Rising Demand for Electricity

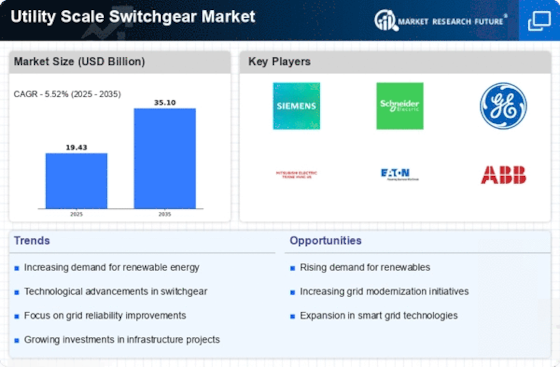

The increasing The Utility Scale Switchgear Industry. As urbanization and industrialization continue to expand, the need for reliable and efficient power distribution systems becomes paramount. According to recent data, electricity consumption is projected to rise by approximately 2.5% annually over the next decade. This surge necessitates the deployment of advanced switchgear solutions to manage the growing load effectively. Utility scale switchgear plays a crucial role in ensuring the stability and reliability of power systems, thereby supporting the infrastructure required to meet this escalating demand. Consequently, manufacturers are likely to focus on enhancing their product offerings to cater to this burgeoning market, which is expected to witness substantial growth in the coming years.

Growing Focus on Energy Efficiency

The growing focus on energy efficiency is a critical driver for the Utility Scale Switchgear Market. As energy costs rise and environmental concerns become more pressing, utilities are under increasing pressure to optimize their operations. Energy-efficient switchgear solutions can significantly reduce losses in power distribution, thereby enhancing overall system performance. According to industry estimates, implementing energy-efficient technologies can lead to reductions in operational costs by up to 20%. This focus on efficiency not only benefits utilities but also aligns with broader sustainability goals. Consequently, the demand for utility scale switchgear that incorporates energy-saving features is likely to increase, fostering market growth as utilities strive to meet both economic and environmental objectives.

Investment in Infrastructure Development

Investment in infrastructure development is a significant catalyst for the Utility Scale Switchgear Market. Governments and private entities are increasingly allocating funds to modernize and expand electrical grids, particularly in developing regions. This trend is driven by the need to improve energy access and reliability. For instance, the International Energy Agency has indicated that investments in grid infrastructure could reach trillions of dollars over the next decade. Such investments are likely to create a favorable environment for the adoption of utility scale switchgear, as these systems are essential for integrating new energy sources and enhancing grid resilience. As infrastructure projects progress, the demand for advanced switchgear solutions is expected to rise, further propelling market growth.

Regulatory Support for Clean Energy Initiatives

Regulatory support for clean energy initiatives is increasingly influencing the Utility Scale Switchgear Market. Governments worldwide are implementing policies aimed at reducing carbon emissions and promoting renewable energy sources. This regulatory landscape encourages the integration of renewable energy into existing power systems, necessitating the use of advanced switchgear technologies. For example, mandates for renewable energy targets often require utilities to upgrade their infrastructure to accommodate variable energy sources like wind and solar. As a result, the demand for utility scale switchgear that can efficiently manage these diverse energy inputs is likely to grow. This trend not only supports environmental goals but also stimulates market expansion as utilities seek compliant and efficient solutions.

Technological Advancements in Switchgear Solutions

Technological advancements in switchgear solutions are reshaping the Utility Scale Switchgear Market. Innovations such as digital switchgear, which incorporates smart technologies, are enhancing the functionality and efficiency of power distribution systems. These advancements enable real-time monitoring and control, improving operational efficiency and reducing downtime. The market for digital switchgear is expected to grow significantly, driven by the increasing need for automation and data analytics in energy management. Furthermore, the integration of Internet of Things (IoT) technologies into switchgear systems is likely to provide utilities with enhanced capabilities for predictive maintenance and fault detection. As these technologies continue to evolve, they are expected to play a pivotal role in the growth of the utility scale switchgear market.