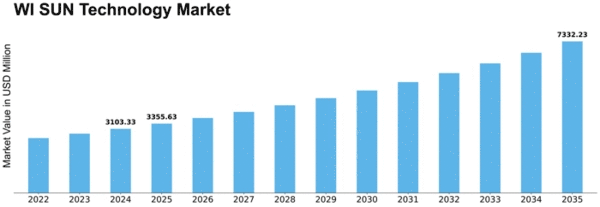

Wi Sun Technology Size

WI SUN Technology Market Growth Projections and Opportunities

Electricity expenses constitute a substantial portion of the operational costs across various sectors, spanning from managing commercial office spaces and industrial facilities to operating retail outlets and healthcare institutions. Within the context of the present business environment, the energy sector is undergoing a profound transformation amid the fourth industrial revolution. This transformation is characterized by the rapid evolution of technologies, emergence of innovative business models, and shifts in regulatory frameworks.

In the United States, commercial and industrial (C&I) entities expend an estimated USD 130 billion annually on electricity. The concept of peak hours, when energy demand reaches its zenith and consumers incur the highest charges per kilowatt-hour (kWh), assumes pivotal importance in this scenario. Effectively analyzing and optimizing electricity expenses necessitates energy managers to procure accurate and accessible electricity rate information. Factors such as reliability, supply stability, transmission limitations, and infrastructure challenges are propelling the adoption of essential solutions like the smart grid, dynamic pricing mechanisms, and demand-response programs. These solutions aim to streamline energy utilization, particularly during peak hours.

Smart grids represent a modernized approach to system planning, encompassing deliberate distributed storage and various other technological alternatives. Consequently, the demand for Wi-SUN technology is on the rise. Wi-SUN technology offers a suite of features, including low-power consumption, seamless setup processes, mesh networking capabilities, and compliance with IEEE 802.15.4g-based specifications. These attributes enable the establishment of intelligent networks for metering controls.

Wi-SUN technology plays a pivotal role in powering smart grid applications, facilitating advanced metering infrastructure, managing peak loads, controlling power distribution, and incorporating alternative energy sources. For electric utilities, the integration of Wi-SUN-enabled networks aids in optimizing electricity generation and distribution. This factor is poised to significantly bolster the demand for Wi-SUN technology in the forthcoming years.

Leave a Comment