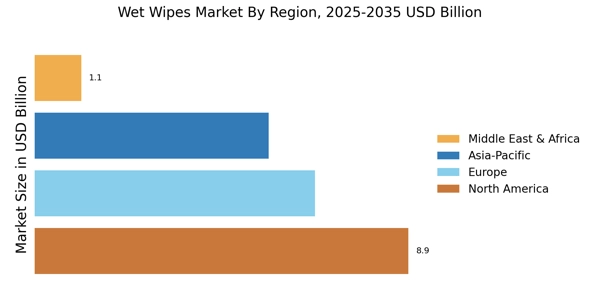

North America : Market Leader in Wet Wipes Market

North America is the largest market for wet wipes, holding approximately 40% of the global share. The growth is driven by increasing consumer demand for convenience and hygiene, particularly in the wake of the COVID-19 pandemic. Regulatory support for safe and effective hygiene products further fuels this market. The U.S. leads the region, with Canada following as the second-largest market, contributing around 15% to the overall share.

The competitive landscape in North America is robust, featuring key players such as Procter & Gamble, Kimberly-Clark, and Johnson & Johnson. These companies leverage innovative marketing strategies and product development to maintain their market positions. The presence of established retail channels and e-commerce platforms enhances product accessibility, driving further growth in the wet wipes segment.

Europe : Emerging Trends in Hygiene

Europe is witnessing significant growth in the wet wipes market, accounting for approximately 30% of the global share. The demand is driven by increasing awareness of hygiene and convenience among consumers. Regulatory frameworks in the EU promote sustainable practices, encouraging manufacturers to innovate with eco-friendly materials. Germany and the UK are the largest markets in this region, together holding about 20% of the total market share.

Leading countries in Europe include Germany, the UK, and France, with a competitive landscape featuring major players like Reckitt Benckiser and SCA Hygiene Products. The market is characterized by a shift towards biodegradable and sustainable products, aligning with consumer preferences for environmentally friendly options. This trend is supported by various EU regulations aimed at reducing plastic waste and promoting sustainability.

Asia-Pacific : Rapid Growth in Emerging Markets

The Asia-Pacific region is rapidly emerging as a significant player in the wet wipes market, holding around 25% of the global share. The growth is primarily driven by rising disposable incomes, urbanization, and increasing health awareness among consumers. Countries like China and Japan are leading this surge, with China alone accounting for nearly 15% of the market. Regulatory initiatives promoting hygiene standards further bolster demand in this region.

China, Japan, and India are the key markets in Asia-Pacific, with a competitive landscape featuring companies like Unicharm and Hengan International Group. The market is characterized by a diverse range of products catering to various consumer needs, from baby wipes to personal care wipes. The presence of both local and international players intensifies competition, driving innovation and product differentiation.

Middle East and Africa : Untapped Potential in Hygiene

The Middle East and Africa (MEA) region is gradually emerging in the wet wipes market, currently holding about 5% of the global share. The growth is driven by increasing urbanization, rising disposable incomes, and a growing awareness of hygiene practices. Countries like South Africa and the UAE are leading the market, with significant potential for expansion as consumer preferences shift towards convenience and hygiene products.

In the MEA region, South Africa and the UAE are the primary markets, with a competitive landscape that includes both local and international brands. The presence of key players such as Edgewell Personal Care and Reckitt Benckiser enhances market dynamics. As the region continues to develop, there is a growing focus on product innovation and marketing strategies tailored to local consumer preferences, paving the way for future growth in the wet wipes segment.