Health and Wellness Trends

The Canned Food Packaging Market is increasingly influenced by the growing health and wellness trends among consumers. There is a rising awareness regarding nutrition, leading to a demand for healthier food options. Canned foods that are low in sodium, free from preservatives, and rich in nutrients are gaining popularity. Market data indicates that products labeled as organic or containing natural ingredients are witnessing a surge in sales, with a projected increase of 6% annually. This shift towards healthier eating habits is prompting manufacturers to adopt packaging that highlights nutritional benefits and ingredient transparency. Consequently, the Canned Food Packaging Market is adapting to these trends by offering packaging solutions that not only preserve food quality but also communicate health benefits effectively.

Expansion of Retail Channels

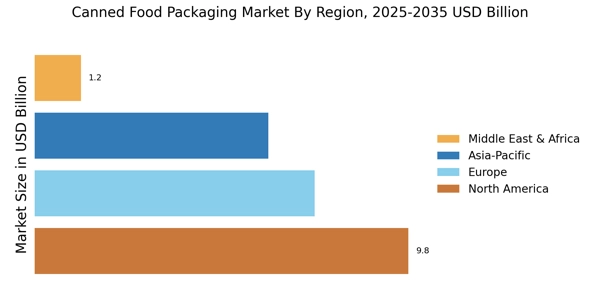

The expansion of retail channels is a crucial driver for the Canned Food Packaging Market. The proliferation of supermarkets, hypermarkets, and online grocery platforms has made canned foods more accessible to consumers. This increased availability is likely to boost sales, as consumers are more inclined to purchase canned products when they are readily available. Recent data indicates that online grocery sales have surged, with a projected growth rate of 15% over the next few years. This trend is encouraging manufacturers to optimize their packaging for e-commerce, ensuring that products remain intact during shipping. Consequently, the Canned Food Packaging Market is adapting to these changes by developing packaging solutions that cater to the needs of various retail formats, thereby enhancing market reach and consumer convenience.

Rising Demand for Convenience Foods

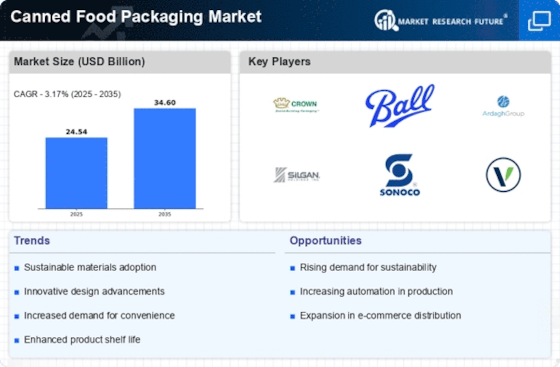

The Canned Food Packaging Market is experiencing a notable increase in demand for convenience foods. As lifestyles become busier, consumers are seeking quick meal solutions that require minimal preparation. Canned foods, which offer ready-to-eat options, align perfectly with this trend. According to recent data, the convenience food sector is projected to grow at a compound annual growth rate of approximately 4.5% over the next five years. This growth is likely to drive the demand for innovative canned food packaging solutions that enhance product shelf life and maintain quality. As a result, manufacturers are investing in advanced packaging technologies to meet consumer expectations for convenience and quality, thereby propelling the Canned Food Packaging Market forward.

Technological Innovations in Packaging

Technological advancements are significantly shaping the Canned Food Packaging Market. Innovations such as smart packaging, which includes QR codes and temperature indicators, are enhancing consumer engagement and product safety. These technologies not only improve the user experience but also provide valuable information regarding product freshness and storage conditions. Market analysis indicates that the smart packaging segment is expected to grow at a rate of 8% annually, reflecting the increasing integration of technology in food packaging. This trend is encouraging manufacturers to explore new materials and designs that incorporate these technologies, thereby improving the overall efficiency and appeal of canned food products. As a result, the Canned Food Packaging Market is poised for substantial growth driven by these technological innovations.

Sustainability and Eco-Friendly Packaging

Sustainability has become a pivotal driver in the Canned Food Packaging Market. With increasing environmental concerns, consumers are gravitating towards products that utilize eco-friendly packaging materials. The demand for recyclable and biodegradable packaging is on the rise, as consumers seek to reduce their carbon footprint. Recent studies suggest that nearly 70% of consumers are willing to pay a premium for products packaged in sustainable materials. This trend is prompting manufacturers to innovate and invest in sustainable packaging solutions, such as aluminum cans and plant-based materials. As a result, the Canned Food Packaging Market is likely to see a shift towards more environmentally responsible practices, which could enhance brand loyalty and attract environmentally conscious consumers.