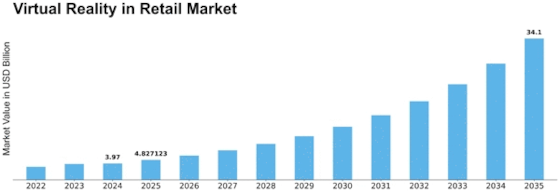

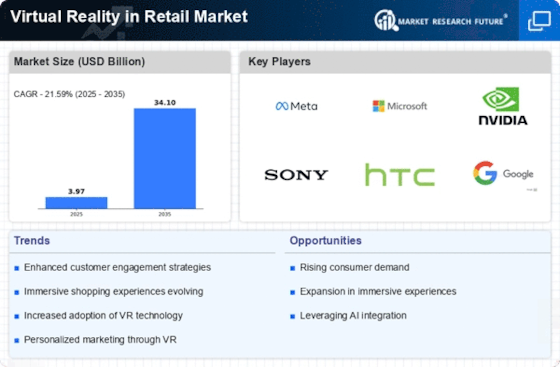

Virtual Reality Retail Size

Virtual Reality Retail Market Growth Projections and Opportunities

VR in retail is witnessing a dramatic transformation, ushering in new era of vivid and individualized purchasing. As technology advances, merchants are using VR to boost consumer loyalty, close transactions, and stay competitive. This dynamic is driven by consumer demand for more interactive and engaging purchasing experiences. Virtual reality lets merchants create three-dimensional store facades and item showcases that customers may explore from home.

Retailers' expanding use of VR to solve problems like showrooming also shapes the industry. Showrooming occurs when buyers visit stores to compare things but buy online, often at better prices. VR is being used by merchants to merge online and offline purchasing. Virtual display rooms enable shoppers view and experience things in a virtual setting, overcoming coming up and online buying difficulties. This enhances the buying experience and encourages further purchases.

Another important market factor is VR integration in the customer dynamic cycle. Virtual reality lets shops give virtual tryouts, notably in design and beauty. Customers may virtually try clothes, accessories, and cosmetics before buying. This reduces profits and enhances customer satisfaction by making shopping more informed and fun. VR is now part of the customer journey, affecting purchases and brand loyalty.

Retailers' need to stand out in a crowded market also affects market factors. Virtual reality allows shops to provide unique experiences beyond blocks and cement or internet buying. Virtual shop tours, interactive product presentations, and dynamic narrative may set retailers apart from competitors. This differentiation is crucial to attracting and maintaining clients in a changing retail environment.

Continued VR innovation drives market factors. As VR technology becomes cheaper, simpler, and easier to operate, merchants' entry barriers fall. This accessibility allows more shops, from small businesses to big names, to use VR. VR programming gives merchants new tools to create immersive and engaging experiences. Mechanical advances boost the retail virtual reality sector."

Leave a Comment