North America : Market Leader in Smart Meters

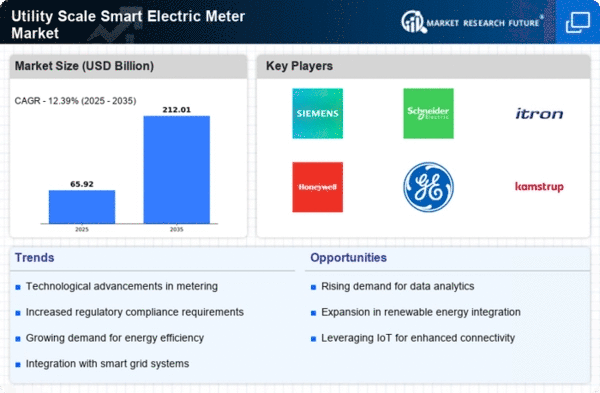

North America is poised to maintain its leadership in the Utility Scale Smart Electric Meter Market, holding a significant market share of 30.0 in 2025. The growth is driven by increasing demand for energy efficiency, smart grid initiatives, and regulatory support for renewable energy integration. Government incentives and funding for smart infrastructure are further propelling market expansion, making it a key region for innovation and investment in smart metering technology. The competitive landscape in North America is robust, featuring key players such as Itron, Siemens, and Honeywell. The U.S. leads the market, supported by favorable policies and a strong focus on technological advancements. Canada is also emerging as a significant player, with investments in smart grid technologies. The presence of established companies and ongoing collaborations among stakeholders are expected to enhance market dynamics and drive further growth.

Europe : Growing Adoption of Smart Technologies

Europe is witnessing a rapid increase in the adoption of Utility Scale Smart Electric Meters, with a market size of 15.0 in 2025. The growth is fueled by stringent regulations aimed at reducing carbon emissions and enhancing energy efficiency. The European Union's commitment to a sustainable energy future, along with national policies promoting smart grid technologies, are key drivers of this market. The region's focus on digital transformation in energy management is expected to further boost demand for smart meters. Leading countries in this market include Germany, France, and the UK, where significant investments in smart infrastructure are being made. Major players like Schneider Electric and Landis+Gyr are actively participating in this growth. The competitive landscape is characterized by innovation and partnerships, as companies strive to meet regulatory requirements and consumer expectations for smarter energy solutions. "The European Commission aims for 80% of households to have smart meters by 2025," European Commission, Directorate-General for Energy.

Asia-Pacific : Emerging Powerhouse in Smart Meters

Asia-Pacific is emerging as a significant player in the Utility Scale Smart Electric Meter Market, with a projected market size of 10.0 in 2025. The region's growth is driven by increasing urbanization, rising energy demand, and government initiatives to modernize energy infrastructure. Countries are investing heavily in smart grid technologies to enhance energy efficiency and reliability, supported by regulatory frameworks that encourage the adoption of smart metering solutions. China and India are leading the charge in this market, with substantial investments in smart meter deployment. The competitive landscape features key players like Itron and Kamstrup, who are expanding their presence in the region. As governments push for energy reforms and sustainability, the demand for smart meters is expected to rise significantly, positioning Asia-Pacific as a critical market for future growth.

Middle East and Africa : Emerging Market with Potential

The Middle East and Africa region is gradually emerging in the Utility Scale Smart Electric Meter Market, with a market size of 3.65 in 2025. The growth is primarily driven by increasing investments in energy infrastructure and the need for efficient energy management solutions. Governments are recognizing the importance of smart metering in achieving energy sustainability and are implementing policies to support its adoption. The region's focus on diversifying energy sources is also contributing to market growth. Countries like South Africa and the UAE are leading the way in smart meter implementation, with initiatives aimed at modernizing their energy sectors. The competitive landscape is still developing, with opportunities for both local and international players. As the region continues to invest in smart technologies, the demand for utility-scale smart meters is expected to rise, creating a favorable environment for market expansion.