Growth in Chemical Manufacturing

The chemical manufacturing industry is experiencing robust growth, which is positively influencing the turbocompressor market. As production capacities expand, the need for reliable and efficient compression systems becomes paramount. Turbocompressors are utilized in various chemical processes, including petrochemicals and specialty chemicals. The American Chemistry Council forecasts a growth rate of 3.5% annually in the US chemical industry, indicating a strong demand for turbocompressors. This growth is likely to drive innovation and investment in turbocompressor technologies, further solidifying their role in the market.

Expansion of the Oil and Gas Sector

The oil and gas sector's expansion in the US is significantly impacting the turbocompressor market. As exploration and production activities increase, the demand for efficient compression solutions rises. Turbocompressors are crucial in various processes, including gas processing and transportation. The US Energy Information Administration projects that oil production will reach approximately 12 million barrels per day by 2026, necessitating advanced compression technologies. This growth in the oil and gas sector is expected to create substantial opportunities for turbocompressor manufacturers, enhancing market dynamics.

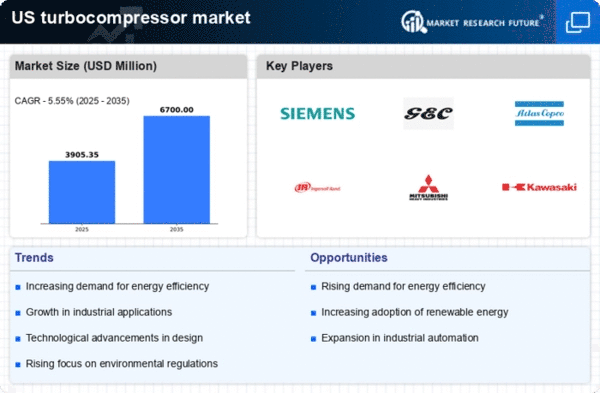

Rising Demand for Energy Efficiency

The increasing emphasis on energy efficiency in various industrial sectors is driving the turbocompressor market. Industries are seeking solutions that reduce energy consumption and operational costs. Turbocompressors, known for their high efficiency, are becoming essential in applications such as oil and gas, chemical processing, and power generation. According to recent data, the energy efficiency of turbocompressors can lead to savings of up to 30% in energy costs. This trend is likely to continue as companies strive to meet regulatory requirements and sustainability goals, further propelling the turbocompressor market.

Increased Focus on Industrial Automation

The trend towards industrial automation is reshaping the turbocompressor market. As industries adopt automated systems to enhance productivity and reduce labor costs, the demand for advanced turbocompressors that integrate seamlessly with automated processes is rising. These systems offer improved control and efficiency, aligning with the goals of modern manufacturing. The market for industrial automation in the US is projected to grow at a CAGR of 9% through 2027, suggesting a significant opportunity for turbocompressor manufacturers to innovate and cater to this evolving landscape.

Regulatory Compliance and Environmental Standards

Stringent regulatory compliance and environmental standards are driving the turbocompressor market. Industries are increasingly required to adopt technologies that minimize emissions and environmental impact. Turbocompressors, with their ability to operate efficiently and reduce waste, are becoming a preferred choice for companies aiming to meet these regulations. The US Environmental Protection Agency has set forth various standards that necessitate the use of advanced technologies in industrial applications. This regulatory landscape is likely to propel the demand for turbocompressors, as companies seek to align with environmental goals while maintaining operational efficiency.