The Wealth Management Platform Market is currently experiencing a transformative phase, driven by advancements in technology and evolving client expectations. Financial institutions are increasingly adopting digital solutions to enhance service delivery and improve client engagement. This shift towards automation and data analytics is reshaping how wealth management services are offered, allowing firms to provide personalized investment strategies and real-time insights. Furthermore, the integration of artificial intelligence and machine learning is enabling wealth managers to analyze vast amounts of data, thereby enhancing decision-making processes and optimizing portfolio management. In addition to technological advancements, regulatory changes are also influencing the Wealth Management Platform Market. Firms are adapting to new compliance requirements, which necessitate the implementation of robust risk management frameworks.

This adaptation not only ensures adherence to regulations but also fosters trust among clients. As the market continues to evolve, the focus on sustainability and responsible investing is becoming more pronounced, with clients increasingly seeking investment options that align with their values. Overall, the Wealth Management Platform Market appears poised for continued growth, driven by innovation and a commitment to meeting the diverse needs of clients. The wealth management platform market is undergoing rapid digital transformation as financial institutions adopt advanced technologies to enhance portfolio management, client engagement, and regulatory compliance.

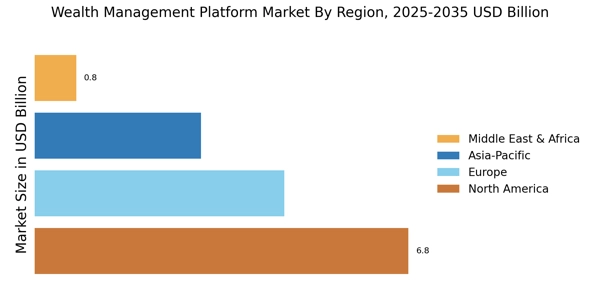

The adoption of a digital wealth management platform enables firms to deliver personalized advisory services, real-time insights, and seamless client experiences across multiple channels. A modern wealth management digital platform integrates data analytics, artificial intelligence, and automation to support informed investment decision-making. The rising adoption of cloud based wealth management software is driven by its scalability, cost efficiency, and ability to support remote advisory services. Financial institutions are increasingly investing in digital wealth management platforms to improve operational efficiency and deliver tailored investment solutions. This wealth management industry report provides comprehensive insights into market size, growth drivers, competitive dynamics, and future opportunities. The wealth management market is expanding steadily due to rising demand for personalized financial advisory services.

Digital Transformation

The Wealth Management Platform Market is witnessing a significant shift towards digital transformation. Financial institutions are increasingly leveraging technology to streamline operations and enhance client experiences. This trend encompasses the adoption of mobile applications, online advisory services, and automated portfolio management tools, which collectively aim to provide clients with seamless access to their financial information. Growth in the wealth management software market is fueled by increasing digitization and regulatory complexity across global financial institutions. Advanced wealth management software products support investment management, financial planning, and regulatory compliance for diverse client segments. The distribution of global market wealth continues to influence regional demand for advanced wealth management platforms. The shift of global market wealth online is accelerating the adoption of digital investment and advisory platforms. An integrated online wealth markets system enables seamless investment execution, reporting, and client communication.

Regulatory Compliance

Regulatory compliance remains a critical focus within the Wealth Management Platform Market. As financial regulations evolve, firms are compelled to implement comprehensive compliance strategies. This trend not only addresses legal requirements but also enhances client trust and confidence in wealth management services, ultimately contributing to long-term client relationships.

Sustainable Investing

Sustainable investing is gaining traction in the Wealth Management Platform Market, reflecting a broader societal shift towards responsible investment practices. Clients are increasingly interested in aligning their portfolios with environmental, social, and governance (ESG) criteria. This trend indicates a growing demand for investment options that not only yield financial returns but also contribute positively to society.