Consumer Awareness and Education

The rise in consumer awareness regarding the benefits of natural fibers is significantly impacting the Vegetal Natural Fiber Market. Educational campaigns and marketing efforts aimed at informing consumers about the advantages of using vegetal natural fibers, such as their environmental benefits and health safety, are gaining traction. As consumers become more informed, they are more likely to choose products made from natural fibers over synthetic alternatives. Market data shows that brands that actively promote their use of natural fibers experience a 30% increase in consumer preference. This heightened awareness is likely to drive demand further, as consumers seek to make more sustainable choices in their purchasing decisions. Consequently, the Vegetal Natural Fiber Market stands to benefit from this growing trend of informed consumerism.

Government Initiatives and Support

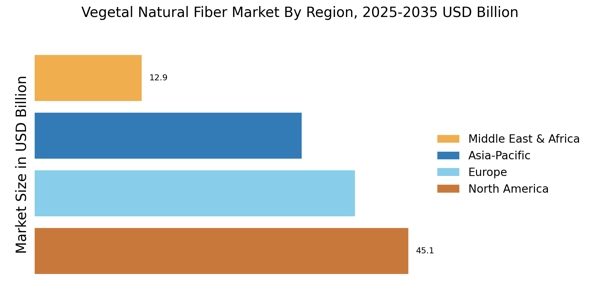

Government policies and initiatives aimed at promoting sustainable practices are playing a crucial role in the Vegetal Natural Fiber Market. Many governments are implementing regulations that encourage the use of natural fibers in various applications, from textiles to construction materials. For example, subsidies and grants for sustainable agriculture practices are becoming more common, which supports the cultivation of fiber-producing plants. Market data indicates that regions with strong governmental support for sustainable practices are witnessing a 20% increase in the production of natural fibers. This regulatory environment not only fosters innovation but also creates a favorable market landscape for the Vegetal Natural Fiber Market, as businesses are incentivized to invest in sustainable materials.

Growing Applications Across Industries

The versatility of vegetal natural fibers is driving their adoption across a multitude of industries, thereby propelling the Vegetal Natural Fiber Market. These fibers are increasingly being utilized in textiles, automotive, construction, and packaging sectors due to their lightweight, strong, and biodegradable properties. For instance, the automotive industry is exploring the use of natural fibers for interior components, which could lead to a reduction in vehicle weight and improved fuel efficiency. Market data suggests that the use of natural fibers in automotive applications is expected to grow by 10% annually. This diversification of applications not only broadens the market reach of vegetal natural fibers but also enhances their overall demand, indicating a robust future for the Vegetal Natural Fiber Market.

Rising Demand for Eco-Friendly Products

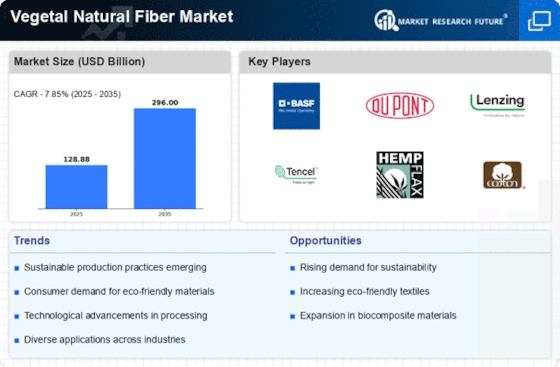

The increasing consumer preference for sustainable and eco-friendly products is a primary driver of the Vegetal Natural Fiber Market. As awareness of environmental issues grows, consumers are gravitating towards products made from natural fibers, which are biodegradable and renewable. This shift is reflected in market data, indicating that the demand for natural fibers is projected to grow at a compound annual growth rate of approximately 8% over the next five years. Companies are responding by incorporating vegetal natural fibers into their product lines, thereby enhancing their market appeal. This trend not only supports environmental sustainability but also aligns with the values of a growing segment of consumers who prioritize ethical consumption. Consequently, the Vegetal Natural Fiber Market is likely to experience robust growth as more brands adopt these materials in their offerings.

Innovations in Fiber Processing Technologies

Technological advancements in fiber processing are significantly influencing the Vegetal Natural Fiber Market. Innovations such as improved extraction methods and enhanced processing techniques are enabling manufacturers to produce higher quality fibers more efficiently. For instance, the development of eco-friendly processing methods reduces the environmental impact associated with traditional fiber production. Market data suggests that investments in these technologies could lead to a 15% reduction in production costs, making natural fibers more competitive against synthetic alternatives. As these technologies continue to evolve, they are expected to enhance the overall quality and performance of vegetal natural fibers, thereby attracting more industries to incorporate them into their products. This trend indicates a promising future for the Vegetal Natural Fiber Market as it adapts to meet the demands of various sectors.