Aging Wind Turbine Fleet

The Global Wind Turbine Gearbox Repair Refurbishment Market Industry is significantly impacted by the aging fleet of wind turbines. Many turbines installed in the early 2000s are now reaching the end of their operational lifespan, necessitating refurbishment and repair services. This trend creates a substantial demand for gearbox refurbishment, as older models often experience higher failure rates. The need to maintain operational efficiency and reduce downtime drives operators to invest in refurbishment services. As the market matures, the focus on maintaining older turbines will likely lead to increased revenue opportunities for service providers within the industry.

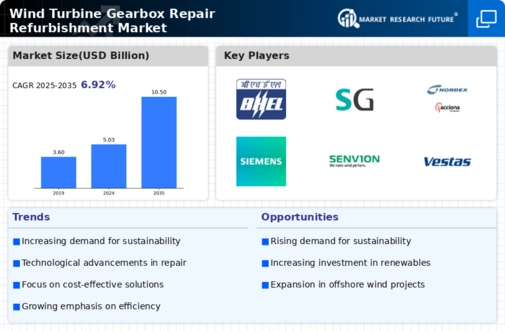

Market Growth Projections

The Global Wind Turbine Gearbox Repair Refurbishment Market Industry is poised for substantial growth, with projections indicating a market value of 10.5 USD Billion by 2035. This anticipated growth is underpinned by a compound annual growth rate (CAGR) of 6.92% from 2025 to 2035. The increasing investments in wind energy infrastructure and the need for efficient maintenance solutions are driving this upward trajectory. As the industry evolves, the demand for specialized refurbishment services is likely to expand, creating opportunities for service providers to innovate and enhance their offerings. This growth reflects the broader trend towards sustainable energy solutions globally.

Regulatory Support and Incentives

Government regulations and incentives play a pivotal role in shaping the Global Wind Turbine Gearbox Repair Refurbishment Market Industry. Many countries are introducing supportive policies aimed at promoting renewable energy and enhancing the efficiency of existing wind farms. These regulations often include financial incentives for refurbishment projects, encouraging operators to invest in gearbox repairs rather than complete replacements. Such initiatives not only foster market growth but also contribute to the overall sustainability goals set by various nations. The combination of regulatory support and market demand is expected to drive the industry forward, particularly as the global focus on renewable energy intensifies.

Increasing Demand for Renewable Energy

The Global Wind Turbine Gearbox Repair Refurbishment Market Industry is experiencing heightened demand due to the global shift towards renewable energy sources. Governments worldwide are implementing policies to reduce carbon emissions, leading to increased investments in wind energy infrastructure. As of 2024, the market is valued at 5.03 USD Billion, reflecting the growing reliance on wind turbines for sustainable energy generation. This trend is expected to continue, with projections indicating a market growth to 10.5 USD Billion by 2035. The emphasis on maintaining and refurbishing existing wind turbine gearboxes is crucial to ensure operational efficiency and longevity, thereby supporting the overall growth of the industry.

Rising Awareness of Maintenance Practices

There is a growing recognition of the importance of proactive maintenance practices within the Global Wind Turbine Gearbox Repair Refurbishment Market Industry. Operators are increasingly aware that regular maintenance can significantly reduce the risk of catastrophic failures and extend the operational life of wind turbines. This awareness is leading to a shift from reactive to preventive maintenance strategies, which include regular inspections and timely refurbishments. As a result, service providers are likely to see an uptick in demand for their expertise in gearbox refurbishment. This trend aligns with the broader industry growth, as operators seek to optimize performance and minimize operational disruptions.

Technological Advancements in Gearbox Design

Innovations in gearbox technology are significantly influencing the Global Wind Turbine Gearbox Repair Refurbishment Market Industry. Advanced materials and design methodologies are enhancing the durability and efficiency of gearboxes, which, in turn, reduces the frequency of repairs and refurbishments. These advancements not only extend the lifespan of gearboxes but also improve energy conversion efficiency. As the industry evolves, the need for specialized repair services that can handle these advanced systems becomes increasingly important. This technological evolution is likely to contribute to the market's projected CAGR of 6.92% from 2025 to 2035, as operators seek to optimize their investments in wind energy.