Increased Focus on Smart Cities

The Wi-Fi 6 Device Market is also being propelled by the increasing focus on smart city initiatives. As urban areas strive to enhance connectivity and improve the quality of life for residents, the deployment of advanced wireless technologies becomes essential. Wi-Fi 6, with its ability to support a higher density of devices and provide faster data transmission, is well-suited for smart city applications. These applications include smart traffic management, public safety systems, and environmental monitoring. Recent projections suggest that investments in smart city technologies will reach substantial figures in the coming years, further driving the demand for Wi-Fi 6 devices. As municipalities seek to implement these technologies, the Wi-Fi 6 Device Market is likely to see significant growth, as it plays a crucial role in enabling the infrastructure necessary for smart city development.

Advancements in Wireless Technology

The Wi-Fi 6 Device Market is significantly influenced by ongoing advancements in wireless technology. As the demand for faster and more reliable internet connections grows, innovations in Wi-Fi technology are essential to meet these expectations. Wi-Fi 6 introduces features such as Orthogonal Frequency Division Multiple Access (OFDMA) and improved beamforming, which enhance network efficiency and performance. These advancements enable devices to communicate more effectively, reducing latency and increasing throughput. Recent data indicates that the adoption of Wi-Fi 6 devices is on the rise, as consumers and businesses seek to leverage these technological improvements. This trend is likely to continue, as the Wi-Fi 6 Device Market evolves to incorporate the latest advancements, ensuring that users benefit from cutting-edge wireless solutions.

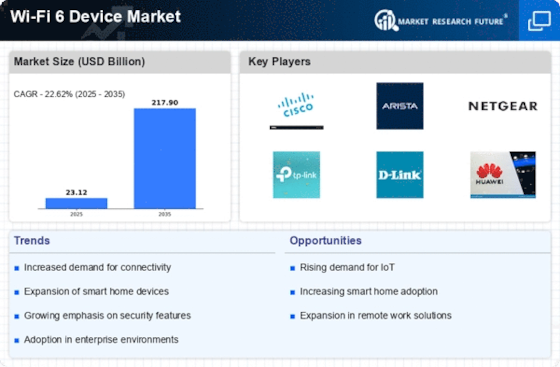

Growing Demand for High-Speed Internet

The Wi-Fi 6 Device Market is experiencing a surge in demand for high-speed internet connectivity. As more consumers and businesses rely on seamless online experiences, the need for faster and more reliable internet connections becomes paramount. Wi-Fi 6 technology, with its ability to support multiple devices simultaneously and deliver higher data rates, addresses this demand effectively. According to recent data, the average internet speed has increased significantly, with many households now requiring speeds exceeding 100 Mbps. This trend is likely to continue, as streaming services, online gaming, and remote work necessitate robust internet solutions. Consequently, the Wi-Fi 6 Device Market is poised for growth as manufacturers respond to this escalating demand by developing advanced devices that leverage the capabilities of Wi-Fi 6.

Rise of Remote Work and Online Learning

The Wi-Fi 6 Device Market is significantly influenced by the rise of remote work and online learning. As organizations and educational institutions increasingly adopt flexible work and learning arrangements, the demand for reliable and high-performance wireless networks has intensified. Wi-Fi 6 technology offers enhanced capacity and efficiency, making it ideal for environments where multiple users connect simultaneously. Recent statistics indicate that a substantial percentage of the workforce now operates remotely, necessitating robust internet solutions to support video conferencing, collaborative tools, and online resources. This shift is likely to drive the adoption of Wi-Fi 6 devices, as users seek to optimize their connectivity for productivity and learning. The Wi-Fi 6 Device Market stands to benefit from this trend, as it aligns with the evolving needs of both businesses and educational institutions.

Emergence of Internet of Things (IoT) Devices

The Wi-Fi 6 Device Market is witnessing a notable impact from the emergence of Internet of Things (IoT) devices. As the number of connected devices continues to rise, the demand for efficient and high-capacity wireless networks becomes increasingly critical. Wi-Fi 6 technology is designed to handle the challenges posed by IoT, offering improved performance in environments with numerous connected devices. Recent estimates indicate that billions of IoT devices are expected to be in use within the next few years, creating a substantial market for Wi-Fi 6 devices that can support these connections. This trend suggests that the Wi-Fi 6 Device Market will experience robust growth as manufacturers develop innovative solutions tailored to the unique requirements of IoT applications, thereby enhancing overall connectivity and user experience.