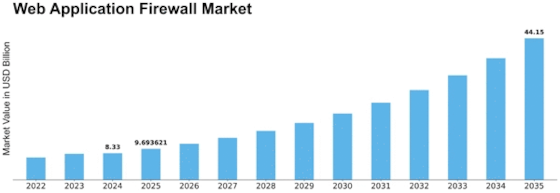

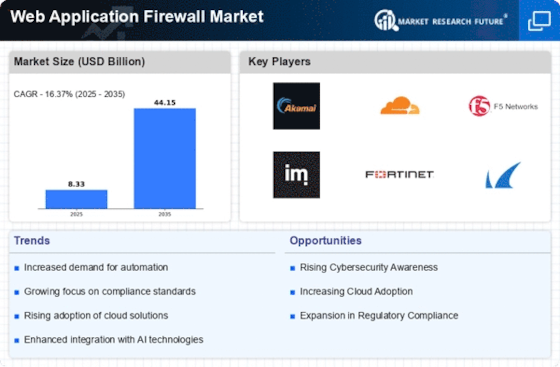

Web Application Firewall Size

Web Application Firewall Market Growth Projections and Opportunities

The Web Application Firewall (WAF) market is shaped by a variety of variables, highlighting cybersecurity's importance in the digital world. Rising frequency and complexity of web application cyber attacks is a driver. WAF solutions are needed as enterprises use web-based platforms for more tasks. Businesses invest in WAF technology to guard against vulnerabilities, data breaches, and malicious actions that exploit web application flaws due to developing cyber threats. The WAF market is heavily influenced by regulation. To secure sensitive data, governments and regulators globally need organisations to use cybersecurity measures like WAF solutions. WAF solutions are used by enterprises to comply with GDPR, HIPAA, and PCI DSS. WAF suppliers that help comply with regional and industry-specific rules are crucial to the market component of regulatory compliance. WAF market variables are influenced by the evolving threat environment. WAF solutions must evolve and improve as cyber attackers find new ways to exploit web application vulnerabilities. The expanding threat environment market factor underscores the necessity for WAF providers to use sophisticated capabilities like AI and ML to identify and react to new attack vectors. Cloud computing is transforming the WAF industry. Cloud-native WAF solutions are in demand as companies move their apps and infrastructure to the cloud. Cloud usage drives WAF vendors to develop solutions that easily connect with cloud environments, offering scalable and adaptable security for online applications independent of deployment methodology. Cloud-native WAF solutions support digital transformation and dynamic IT infrastructures. Application security in DevOps approaches drives WAF market dynamics. Organizations using DevOps to expedite development and delivery must include security safeguards into the pipeline. DevSecOps market factors indicate the need for WAF solutions that connect with development processes and provide automation, continuous monitoring, and proactive security. WAF vendors who follow DevSecOps concepts meet demand for agile development-integrated security solutions. Strategic alliances and cooperation affect WAF market dynamics. WAF providers commonly partner with technology, cloud, and MSSPs to expand their products and market reach. Strategic alliances help build integrated cybersecurity ecosystems that guard against many threats. Collaboration and collaborations provide synergies that boost WAF solutions' market position. API security is becoming a major WAF market factor. Securing APIs is crucial as businesses increasingly use them to communicate between apps and services. API security market factors highlight the need for WAF solutions that defend against API-specific vulnerabilities to ensure data interchange integrity and security. Businesses seeking complete WAF solutions are prioritizing API security as linked APIs grow. The WAF industry is affected by zero-trust security paradigm knowledge and acceptance. Zero-trust security stresses continuous verification and authentication independent of user location or network, challenging perimeter-based security approaches. Zero-trust security market factor has changed how firms secure online applications by emphasizing continuous verification and risk-based access. Zero-trust WAF providers improve security, especially for remote work and external network use.

Leave a Comment