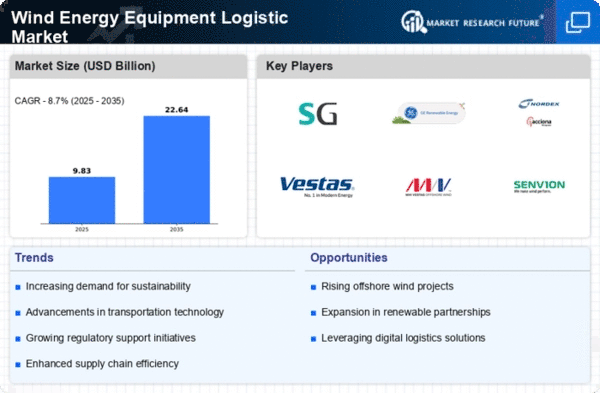

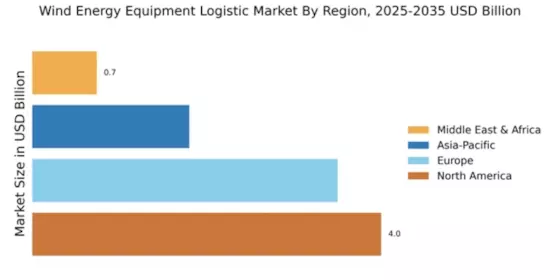

North America : Leading Market Innovators

North America is poised to maintain its leadership in the Wind Energy Equipment Logistic Market, holding a market size of $4.0 billion in 2025. The region's growth is driven by robust investments in renewable energy infrastructure, favorable government policies, and increasing demand for sustainable energy solutions. Regulatory support, such as tax incentives and renewable energy mandates, further catalyzes market expansion, making it a prime location for wind energy logistics.

The competitive landscape in North America is characterized by major players like GE Renewable Energy and Siemens Gamesa, who are at the forefront of technological advancements. The U.S. and Canada are leading countries, with significant projects underway that enhance logistics capabilities. The presence of established companies and a growing number of startups contribute to a dynamic market environment, ensuring continued growth and innovation.

Europe : Sustainable Energy Leader

Europe is a key player in the Wind Energy Equipment Logistic Market, with a market size of $3.5 billion projected for 2025. The region benefits from strong regulatory frameworks aimed at reducing carbon emissions and promoting renewable energy. Initiatives like the European Green Deal and national targets for wind energy generation are driving demand and investment in logistics solutions, positioning Europe as a leader in sustainable energy practices.

Countries like Germany, Denmark, and Spain are at the forefront of this market, hosting major players such as Vestas Wind Systems and Nordex. The competitive landscape is marked by innovation and collaboration among industry stakeholders, including government bodies and private enterprises. This synergy fosters advancements in logistics efficiency and technology, ensuring that Europe remains a hub for wind energy logistics.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region is rapidly emerging in the Wind Energy Equipment Logistic Market, with a projected market size of $1.8 billion by 2025. This growth is fueled by increasing energy demands, government initiatives promoting renewable energy, and investments in infrastructure. Countries like China and India are leading the charge, supported by favorable policies and a growing awareness of environmental sustainability, which are critical for market expansion.

China stands out as a dominant player, with companies like Goldwind and Envision Energy driving innovation and logistics capabilities. The competitive landscape is evolving, with both established firms and new entrants vying for market share. As the region continues to invest in wind energy projects, the logistics sector is expected to grow, enhancing the overall market dynamics in Asia-Pacific.

Middle East and Africa : Untapped Energy Resources

The Middle East and Africa region is gradually developing its Wind Energy Equipment Logistic Market, with a market size of $0.74 billion anticipated by 2025. The growth is primarily driven by increasing energy needs and a shift towards renewable energy sources. Governments are beginning to recognize the potential of wind energy, leading to regulatory frameworks that support investment in logistics and infrastructure, which are essential for market growth.

Countries like South Africa and Morocco are taking the lead in wind energy initiatives, attracting investments from global players. The competitive landscape is still in its nascent stages, but the presence of companies like Suzlon Energy indicates a growing interest in the region. As more projects are initiated, the logistics sector is expected to expand, paving the way for a more sustainable energy future in the region.