Market Analysis

Varicose Veins Treatment Devices Market (Global, 2025)

Introduction

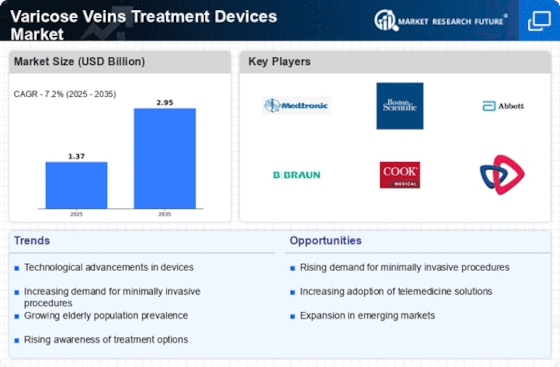

Varicose Veins Treatment Devices Market is set to witness significant advancements as medical practitioners and patients increasingly prefer to opt for effective and minimally invasive treatment options for varicose veins. Varicose veins are enlarged, twisted veins, which affect a significant portion of the population and cause physical discomfort and cosmetic concerns. Moreover, growing awareness about the health risks associated with untreated varicose veins is likely to increase the demand for varicose veins treatment devices. Varicose veins treatment devices, such as radiofrequency ablation devices, endovenous laser devices, and sclerotherapy devices, are replacing the surgical procedure for the treatment of varicose veins. Moreover, integration of telemedicine and digital health solutions is expected to enhance patient access to treatment, thereby driving the market. However, as the market evolves, the key players need to focus on developing user-friendly devices that can cater to the varied needs of the patients and the physicians.

PESTLE Analysis

- Political

- In 2025, the regulatory framework for medical devices, including those for the treatment of varicose veins, will be largely influenced by the government’s policies for the provision of universal health care. The US Food and Drug Administration (FDA) has imposed a new policy requiring at least 75% of medical devices to be subject to a pre-market approval process. This has increased the compliance costs for manufacturers. The European Union’s Medical Device Regulation (MDR) will impose stricter regulations on medical devices, affecting over 1,000 manufacturers.

- Economic

- In 2025, the economy is characterized by an expenditure of about $ 4,000,000,000,000 on health care in the United States alone, a portion of which is directed toward the treatment of chronic diseases such as varicose veins. Varicose vein treatment, including equipment, costs $ 1,500 to $ 3,000 per procedure, which is a major concern for patients and health care institutions. Also, the unemployment rate, which is estimated to be around 4.2 percent, has a significant impact on the availability of disposable income and the ability of patients to afford elective procedures.

- Social

- Health consciousness is growing, with sixty percent of Americans desiring treatment for varicose veins, due to discomfort and esthetics. Minimally invasive procedures are desirable. In addition, an aging population, with over twenty percent of the population over the age of sixty-five by 2025, will increase the prevalence of varicose veins, thereby increasing the need for effective treatments.

- Technological

- Varicose veins treatment devices are the subject of notable technological developments, with innovations such as laser ablation and radiofrequency ablation gaining popularity. By 2025, it is expected that over 40 per cent of procedures will be carried out using these advanced devices, which are associated with shorter recovery times and better patient outcomes. Artificial intelligence is also set to play an increasing role in diagnostics. By 2025, it is forecast that 30 per cent of healthcare facilities will be using AI-based solutions for better patient management and treatment planning.

- Legal

- The regulations for medical devices are becoming increasingly strict. In 2025, the new labeling requirements for the devices used to treat varicose veins will take effect. The manufacturers will have to provide detailed information on the performance of the devices and the health outcomes of the patients, and the companies in this sector number over 500. Moreover, the cost of liability insurance for manufacturers is expected to rise by up to 15 percent, as a result of the increase in lawsuits over the safety of medical devices.

- Environmental

- The consideration of the environment is increasingly important for medical technology companies. By 2025, it is expected that at least one-quarter of the manufacturers of varicose vein treatment devices will be using sustainable methods and biodegradable materials in the production of their devices. Furthermore, stricter regulations for the disposal of medical waste are coming into force. The EPA, for example, is enforcing a 30 per cent reduction in medical waste by 2025, which will affect both operating costs and the clinical practice.

Porter's Five Forces

- Threat of New Entrants

- The market for devices for the treatment of varicose veins is characterized by moderate barriers to entry due to the high cost of R&D, regulatory approvals, and the establishment of distribution channels. However, technological progress and increasing demand for minimally invasive procedures can attract new entrants, which could increase the threat of competition.

- Bargaining Power of Suppliers

- The bargaining power of suppliers in this market is relatively low, as there are numerous suppliers of the materials and components used in the manufacture of medical appliances. The ease with which manufacturers can change suppliers means that the power of suppliers is limited, and the cost of supplies is competitive.

- Bargaining Power of Buyers

- The bargaining power of the buyers of varicose veins treatment devices, such as hospitals and clinics, is high because of the availability of several treatment methods and devices. The buyers are looking for cost-effective solutions, which makes it easier for them to negotiate better prices and terms with the manufacturers.

- Threat of Substitutes

- The threat of substitutes is moderate, as there are other treatments for varicose veins, such as sclerotherapy and sclerotherapy. These alternatives do not directly replace the device, but they offer patients different treatment options, which can affect the demand for devices used in the traditional treatment.

- Competitive Rivalry

- The competition in the varicose veins treatment devices market is very intense, mainly due to the presence of several established players and the continuous development of treatment technology. Companies are engaged in aggressive marketing, product differentiation and strategic alliances to gain market share, which intensifies competition.

SWOT Analysis

Strengths

- Increasing prevalence of varicose veins due to aging population and sedentary lifestyles.

- Advancements in technology leading to more effective and less invasive treatment options.

- Growing awareness and acceptance of varicose vein treatments among patients.

Weaknesses

- High cost of advanced treatment devices may limit accessibility for some patients.

- Lack of reimbursement policies in certain regions affecting market growth.

- Potential side effects and complications associated with some treatment methods.

Opportunities

- Expansion of telemedicine and remote consultation services for varicose vein treatments.

- Emerging markets showing increased demand for varicose vein treatment solutions.

- Research and development of innovative devices and techniques to enhance treatment efficacy.

Threats

- Intense competition among existing players leading to price wars.

- Regulatory challenges and stringent approval processes for new devices.

- Economic downturns affecting healthcare spending and patient willingness to undergo elective procedures.

Summary

Varicose Veins Treatment Devices Market 2025 is characterized by significant strengths such as technological advancements and increasing patient awareness. On the other hand, these strengths are hampered by high costs and regulatory hurdles. Opportunities for growth are mainly in the field of telemedicine and emerging markets. The market is threatened by competition and macroeconomic factors. The key to success for the companies operating in this market is to focus on innovation and accessibility.

Leave a Comment