Growth in the Construction Sector

The US Zeolites Market is benefiting from the robust growth in the construction sector. Zeolites are being increasingly incorporated into construction materials, such as concrete and asphalt, due to their lightweight properties and ability to enhance durability. The US construction industry is projected to grow at a CAGR of around 4% in the coming years, driven by infrastructure development and housing projects. This growth presents a significant opportunity for zeolite manufacturers to expand their market presence. Additionally, the incorporation of zeolites in construction materials aligns with sustainability goals, as they can improve energy efficiency and reduce the carbon footprint of buildings. As the demand for green building materials rises, zeolites are likely to play a pivotal role in shaping the future of the construction industry.

Increased Agricultural Applications

The US Zeolites Market is witnessing a surge in agricultural applications, driven by the need for sustainable farming practices. Zeolites are utilized as soil amendments to improve nutrient retention and water management, which is crucial for enhancing crop yields. The US agricultural sector is increasingly adopting zeolite-based products, with the market for zeolites in agriculture expected to grow significantly in the next few years. This growth is supported by government initiatives promoting sustainable agriculture and the use of natural soil enhancers. Furthermore, the ability of zeolites to reduce fertilizer runoff aligns with environmental regulations aimed at protecting water quality. As farmers seek to optimize their practices, zeolites are emerging as a valuable tool in modern agriculture.

Rising Demand for Eco-Friendly Products

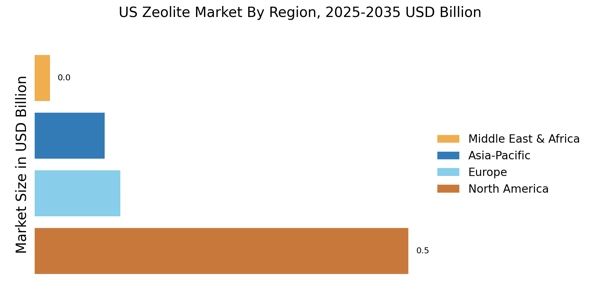

The US Zeolites Market is experiencing a notable increase in demand for eco-friendly products. As consumers become more environmentally conscious, industries are seeking sustainable alternatives to traditional materials. Zeolites, known for their natural origin and low environmental impact, are increasingly utilized in various applications, including agriculture and water treatment. The market for zeolites in the US is projected to grow at a compound annual growth rate (CAGR) of approximately 5% over the next five years, driven by this shift towards sustainability. Companies are investing in research and development to enhance the efficiency of zeolite applications, further solidifying their position in the market. This trend not only supports environmental goals but also aligns with regulatory frameworks promoting sustainable practices across multiple sectors.

Advancements in Water Treatment Technologies

Innovations in water treatment technologies are significantly influencing the US Zeolites Market. Zeolites are increasingly recognized for their ability to remove contaminants from water, making them a preferred choice in municipal and industrial water treatment applications. The US Environmental Protection Agency (EPA) has been promoting the use of zeolites due to their effectiveness in ion exchange processes, which are crucial for purifying drinking water. The market for zeolites in water treatment is expected to expand as municipalities invest in upgrading their infrastructure to meet stricter water quality standards. This growth is further supported by the increasing awareness of water scarcity issues, prompting a shift towards more efficient and sustainable water treatment solutions.

Regulatory Support for Sustainable Practices

The US Zeolites Market is positively impacted by regulatory support for sustainable practices across various sectors. Government policies aimed at reducing environmental impact and promoting the use of natural materials are fostering growth in the zeolite market. Agencies such as the EPA and the Department of Agriculture are encouraging the adoption of zeolites in applications ranging from water treatment to agriculture. This regulatory framework not only enhances the credibility of zeolite products but also incentivizes industries to invest in sustainable alternatives. As regulations become more stringent, the demand for zeolites is likely to increase, positioning them as a key component in achieving environmental compliance. This trend underscores the importance of zeolites in supporting a sustainable future for the US economy.