Market Analysis

In-depth Analysis of Virtual Private Server Market Industry Landscape

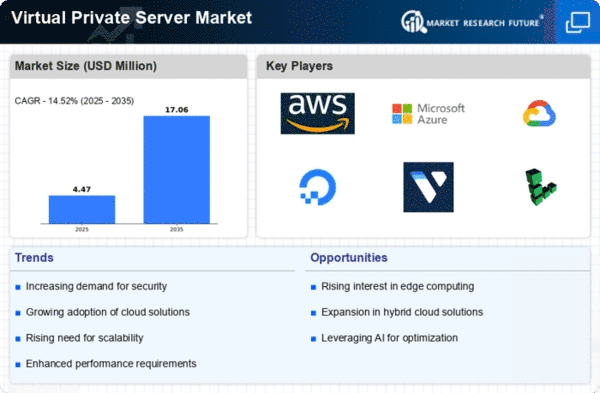

There are many factors which have shaped the landscape of this market in recent years, and it has witnessed a rapid growth as well as lots of changes. The digital transformation of businesses has increased demand for scalable and flexible hosting services, making the market for virtual private servers (VPS) a significant cog in the larger cloud computing ecosystem. Rising adoption of VPS by businesses of all sizes is one key factor among the market's dynamics. Highly economical and scalable according to resource needs, VPS hosting is attractive to small-and medium sized enterprises (SMEs). In contrast, bigger businesses value the higher performance and individual resources that VPS provides over shared hosting. This variety of demand has given rise to a dynamic market in which providers meet the needs of various clients with different hosting requirements. Advances in technology are an important factor affecting VPS's market dynamics. As hardware capabilities improve, VPS providers can offer more robust and powerful virtualization solutions. The result has been higher performance, better resource allocation and greater overall reliability. This culminates in VPS being the perfect solution for companies who place big demands on their hosting environment. The VPS market's competitive landscape is thus marked by numerous service providers, all vying for a piece of the growing pie. It has resulted in novel service offerings, pricing models and customer support processes that have all benefited users. Now, providers differentiate themselves through options like managed services and customizability. There are tons of choices for businesses to choose from. Security has been playing an increasingly important part in shaping VPS market conditions. As cyber threats surge, business are now more focused than ever on protecting their digital assets. In fact, with its own separate virtual environments, VPS provides a safer platform for hosting than shared ones. In response to this demand, providers have adopted advanced security measures such as firewalls and DDoS protection. They've also begun performing regular security audits, skyrocketing the VPS market even higher. Another trend in the VPS market is one toward managed VPS services. As businesses concentrate on their core competencies, MANY opt for managed VPS solutions which transfer the technical complexities of running a server to the hosting provider. This trend is convenient for businesses because they can focus on their business while the provider takes care of server maintenance, updating and other bug fixing.

Leave a Comment