Water Based Resins Size

Water-Based Resins Market Growth Projections and Opportunities

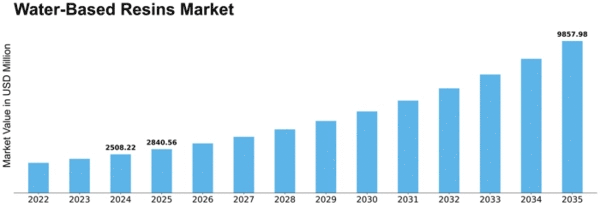

The water-based resins market is estimated at USD 38.89 billion in 2021 and is projected to reach USD 52.69 billion by 2028, at a CAGR of 6.9% from 2022 to 2028.

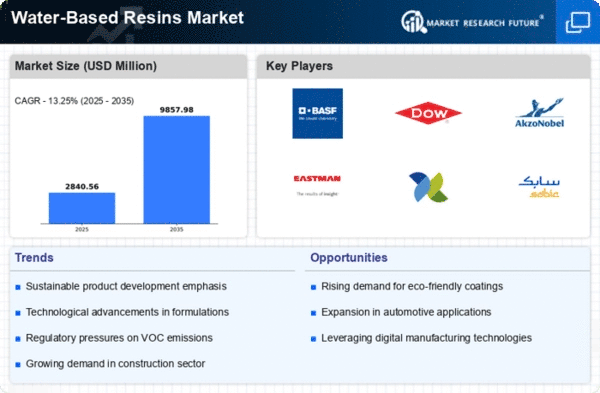

The water-based resins market is influenced by various market factors that shape its dynamics, growth, and trends. Supply and demand dynamics play a crucial role in determining the market scenario. The demand for water-based resins is heavily influenced by their eco-friendly nature and lower volatile organic compound (VOC) emissions compared to solvent-based alternatives. This factor has significantly increased their adoption across industries, including paints and coatings, adhesives, and packaging.

The market is also impacted by regulatory frameworks and environmental policies. Stringent regulations aimed at reducing VOC emissions and promoting sustainable products have fueled the demand for water-based resins. Compliance with these regulations has become a key driver for manufacturers and end-users, leading to a shift away from solvent-based resins.

Technological advancements and innovations have played a pivotal role in market growth. Continuous research and development efforts have led to the introduction of improved formulations with enhanced performance characteristics, such as better adhesion, durability, and flexibility. These innovations have widened the application scope of water-based resins, driving market expansion.

The construction industry acts as a significant driver for the water-based resins market. With increasing urbanization and infrastructure development projects worldwide, there's a growing demand for water-based resins in construction-related applications like architectural coatings, flooring, and sealants. The emphasis on sustainable and durable construction materials has further propelled the use of these resins in the sector.

Market dynamics are also influenced by economic factors such as GDP growth, consumer spending patterns, and industrialization. As economies grow and consumer preferences shift towards environmentally friendly products, the demand for water-based resins is expected to rise. Conversely, economic downturns may impact market growth due to reduced investments in construction and manufacturing activities.

Globalization and trade dynamics also impact the water-based resins market. Fluctuations in raw material prices, trade tariffs, and supply chain disruptions can affect market stability and pricing. Additionally, the market is affected by the competitive landscape and the strategies adopted by key players, including mergers, acquisitions, collaborations, and product launches, which can influence market share and overall growth.

Environmental factors, such as water scarcity and climate change, also have implications for the water-based resins market. Manufacturers are under pressure to develop sustainable production processes and source raw materials responsibly to minimize their environmental impact. Consumer awareness and preference for eco-friendly products further drive the adoption of water-based resins.

Leave a Comment