Wi Fi As A Service Size

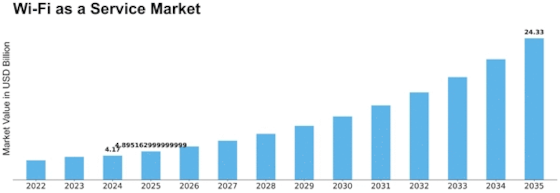

Wi-Fi as a Service Market Growth Projections and Opportunities

The Cloud Radio Access Network (C-RAN) market is influenced by a multitude of market factors that collectively shape its growth trajectory. One of the primary drivers is the escalating demand for enhanced mobile communication services. As mobile networks transition to accommodate higher data speeds and increased capacity, C-RAN emerges as a pivotal technology to meet these demands. The rising prevalence of data-intensive applications, such as video streaming and augmented reality, amplifies the need for more efficient and scalable radio access networks, positioning C-RAN as a key solution in the telecommunications landscape.

Moreover, the ongoing deployment of 5G networks is a significant market factor propelling the growth of C-RAN. As 5G technology continues to roll out globally, the requirements for increased network density, reduced latency, and improved energy efficiency become paramount. C-RAN's ability to centralize baseband processing and optimize network resources aligns with the demands of 5G infrastructure, making it a preferred choice for network operators looking to harness the full potential of next-generation connectivity.

Cost-effectiveness remains a critical consideration in the C-RAN market. By centralizing processing functions and virtualizing network elements, C-RAN offers potential cost savings in terms of infrastructure, energy consumption, and maintenance. This cost efficiency is particularly appealing to network operators seeking to balance the deployment of advanced technologies with the imperative to manage operational expenses effectively.

Interoperability and standardization play a pivotal role in the C-RAN market landscape. The existence of standardized interfaces and protocols ensures smooth integration between various network components, facilitating interoperability among different vendors' equipment. Industry-wide collaboration on standards enables a more streamlined deployment of C-RAN solutions, fostering a competitive yet cooperative ecosystem that benefits both vendors and end-users.

Security considerations are another crucial factor influencing the C-RAN market. With the centralization of critical network functions, security measures become paramount to safeguard against potential vulnerabilities. As C-RAN adoption increases, addressing cybersecurity concerns becomes imperative to ensure the integrity and confidentiality of data transmitted across the network. Vendors and operators alike must invest in robust security measures to build trust and mitigate risks associated with centralized processing.

Government regulations and policies also exert a significant impact on the C-RAN market. Regulatory frameworks related to spectrum allocation, infrastructure deployment, and data protection influence the pace and direction of C-RAN adoption. Governments worldwide play a pivotal role in shaping the telecommunications landscape, and their policies can either encourage or impede the deployment of C-RAN solutions.

The competitive landscape and market consolidation contribute to the dynamics of the C-RAN market. As vendors vie for market share, innovations in technology, service offerings, and strategic partnerships become key differentiators. Market consolidation through mergers and acquisitions further shapes the competitive landscape, influencing the overall market structure and the range of solutions available to customers.

In conclusion, the Cloud Radio Access Network market is intricately linked to a myriad of market factors that collectively drive its evolution. From the demands of 5G networks to considerations of cost-effectiveness, interoperability, security, government regulations, and the competitive landscape, each factor contributes to shaping the trajectory of C-RAN adoption in the telecommunications industry. As technology continues to advance, the C-RAN market will likely see further transformations, with key players adapting their strategies to align with the evolving needs of the industry and end-users.

User Write 600 simple words on market share positioning strategies Wi-Fi as a Service Market in paragraph form ChatGPT The Wi-Fi as a Service (WaaS) market is characterized by a range of market share positioning strategies employed by companies aiming to establish a competitive edge in this dynamic industry. Wi-Fi as a Service, which provides wireless connectivity solutions on a subscription basis, has become increasingly popular as businesses and organizations seek flexible and scalable networking solutions. One prevalent strategy in market positioning involves customization. Companies strive to tailor their WaaS offerings to meet the specific needs and preferences of diverse customer segments. This could include specialized packages for small businesses, enterprise-level solutions with advanced features, or industry-specific configurations. By offering a range of customizable options, companies aim to attract a broad customer base while addressing the unique requirements of different market segments.

Differentiation is another key strategy in the WaaS market. To stand out in a crowded field, companies focus on highlighting distinctive features or services that set their offerings apart from competitors. This might include innovative security protocols, seamless integration with other technologies, or unique value-added services. By emphasizing these differentiators, companies aim to capture the attention of customers seeking specific functionalities or benefits that align with their business objectives. This approach not only helps in acquiring new customers but also in retaining existing ones through the perceived added value.

Cost leadership is a significant market positioning strategy in the WaaS sector. Some companies concentrate on providing WaaS solutions at a lower cost than competitors, aiming to attract budget-conscious customers. This approach involves optimizing operational efficiencies, leveraging economies of scale, and offering competitive pricing structures. However, it's essential to balance cost reduction efforts with maintaining service quality and reliability to avoid compromising the perceived value of the WaaS offering.

Leave a Comment