Regulatory Compliance and Standards

The US Vacuum Valve Market is significantly influenced by stringent regulatory compliance and standards set forth by government agencies. These regulations ensure that vacuum valves meet safety and performance criteria, particularly in industries such as aerospace, pharmaceuticals, and food processing. Compliance with standards such as the American National Standards Institute (ANSI) and the International Organization for Standardization (ISO) is crucial for manufacturers. As companies strive to adhere to these regulations, they are compelled to invest in high-quality materials and advanced manufacturing techniques. This focus on compliance not only enhances product reliability but also fosters consumer trust, thereby driving market growth. The increasing emphasis on regulatory adherence is expected to contribute to a steady rise in market demand.

Rising Demand from Semiconductor Industry

The US Vacuum Valve Market is experiencing a surge in demand driven by the semiconductor industry. As the need for advanced electronic devices continues to rise, semiconductor manufacturers are increasingly relying on vacuum systems for processes such as thin-film deposition and etching. Vacuum valves play a critical role in maintaining the necessary conditions for these processes, ensuring optimal performance and product quality. The semiconductor sector is projected to grow significantly, with estimates indicating a market size exceeding $500 billion by 2026. This growth directly correlates with the increasing demand for high-quality vacuum valves, positioning the US Vacuum Valve Market for substantial expansion.

Technological Advancements in Manufacturing

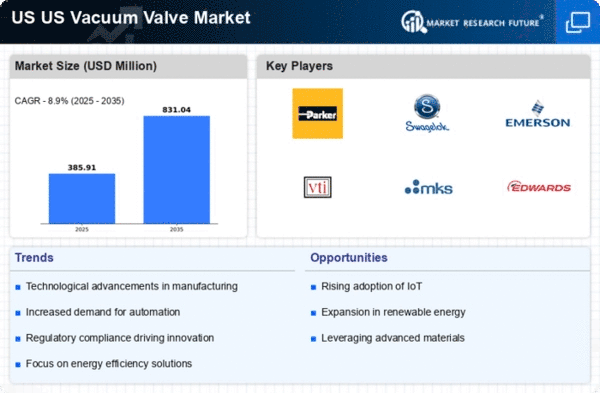

The US Vacuum Valve Market is experiencing a notable transformation due to rapid technological advancements in manufacturing processes. Innovations such as automation and precision engineering are enhancing the production efficiency and quality of vacuum valves. For instance, the integration of computer numerical control (CNC) machines has allowed manufacturers to produce valves with tighter tolerances and improved performance characteristics. This shift not only reduces production costs but also meets the increasing demand for high-performance vacuum systems across various sectors, including semiconductor manufacturing and pharmaceuticals. As a result, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 5% over the next five years, driven by these technological improvements.

Growth in Research and Development Activities

The US Vacuum Valve Market is benefiting from a marked increase in research and development (R&D) activities across various sectors. Institutions and companies are investing heavily in R&D to innovate and improve vacuum technologies, which is essential for applications in fields such as aerospace, healthcare, and materials science. This focus on R&D is fostering the development of advanced vacuum valves that offer enhanced performance and reliability. Furthermore, government funding and grants for scientific research are likely to bolster these initiatives, creating a favorable environment for market growth. As R&D continues to thrive, the US Vacuum Valve Market is expected to see a corresponding rise in demand for innovative valve solutions.

Sustainability Initiatives and Eco-Friendly Products

The US Vacuum Valve Market is witnessing a growing trend towards sustainability initiatives and the development of eco-friendly products. As environmental concerns become more pronounced, manufacturers are increasingly focusing on creating vacuum valves that minimize energy consumption and reduce waste. This shift is evident in the adoption of materials that are recyclable and processes that lower carbon footprints. Companies that prioritize sustainability are likely to gain a competitive edge, as consumers and businesses alike are becoming more environmentally conscious. The market for eco-friendly vacuum valves is projected to expand, with estimates suggesting a growth rate of around 4% annually as industries seek to align with sustainability goals.