness of environmental issues rises, the demand for wood pellets is expected to increase, positioning Asia-Pacific as a significant player in the global market.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa wood pellets market is currently valued at 0.74 million tons in 2025, representing an emerging opportunity for biomass energy solutions. The region is beginning to explore renewable energy sources to diversify its energy portfolio and reduce carbon emissions. Government policies are gradually shifting towards sustainability, creating a favorable environment for wood pellet adoption. Countries like South Africa and Kenya are leading the way in exploring biomass as a viable energy source. The competitive landscape is still developing, with local and international players looking to establish a foothold. As awareness of renewable energy benefits grows, the market for wood pellets is expected to expand, driven by both domestic and export opportunities.