Rising Consumer Demand

Consumer demand for wearable payment devices is on the rise, driven by the increasing preference for convenience and efficiency in transactions. The Global Wearable Payment Device Market Industry is projected to reach 71.5 USD Billion in 2024, reflecting a growing acceptance of these devices among consumers. Factors such as the proliferation of e-commerce and the need for contactless payment options contribute to this trend. As more consumers seek quick and secure payment methods, the market is likely to expand, with wearable devices becoming an integral part of everyday transactions.

Market Growth Projections

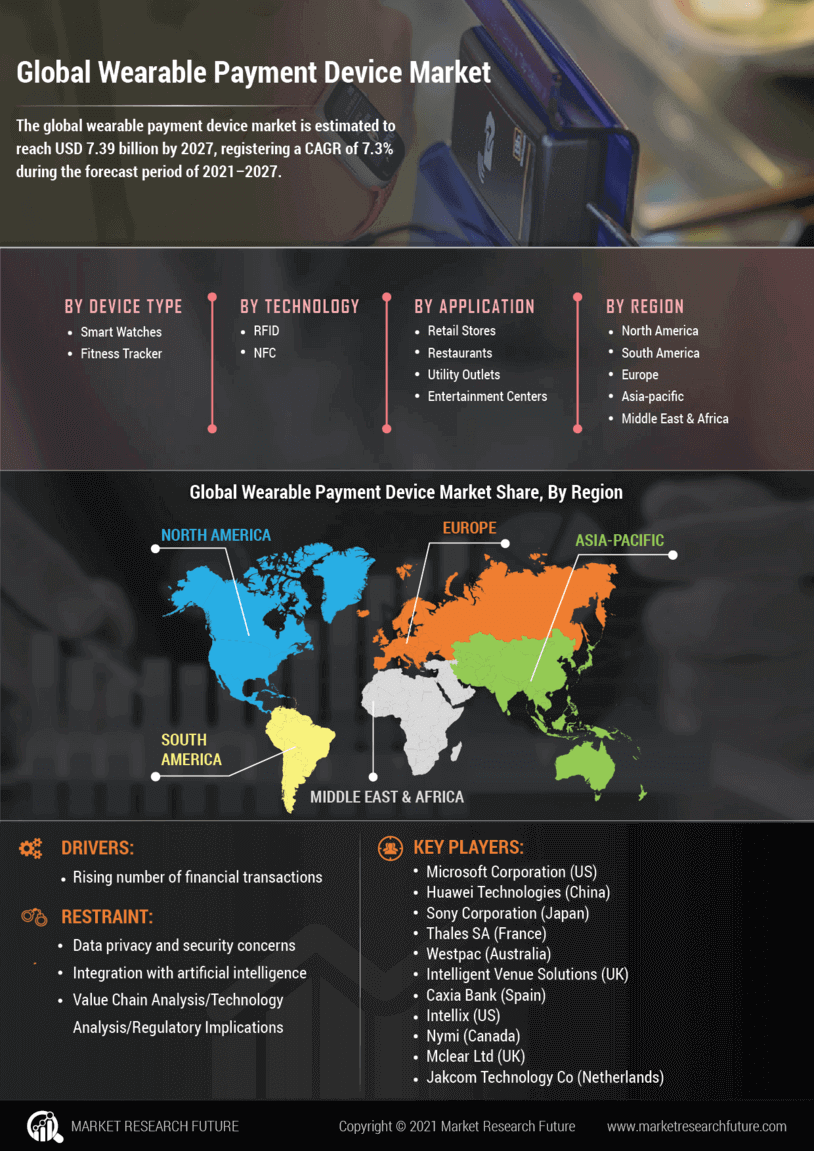

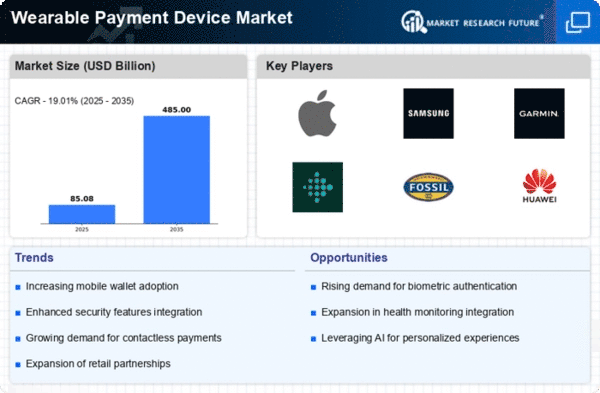

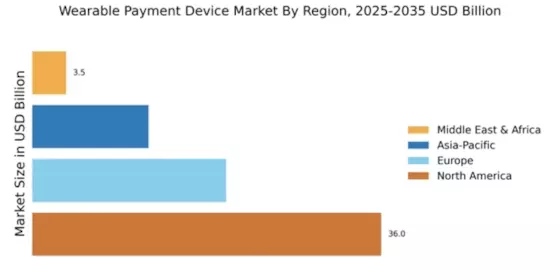

The Global Wearable Payment Device Market Industry is projected to experience substantial growth, with estimates indicating a market size of 484.9 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 19.01% from 2025 to 2035. Such projections underscore the increasing adoption of wearable payment devices across various demographics and regions. As technology continues to evolve and consumer preferences shift towards more integrated payment solutions, the market is poised for significant expansion, driven by both innovation and changing consumer behaviors.

Technological Advancements

The Global Wearable Payment Device Market Industry is experiencing rapid technological advancements that enhance functionality and user experience. Innovations such as biometric authentication, contactless payment capabilities, and integration with mobile applications are driving consumer adoption. For instance, devices equipped with NFC technology allow seamless transactions, making payments more convenient. As technology evolves, features like health monitoring and fitness tracking are increasingly integrated into payment devices, appealing to health-conscious consumers. This convergence of technology and payment solutions is likely to attract a broader audience, further propelling market growth.

Increased Focus on Security

Security concerns are paramount in the Global Wearable Payment Device Market Industry, prompting manufacturers to enhance security features. The integration of advanced encryption technologies and biometric authentication methods, such as fingerprint and facial recognition, is becoming standard practice. These measures not only protect user data but also instill confidence among consumers regarding the safety of their transactions. As security remains a critical factor in consumer decision-making, the emphasis on secure payment solutions is expected to drive market growth, attracting users who prioritize safety in their financial dealings.

Expansion of Retail Partnerships

The expansion of retail partnerships plays a crucial role in the Global Wearable Payment Device Market Industry. Retailers are increasingly adopting wearable payment solutions to enhance customer experience and streamline transactions. Collaborations between device manufacturers and retail chains facilitate the integration of wearable payment options at points of sale. This trend is likely to increase the visibility and accessibility of wearable payment devices, encouraging more consumers to adopt them. As retailers recognize the benefits of offering diverse payment methods, the market is expected to witness significant growth, driven by these strategic partnerships.

Growing Health and Fitness Trends

The Global Wearable Payment Device Market Industry is benefiting from the growing health and fitness trends among consumers. Wearable devices that combine payment functionality with health monitoring features are gaining traction, appealing to fitness enthusiasts. As individuals increasingly prioritize health and wellness, the demand for devices that track fitness metrics while facilitating payments is likely to rise. This dual functionality not only enhances user experience but also positions wearable payment devices as essential tools for health-conscious consumers. The convergence of health and payment technology is expected to further stimulate market growth.