Focus on Enhanced Recovery Techniques

The Wireline Logging Services Market is witnessing a growing focus on enhanced oil recovery (EOR) techniques. As conventional oil reserves decline, operators are increasingly turning to EOR methods to maximize extraction from existing fields. Wireline logging services play a crucial role in this process by providing detailed information on reservoir characteristics and fluid behavior. The integration of logging data with EOR strategies allows for more effective planning and execution of recovery operations. This trend is likely to drive the demand for wireline logging services, as companies seek to optimize their production capabilities and extend the life of mature fields.

Increasing Demand for Energy Resources

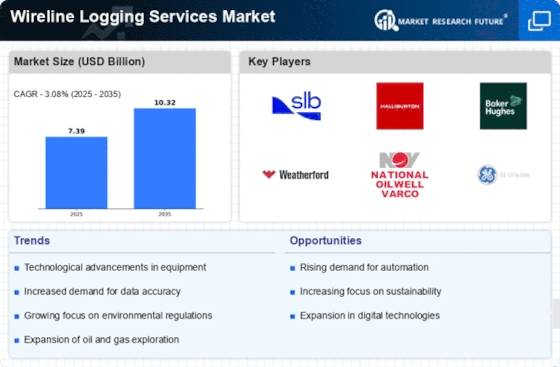

The Wireline Logging Services Market is experiencing a surge in demand for energy resources, driven by the need for efficient exploration and production of oil and gas. As countries strive to meet their energy needs, the exploration of new reserves becomes paramount. This has led to an increased reliance on wireline logging services, which provide critical data for reservoir characterization and well integrity assessment. According to recent estimates, the wireline logging services market is projected to grow at a compound annual growth rate of approximately 5.2% over the next few years. This growth is indicative of the industry's response to the rising energy demands and the necessity for advanced logging techniques to optimize resource extraction.

Regulatory Compliance and Safety Standards

The Wireline Logging Services Market is significantly influenced by stringent regulatory compliance and safety standards. Governments and regulatory bodies are imposing rigorous guidelines to ensure the safety and environmental sustainability of oil and gas operations. This has led to an increased demand for wireline logging services that adhere to these regulations, as they provide essential data for risk assessment and management. Companies that invest in compliant logging services are likely to gain a competitive edge, as they can demonstrate their commitment to safety and environmental stewardship. The emphasis on regulatory compliance is expected to drive market growth, as operators seek reliable partners to navigate the complex regulatory landscape.

Growing Investment in Oil and Gas Exploration

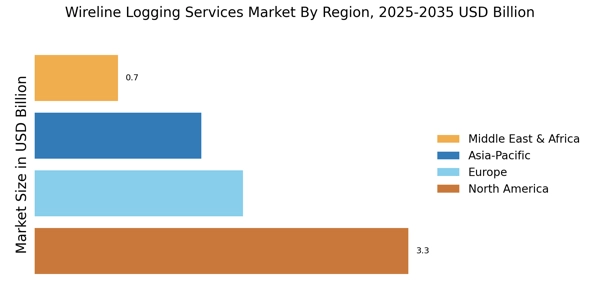

Investment in oil and gas exploration is a key driver for the Wireline Logging Services Market. As energy prices stabilize, companies are increasingly allocating resources towards exploring untapped reserves. This trend is particularly evident in regions with rich hydrocarbon potential, where wireline logging services are essential for evaluating the viability of new drilling projects. The market is projected to benefit from this influx of investment, as operators require accurate and timely data to make informed decisions. Furthermore, the rise of unconventional resources, such as shale gas, is further fueling the demand for advanced logging services that can provide detailed insights into complex geological formations.

Technological Innovations in Logging Techniques

Technological advancements play a pivotal role in shaping the Wireline Logging Services Market. Innovations such as advanced sensors, real-time data transmission, and enhanced imaging techniques are revolutionizing the way logging services are conducted. These technologies not only improve the accuracy of subsurface data but also reduce operational costs and time. For instance, the integration of artificial intelligence and machine learning in data analysis is enabling more precise interpretations of geological formations. As a result, companies are increasingly adopting these advanced logging techniques to enhance their operational efficiency and decision-making processes. The ongoing investment in research and development is likely to further propel the market forward.