Expansion of LNG Infrastructure

The expansion of liquefied natural gas infrastructure is significantly influencing the Very Large Gas Carrier Market. Investments in LNG terminals, regasification facilities, and storage capacities are on the rise, facilitating the growth of the LNG supply chain. For instance, several countries are developing new LNG import terminals to accommodate increasing demand. This infrastructure development is expected to enhance the operational efficiency of Very Large Gas Carriers, as they can deliver larger volumes of LNG to these facilities. Furthermore, the establishment of new trade routes and partnerships is likely to create additional opportunities for the Very Large Gas Carrier Market, as it enables more flexible and reliable transportation options.

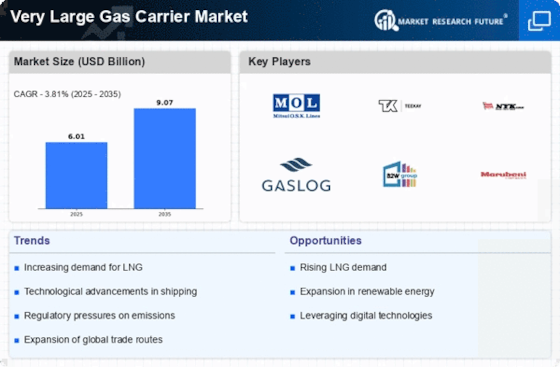

Increasing Demand for Natural Gas

The rising demand for natural gas as a cleaner alternative to coal and oil is a primary driver for the Very Large Gas Carrier Market. As countries strive to reduce carbon emissions, natural gas is increasingly viewed as a transitional fuel. According to recent data, the demand for liquefied natural gas (LNG) is projected to grow at a compound annual growth rate of approximately 5% over the next decade. This trend is likely to stimulate the construction of new Very Large Gas Carriers, as they are essential for transporting LNG efficiently across long distances. The shift towards natural gas not only supports energy security but also aligns with global sustainability goals, thereby enhancing the market dynamics of the Very Large Gas Carrier Market.

Rising Investments in Renewable Energy

The increasing investments in renewable energy sources are indirectly influencing the Very Large Gas Carrier Market. As countries transition towards renewable energy, the demand for natural gas as a backup energy source is likely to rise. This trend is particularly evident in regions where renewable energy generation is intermittent. The need for reliable energy sources to complement renewables is expected to drive the demand for LNG, thereby boosting the Very Large Gas Carrier Market. Furthermore, as more countries commit to ambitious climate targets, the role of natural gas in the energy mix is likely to become more prominent, creating additional opportunities for Very Large Gas Carriers to facilitate this transition.

Regulatory Support for Cleaner Shipping

Regulatory frameworks aimed at promoting cleaner shipping practices are emerging as a crucial driver for the Very Large Gas Carrier Market. Various international maritime organizations are implementing stricter emissions regulations, which compel shipping companies to adopt more environmentally friendly technologies. The International Maritime Organization's (IMO) regulations on sulfur emissions are particularly noteworthy, as they encourage the use of LNG as a marine fuel. This regulatory support not only drives the demand for Very Large Gas Carriers but also incentivizes the development of innovative technologies that enhance fuel efficiency and reduce emissions. Consequently, the Very Large Gas Carrier Market is likely to experience growth as companies adapt to these evolving regulations.

Technological Innovations in Vessel Design

Technological innovations in vessel design are reshaping the Very Large Gas Carrier Market. Advances in shipbuilding techniques and materials are leading to the construction of more efficient and environmentally friendly carriers. For example, the integration of digital technologies and automation in vessel operations is enhancing safety and operational efficiency. Additionally, the development of dual-fuel engines allows Very Large Gas Carriers to operate on both LNG and traditional fuels, providing flexibility in fuel choice. These innovations not only reduce operational costs but also align with the industry's shift towards sustainability. As a result, the Very Large Gas Carrier Market is poised for growth, driven by the need for modernized and efficient shipping solutions.