Innovative Product Development

Innovation in product development is a crucial driver for the vegan sour-cream market. Manufacturers are increasingly experimenting with various plant-based ingredients to enhance flavor, texture, and nutritional value. This trend is evident in the introduction of new formulations that incorporate ingredients like cashews, almonds, and coconut, which not only provide a creamy consistency but also appeal to diverse consumer preferences. The market has seen a rise in products fortified with vitamins and minerals, catering to health-conscious consumers. As of 2025, the vegan sour-cream market is projected to grow at a CAGR of approximately 12%, driven by these innovations. This focus on product development attracts new customers and retains existing ones, as consumers are eager to try new flavors and formulations that align with their dietary choices.

Rising Plant-Based Diet Adoption

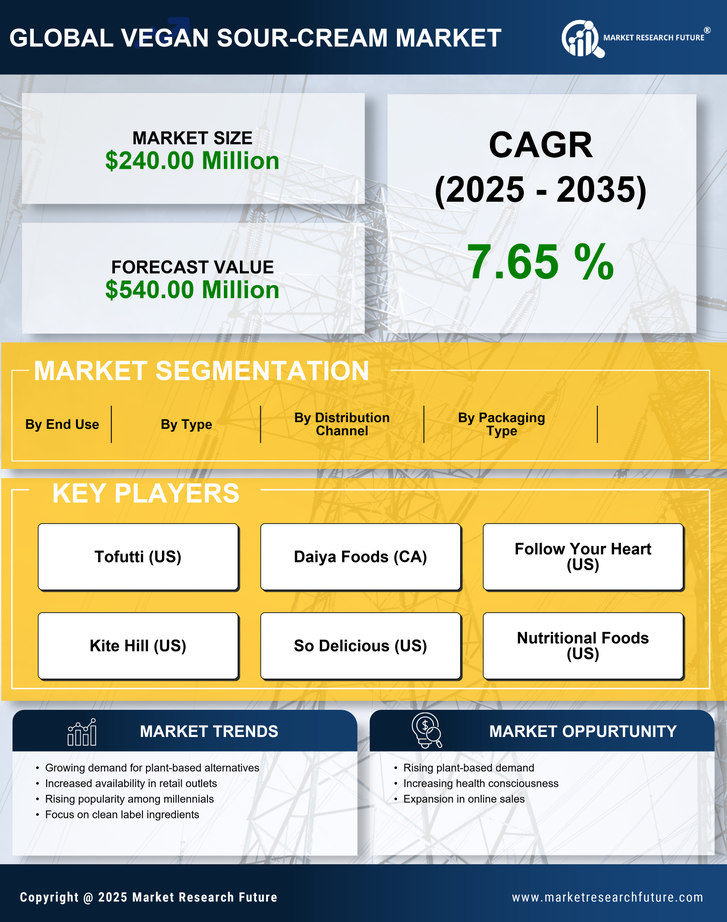

The increasing adoption of plant-based diets in the US is a pivotal driver for the vegan sour-cream market. As consumers become more health-conscious, they are gravitating towards alternatives that align with their dietary preferences. Reports indicate that approximately 9.7 million Americans identify as vegan, reflecting a growing trend towards plant-based eating. This shift is not merely a fad; it suggests a fundamental change in consumer behavior, with many seeking dairy alternatives that offer similar taste and texture. The vegan sour-cream market is likely to benefit significantly from this trend, as it provides a suitable option for those avoiding animal products. Furthermore, the rise in veganism is often linked to environmental concerns, prompting consumers to choose products that are perceived as more sustainable. This evolving dietary landscape is likely to continue influencing the market positively.

Expansion of Distribution Channels

The expansion of distribution channels is a significant driver for the vegan sour-cream market. As consumer interest in plant-based products grows, retailers are increasingly incorporating vegan options into their offerings. This trend is evident in the rise of specialty grocery stores, health food stores, and online platforms that cater specifically to vegan and health-conscious consumers. In 2025, it is estimated that the availability of vegan products in mainstream supermarkets has increased by over 30%, making it easier for consumers to access vegan sour-cream. This enhanced accessibility is likely to drive sales, as consumers are more inclined to purchase products that are readily available. Furthermore, the growth of e-commerce has enabled brands to reach a wider audience, allowing for greater market penetration. This expansion of distribution channels is likely to drive continued growth in the vegan sour-cream market.

Growing Demand for Clean Label Products

The clean label movement is gaining traction in the US, with consumers increasingly seeking transparency in food labeling. This trend is particularly relevant to the vegan sour-cream market, as consumers are more inclined to purchase products that contain recognizable ingredients and minimal additives. Research indicates that over 60% of consumers prefer products with clean labels, reflecting a desire for healthier, more natural options. This demand is prompting manufacturers to reformulate their products, ensuring that they meet consumer expectations for quality and simplicity. As a result, the vegan sour-cream market is likely to see an influx of products that emphasize clean ingredients, appealing to a demographic that prioritizes health and wellness. This shift towards clean labeling is likely to enhance brand loyalty, as consumers gravitate towards brands that align with their values.

Increased Awareness of Lactose Intolerance

Lactose intolerance affects a substantial portion of the US population, with estimates suggesting that around 36% of adults experience some level of lactose malabsorption. This condition increases demand for dairy alternatives, including vegan sour-cream. As awareness of lactose intolerance grows, consumers are actively seeking products that do not cause discomfort. The vegan sour-cream market is well-positioned to cater to this demographic, offering a creamy, flavorful alternative that aligns with their dietary needs. Additionally, the rise in health awareness has led to increased education about the benefits of plant-based diets, further encouraging those with lactose intolerance to explore vegan options. This trend suggests sustained growth in the vegan sour-cream market, as more consumers prioritize their digestive health and seek suitable alternatives.