Market Growth Projections

The Global Vacuum Gas Oil Market Industry is poised for substantial growth, with projections indicating a market size of 1.23 USD Billion in 2024 and an anticipated increase to 2.14 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate (CAGR) of 5.19% from 2025 to 2035. Such projections underscore the increasing reliance on vacuum gas oil as a critical feedstock in various refining processes, driven by the rising demand for high-quality fuels and petrochemicals. The market's expansion is indicative of broader trends in energy consumption and technological advancements in refining.

Rising Energy Consumption Globally

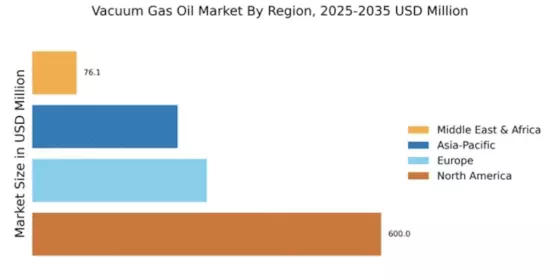

The Global Vacuum Gas Oil Market Industry is closely linked to the increasing energy consumption worldwide. As developing nations industrialize and urbanize, the demand for energy sources, including vacuum gas oil, escalates. This trend is particularly evident in Asia-Pacific regions, where rapid economic growth drives energy needs. The market's expansion is projected to coincide with a broader increase in energy consumption, suggesting that vacuum gas oil will play a crucial role in meeting these demands. By 2035, the market could reach 2.14 USD Billion, underscoring the importance of vacuum gas oil in the global energy landscape.

Increasing Demand for Petrochemicals

The Global Vacuum Gas Oil Market Industry experiences a notable surge in demand for petrochemicals, driven by the expanding applications in various sectors, including automotive, construction, and consumer goods. As industries increasingly rely on petrochemical derivatives, the market is projected to reach 1.23 USD Billion in 2024. This growth is indicative of the broader trend towards enhanced production capabilities and the need for high-quality feedstocks. The versatility of vacuum gas oil in producing high-value products further solidifies its role in meeting the rising global demand, suggesting a robust trajectory for the industry.

Regulatory Support for Cleaner Fuels

Regulatory frameworks promoting cleaner fuels significantly impact the Global Vacuum Gas Oil Market Industry. Governments worldwide are implementing stringent regulations aimed at reducing emissions and enhancing fuel quality. This regulatory support encourages refiners to produce higher-quality vacuum gas oil, which can be utilized in cleaner fuel formulations. As environmental concerns gain prominence, the industry is likely to adapt, leading to increased investments in cleaner technologies. Such initiatives not only align with global sustainability goals but also position vacuum gas oil as a vital component in the transition towards greener energy solutions.

Market Dynamics and Competitive Landscape

The Global Vacuum Gas Oil Market Industry is characterized by dynamic market conditions and a competitive landscape. The presence of numerous players, ranging from large multinational corporations to regional refiners, fosters innovation and competitive pricing. This competition drives companies to enhance their product offerings and improve operational efficiencies. Additionally, strategic partnerships and collaborations among industry stakeholders are becoming increasingly common, further shaping the market dynamics. As companies strive to maintain their market positions, the ongoing evolution of the competitive landscape is likely to influence the growth trajectory of vacuum gas oil in the coming years.

Technological Advancements in Refining Processes

Technological innovations in refining processes significantly influence the Global Vacuum Gas Oil Market Industry. Enhanced refining techniques, such as hydrocracking and catalytic cracking, improve the yield and quality of vacuum gas oil, making it a preferred choice for refiners. These advancements not only optimize production efficiency but also align with environmental regulations, promoting cleaner operations. As a result, the market is expected to grow at a CAGR of 5.19% from 2025 to 2035, reflecting the industry's commitment to adopting cutting-edge technologies that enhance product quality and sustainability.