North America : Health-Conscious Consumer Base

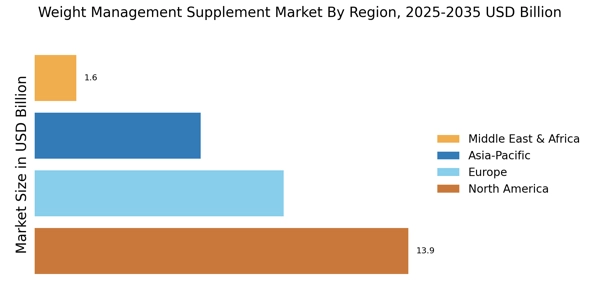

North America leads the weight management supplement market, accounting for approximately 45% of the global share. The region's growth is driven by increasing health awareness, rising obesity rates, and a growing preference for dietary supplements. Regulatory support from agencies like the FDA ensures product safety and efficacy, further boosting consumer confidence in these products. The demand for natural and organic supplements is also on the rise, reflecting a shift towards healthier lifestyles.

The United States is the largest market, followed by Canada, with key players such as Herbalife, Nutrisystem, and Weight Watchers dominating the landscape. The competitive environment is characterized by innovation in product formulations and marketing strategies aimed at diverse consumer segments. Retail channels, including e-commerce, are expanding, making these products more accessible to consumers. The presence of established brands and a robust distribution network contribute to the region's market strength.

Europe : Emerging Market with Regulations

Europe is witnessing significant growth in the weight management supplement market, holding approximately 30% of the global share. The increasing prevalence of obesity and lifestyle-related diseases is driving demand for effective weight management solutions. Regulatory frameworks, such as the European Food Safety Authority (EFSA) guidelines, ensure product safety and efficacy, fostering consumer trust and encouraging market expansion. The trend towards clean label products is also gaining traction, influencing consumer choices.

Leading countries in this region include Germany, the UK, and France, where a mix of local and international brands compete for market share. Key players like Herbalife and GNC Holdings are prominent, alongside emerging startups focusing on innovative formulations. The competitive landscape is marked by a growing emphasis on research and development, with companies investing in clinical studies to validate product claims and enhance consumer appeal.

Asia-Pacific : Rapid Growth and Urbanization

Asia-Pacific is rapidly emerging as a significant player in the weight management supplement market, accounting for about 20% of the global share. The region's growth is fueled by urbanization, increasing disposable incomes, and a rising awareness of health and wellness. Countries like China and India are witnessing a surge in demand for weight management products, driven by changing lifestyles and dietary habits. Regulatory bodies are also becoming more active in ensuring product safety and efficacy, which is crucial for market growth.

China is the largest market in the region, followed by India and Japan. The competitive landscape features both established brands and local players, with companies like Herbalife and Isagenix leading the charge. The market is characterized by a diverse range of products, including meal replacements, fat burners, and dietary supplements, catering to various consumer preferences. E-commerce is becoming a vital channel for distribution, enhancing product accessibility across urban and rural areas.

Middle East and Africa : Untapped Potential in Supplements

The Middle East and Africa region is gradually emerging in the weight management supplement market, holding around 5% of the global share. The growth is driven by increasing health consciousness, rising obesity rates, and a growing middle class seeking effective weight management solutions. Regulatory frameworks are still developing, but there is a noticeable shift towards ensuring product safety and efficacy, which is essential for consumer trust and market growth.

Leading countries in this region include South Africa, the UAE, and Nigeria, where the demand for weight management products is on the rise. The competitive landscape is characterized by a mix of local and international brands, with companies like Herbalife and Amway making significant inroads. The market is expected to grow as more consumers turn to dietary supplements as part of their health and wellness routines, supported by increasing availability through retail and online channels.