North America : Market Leader in Water Services

North America leads the Water Treatment Plant Operation and Maintenance Services market, holding a significant share of 12.5 in 2024. The region's growth is driven by stringent environmental regulations, increasing investments in infrastructure, and a rising demand for sustainable water management solutions. The focus on upgrading aging water systems and enhancing operational efficiency further propels market expansion.

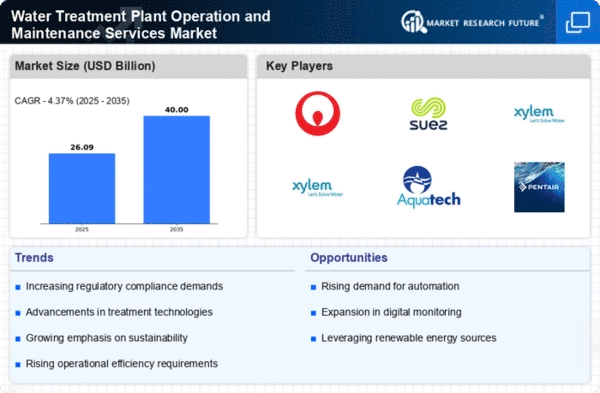

The United States is the primary contributor, with key players like Veolia, Suez, and Xylem dominating the landscape. The competitive environment is characterized by innovation and strategic partnerships aimed at improving service delivery. As municipalities and industries prioritize water quality and sustainability, the presence of established firms ensures a robust market framework.

Europe : Sustainable Practices in Water Management

Europe's Water Treatment Plant Operation and Maintenance Services market is valued at 7.5, reflecting a strong commitment to sustainable practices. The region is witnessing a surge in demand for eco-friendly solutions, driven by EU regulations aimed at improving water quality and resource efficiency. Initiatives to reduce water waste and enhance recycling capabilities are key growth factors, supported by government funding and public awareness campaigns.

Leading countries like Germany, France, and the UK are at the forefront, with major players such as Veolia and Suez actively participating in the market. The competitive landscape is marked by innovation in technology and service delivery, as companies strive to meet regulatory standards and customer expectations. The emphasis on sustainability positions Europe as a leader in water treatment services.

Asia-Pacific : Emerging Market with Growth Potential

The Asia-Pacific region, with a market size of 4.5, is rapidly emerging in the Water Treatment Plant Operation and Maintenance Services sector. The growth is fueled by urbanization, population growth, and increasing industrial activities, leading to heightened demand for efficient water management solutions. Governments are implementing policies to enhance water quality and infrastructure, creating a favorable regulatory environment for market players.

Countries like China, India, and Japan are leading the charge, with significant investments in water treatment technologies. The competitive landscape features both local and international players, including Xylem and Evoqua Water Technologies. As the region grapples with water scarcity and pollution, the focus on innovative solutions and sustainable practices is expected to drive further market growth.

Middle East and Africa : Resource-Rich Yet Challenged Region

The Middle East and Africa region, with a market size of 0.5, faces unique challenges in the Water Treatment Plant Operation and Maintenance Services market. Water scarcity and pollution are critical issues, prompting governments to invest in advanced water treatment technologies. The region's growth is supported by international aid and partnerships aimed at improving water infrastructure and management practices.

Countries like Saudi Arabia and South Africa are leading efforts to enhance water quality and availability. The competitive landscape includes both local firms and international players, focusing on innovative solutions to address pressing water issues. As the region continues to develop, the emphasis on sustainable practices will be crucial for long-term success.