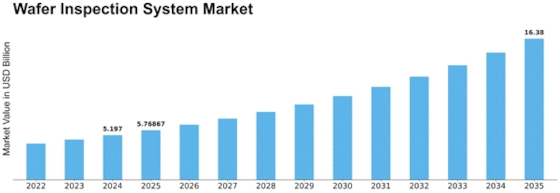

Wafer Inspection System Size

Wafer Inspection System Market Growth Projections and Opportunities

The Wafer Inspection System market is influenced by various market factors that play a crucial role in shaping its dynamics. One key determinant is the rapid technological advancements in the semiconductor industry. As manufacturers strive to enhance the performance and functionality of electronic devices, the demand for more advanced wafer inspection systems increases. Continuous innovation in semiconductor fabrication processes necessitates cutting-edge inspection tools to ensure the quality and reliability of the wafers used in electronic components.

Global economic conditions also significantly impact the Wafer Inspection System market. The industry is closely tied to the overall economic health, as semiconductor demand is closely linked to consumer spending, industrial activities, and business investments. Economic downturns can lead to reduced spending on electronic devices, affecting the demand for wafer inspection systems. On the other hand, periods of economic growth often see increased investments in technology, driving the need for more sophisticated wafer inspection solutions.

The growing complexity of semiconductor devices is another market factor influencing the Wafer Inspection System market. With the development of smaller and more intricate electronic components, there is an increased likelihood of defects during the manufacturing process. As a result, manufacturers are compelled to adopt advanced wafer inspection systems that can detect and rectify these defects, ensuring the production of high-quality semiconductors.

Government regulations and policies also play a pivotal role in shaping the Wafer Inspection System market landscape. Regulatory standards regarding the quality and safety of electronic devices, as well as environmental concerns, impact the manufacturing processes in the semiconductor industry. Compliance with these regulations often necessitates the adoption of specific wafer inspection technologies, driving market growth.

Furthermore, the global trend towards automation in manufacturing processes contributes to the expansion of the Wafer Inspection System market. Automation enhances efficiency, reduces production costs, and minimizes human errors, thereby increasing the overall quality of semiconductor manufacturing. As companies increasingly embrace automation, the demand for advanced wafer inspection systems that can seamlessly integrate into automated production lines rises.

Market competition and consolidation are additional factors shaping the dynamics of the Wafer Inspection System market. The industry is characterized by the presence of several key players competing to gain a larger market share. Mergers, acquisitions, and collaborations are common strategies employed by companies to strengthen their position and expand their product portfolios. This competitive environment drives innovation and leads to the introduction of more sophisticated wafer inspection technologies.

Geopolitical factors also contribute to the overall market dynamics. Trade tensions, tariff impositions, and geopolitical uncertainties can impact the global supply chain, affecting the semiconductor industry, and consequently, the Wafer Inspection System market. Companies in the industry must navigate these geopolitical challenges to ensure a stable supply chain and market presence.

Leave a Comment