Economic Value of Recycled Materials

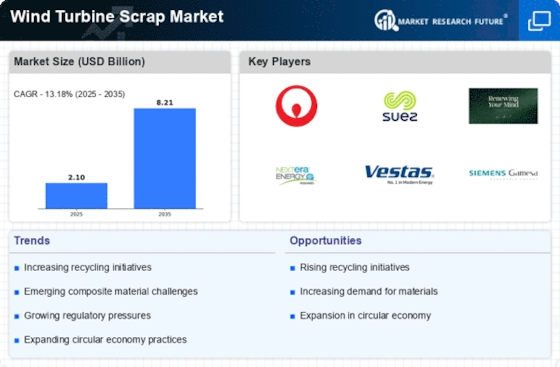

The economic value associated with recycled materials is a compelling driver for the Wind Turbine Scrap Market. As the demand for raw materials continues to rise, the financial incentives for recycling wind turbine scrap become increasingly attractive. Recycled materials, such as steel and rare earth elements, can be sold at competitive prices, providing a revenue stream for companies involved in the recycling process. Recent market analyses suggest that the value of recycled materials from wind turbine scrap could reach several billion dollars in the next few years. This potential for economic gain is likely to stimulate investment in the Wind Turbine Scrap Market, encouraging more players to enter the recycling sector.

Advancements in Recycling Technologies

Technological advancements in recycling processes are significantly influencing the Wind Turbine Scrap Market. Innovations in material recovery techniques enable more efficient extraction of valuable components from wind turbine scrap, such as rare earth metals and composites. These advancements not only enhance the economic viability of recycling but also reduce environmental impacts associated with landfill disposal. Recent studies indicate that improved recycling methods can recover up to 90% of materials from decommissioned turbines. As these technologies continue to evolve, the Wind Turbine Scrap Market is expected to expand, attracting investments and fostering partnerships between manufacturers and recycling firms.

Increasing Demand for Renewable Energy

The rising demand for renewable energy sources is a primary driver for the Wind Turbine Scrap Market. As countries strive to meet their energy needs sustainably, the installation of wind turbines has surged. This increase in installations leads to a corresponding rise in the volume of wind turbine scrap generated as older turbines are decommissioned. According to recent data, the wind energy sector is projected to grow at a compound annual growth rate of over 8% in the coming years. Consequently, the Wind Turbine Scrap Market is likely to experience heightened activity as stakeholders seek to recycle and repurpose materials from decommissioned turbines, thereby contributing to a circular economy.

Growing Awareness of Environmental Impact

The growing awareness of the environmental impact of waste is a significant driver for the Wind Turbine Scrap Market. As stakeholders become more conscious of the ecological footprint of wind energy systems, there is an increasing emphasis on responsible disposal and recycling of turbine components. This awareness is prompting manufacturers and operators to prioritize sustainable practices, including the recycling of wind turbine scrap. Recent surveys indicate that a majority of industry players are now actively seeking solutions to minimize waste and enhance sustainability. Consequently, the Wind Turbine Scrap Market is poised for growth as more entities recognize the importance of integrating environmental considerations into their operational strategies.

Regulatory Support for Recycling Initiatives

Regulatory frameworks promoting recycling initiatives are becoming increasingly prevalent, thereby driving the Wind Turbine Scrap Market. Governments are implementing policies that encourage the recycling of wind turbine components, often providing incentives for companies that engage in sustainable practices. For instance, some regions have established mandates requiring a certain percentage of materials from decommissioned turbines to be recycled. This regulatory support not only enhances the economic feasibility of recycling but also aligns with broader environmental goals. As a result, the Wind Turbine Scrap Market is likely to benefit from these supportive measures, fostering a more sustainable approach to wind energy management.