Integration of Emerging Technologies

The integration of emerging technologies is shaping the future of the Virtual Client Computing Market. Innovations such as artificial intelligence (AI), machine learning, and automation are being incorporated into virtual client computing solutions to enhance functionality and user experience. These technologies enable predictive analytics, automated resource allocation, and improved performance monitoring, which are essential for modern IT environments. Market trends indicate that the AI market is projected to grow to USD 190 billion by 2025, suggesting a significant opportunity for virtual client computing providers to leverage these advancements. As organizations seek to enhance their IT capabilities, the integration of emerging technologies into virtual client computing solutions is likely to drive growth in the market, positioning it as a vital component of future IT strategies.

Advancements in Network Infrastructure

The evolution of network infrastructure is significantly influencing the Virtual Client Computing Market. With the advent of 5G technology and enhanced broadband capabilities, organizations are now able to support high-performance virtual desktop environments. These advancements facilitate faster data transmission and improved user experiences, which are essential for the effective deployment of virtual client computing solutions. Market analysts suggest that the global 5G infrastructure market could reach USD 700 billion by 2028, indicating a substantial investment in network capabilities. As organizations leverage these advancements, they are likely to adopt virtual client computing technologies to maximize efficiency and performance. Consequently, the Virtual Client Computing Market stands to gain from the ongoing improvements in network infrastructure, enabling seamless access to applications and data.

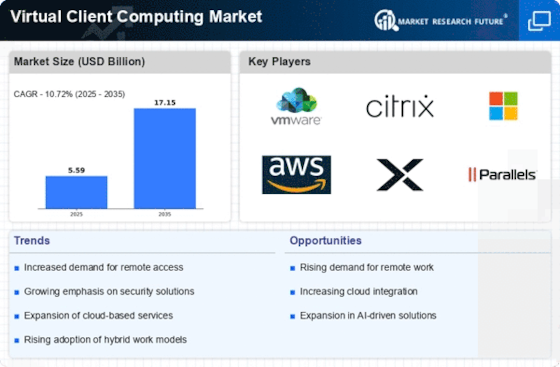

Rising Demand for Remote Work Solutions

The Virtual Client Computing Market is experiencing a notable surge in demand for remote work solutions. As organizations increasingly adopt flexible work arrangements, the need for efficient virtual desktop infrastructure (VDI) and application delivery systems has become paramount. According to recent data, the market for VDI is projected to grow at a compound annual growth rate (CAGR) of approximately 15% over the next five years. This growth is driven by the necessity for businesses to provide employees with secure and reliable access to applications and data from any location. Consequently, companies are investing in virtual client computing technologies to enhance productivity and maintain operational continuity. The shift towards remote work is likely to persist, further propelling the Virtual Client Computing Market as organizations seek to optimize their IT environments.

Growing Need for Cost-Effective IT Solutions

Cost efficiency remains a critical driver in the Virtual Client Computing Market. Organizations are increasingly seeking ways to reduce IT expenditures while maintaining high levels of performance and security. Virtual client computing solutions offer a compelling value proposition by centralizing management and reducing the need for extensive hardware investments. Market data suggests that businesses can save up to 30% on IT costs by implementing virtual desktop solutions. This financial incentive is prompting many organizations to transition from traditional computing models to virtual environments. As the demand for cost-effective IT solutions continues to rise, the Virtual Client Computing Market is likely to expand, driven by organizations' efforts to optimize their IT budgets while enhancing operational efficiency.

Increased Focus on Data Security and Compliance

In the current landscape, the Virtual Client Computing Market is witnessing an intensified focus on data security and compliance. Organizations are increasingly aware of the risks associated with data breaches and the importance of adhering to regulatory standards. As a result, there is a growing demand for virtual client computing solutions that offer robust security features, such as encryption, multi-factor authentication, and centralized management. Market data indicates that The Virtual Client Computing Market is expected to reach USD 345 billion by 2026, highlighting the critical need for secure virtual environments. This emphasis on security is driving investments in virtual desktop solutions that not only protect sensitive information but also ensure compliance with industry regulations. Thus, the Virtual Client Computing Market is likely to benefit from this heightened awareness and demand for secure computing solutions.