North America : Market Leader in Vehicle Leasing

North America is poised to maintain its leadership in the vehicle leasing and rental services market, holding a significant market share of 55.0% as of 2024. The growth is driven by increasing consumer demand for flexible mobility solutions, coupled with favorable regulatory frameworks that encourage leasing over ownership. The rise of e-commerce and delivery services has further fueled demand for rental vehicles, particularly in urban areas.

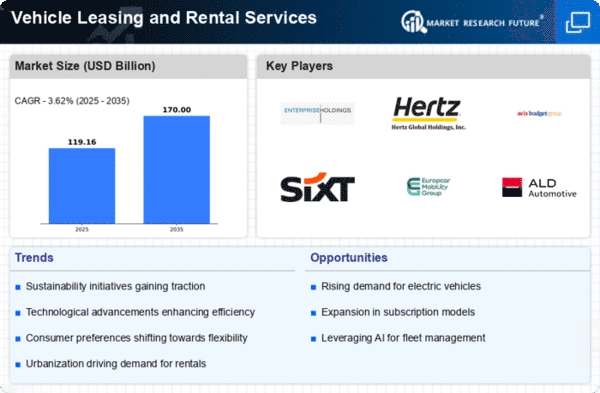

The competitive landscape is dominated by key players such as Enterprise Holdings, Hertz Global Holdings, and Avis Budget Group, which have established extensive networks across the region. The U.S. remains the largest market, supported by a robust infrastructure and a growing trend towards shared mobility. Companies are increasingly adopting technology to enhance customer experience, making the market dynamic and competitive.

Europe : Emerging Mobility Solutions Hub

Europe's vehicle leasing and rental services market is expanding, with a market share of 30.0% as of 2024. The growth is driven by increasing urbanization, environmental regulations promoting sustainable transport, and a shift towards shared mobility solutions. Governments are implementing policies to reduce emissions, which is catalyzing the demand for eco-friendly rental options, thus enhancing market dynamics.

Leading countries in this region include Germany, France, and the Netherlands, where companies like Sixt SE and Europcar Mobility Group are prominent. The competitive landscape is characterized by a mix of local and international players, with a focus on innovation and customer-centric services. The European market is adapting to changing consumer preferences, emphasizing flexibility and sustainability in vehicle leasing.

Asia-Pacific : Rapidly Growing Market Potential

The Asia-Pacific region is witnessing significant growth in vehicle leasing and rental services, with a market share of 25.0% as of 2024. This growth is fueled by rising disposable incomes, urbanization, and an increasing preference for rental services over ownership. Regulatory support for shared mobility initiatives is also contributing to the market's expansion, as governments encourage sustainable transport solutions.

Countries like China, India, and Australia are leading the charge, with a competitive landscape featuring both local and international players. Companies are focusing on technology integration to streamline operations and enhance customer experiences. The presence of key players such as ALD Automotive and LeasePlan Corporation is strengthening the market, making it a focal point for investment and innovation.

Middle East and Africa : Emerging Market Opportunities

The Middle East and Africa region is gradually emerging in the vehicle leasing and rental services market, holding a market share of 5.0% as of 2024. The growth is driven by increasing urbanization, a rising middle class, and a growing demand for flexible transportation solutions. Regulatory frameworks are evolving to support the growth of the rental sector, making it an attractive market for investment.

Leading countries in this region include South Africa and the UAE, where the presence of key players like Ryder System is notable. The competitive landscape is characterized by a mix of local and international companies, focusing on enhancing service offerings and customer satisfaction. As the market matures, there is a growing emphasis on technology and sustainability, positioning the region for future growth.