Market Trends

Key Emerging Trends in the Virtual Private Server Market

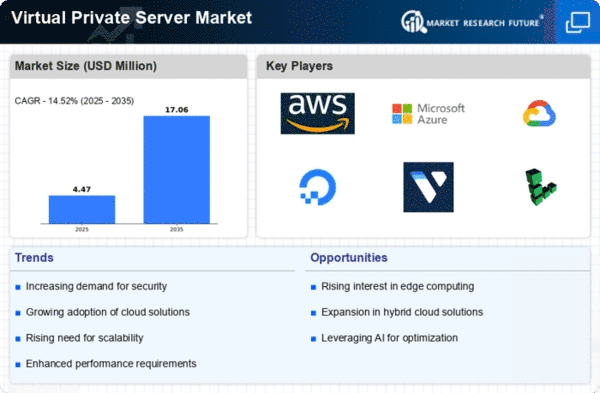

The past few years have seen the VPS market rise to meteoric proportions, as cloud computing has become an ever more prevalent business infrastructure and companies struggle for sufficient flexible, scalable hosting. The main driver behind this market trend is the rapid growth in demand for virtualized environments from clients who want dedicated resources within a shared server infrastructure. VPS is attracting businesses of all sizes because it offers a cost-efficient half way between shared hosting and dedicated servers. This surge is also fueled by the growing understanding of enterprises about VPS ’ s benefits: better control, higher performance and greater security. A noteworthy development in the VPS market has been the swift uptake of cloud-based hosting for VPS. Cloud technologies have now become an indispensable part of modern businesses. And VPS on the cloud fits exactly what today's market needs: speed and scalability. Cloud-based VPS services enable enterprises to add resources when needed, maintaining optimum performance levels during peak usage and reducing costs at times of low activity. The popularity of cloud platforms is also changing the hosting scene, with more providers offering VPS services on one or another well-known platform. This has made it much easier for businesses to integrate these solutions into their existing infrastructure. Also, the VPS market is moving away from unmanaged services. Since businesses are emphasizing their own core competencies, we're seeing a greater demand for VPS hosting solutions with complete management services. These tend to include automated backups, security monitoring, software upgrades and 24/7 technical support. This trend indicates that businesses are eager to dump the operational burden of server management onto capable hosting providers so they can focus on strategic initiatives and business expansion. As cyber threats have become more complex, enterprises are willing to pay an exorbitant sum for the safety of their digital assets. Its isolated environments and dedicated resources make VPS hosting a safer choice than traditional shared accounts. This resulted in more and more companies choosing VPS solutions to strengthen their Internet presence and protect sensitive information. In reply, providers of hosting facilities are upgrading their security functions and providing higher-level solutions such as firewalls, DDoS protection or regular system audits. With the increasing number of specialized VPS solutions that are geared to serve specific industries, both horizontal and vertical ground is being broken in the market for this service. In e-commerce, in healthcare and finance--all businesses demand VPS services that meet compliance standards for their fields as well as performance expectations.

Leave a Comment